Bitcoin Traders Target $20K Bitcoin Strike as Deep Out of the Money Options Gain Traction

Analysis

Price Impact

MedWhile deep out-of-the-money options are often seen as directional bets, this activity in both otm puts ($20k) and calls ($230k) is interpreted as a play on long-dated volatility rather than a specific price direction. it suggests traders are anticipating significant price swings, but not necessarily a direct move up or down immediately.

Trustworthiness

HighThe analysis comes from coindesk, a reputable source, quoting deribit's global head of retail and referencing amberdata, providing expert insight into options market dynamics.

Price Direction

NeutralThe article explicitly states that these flows 'do not suggest directional trading, but rather deep wing trades that professionals use to trade long-dated volatility cheaply.' traders are betting on the magnitude of future price movements, not a specific upward or downward trend.

Time Effect

LongThe options discussed have long-dated expiries, specifically june 2026, indicating a strategy focused on potential volatility over the next six months to a year, rather than immediate price action.

Original Article:

Article Content:

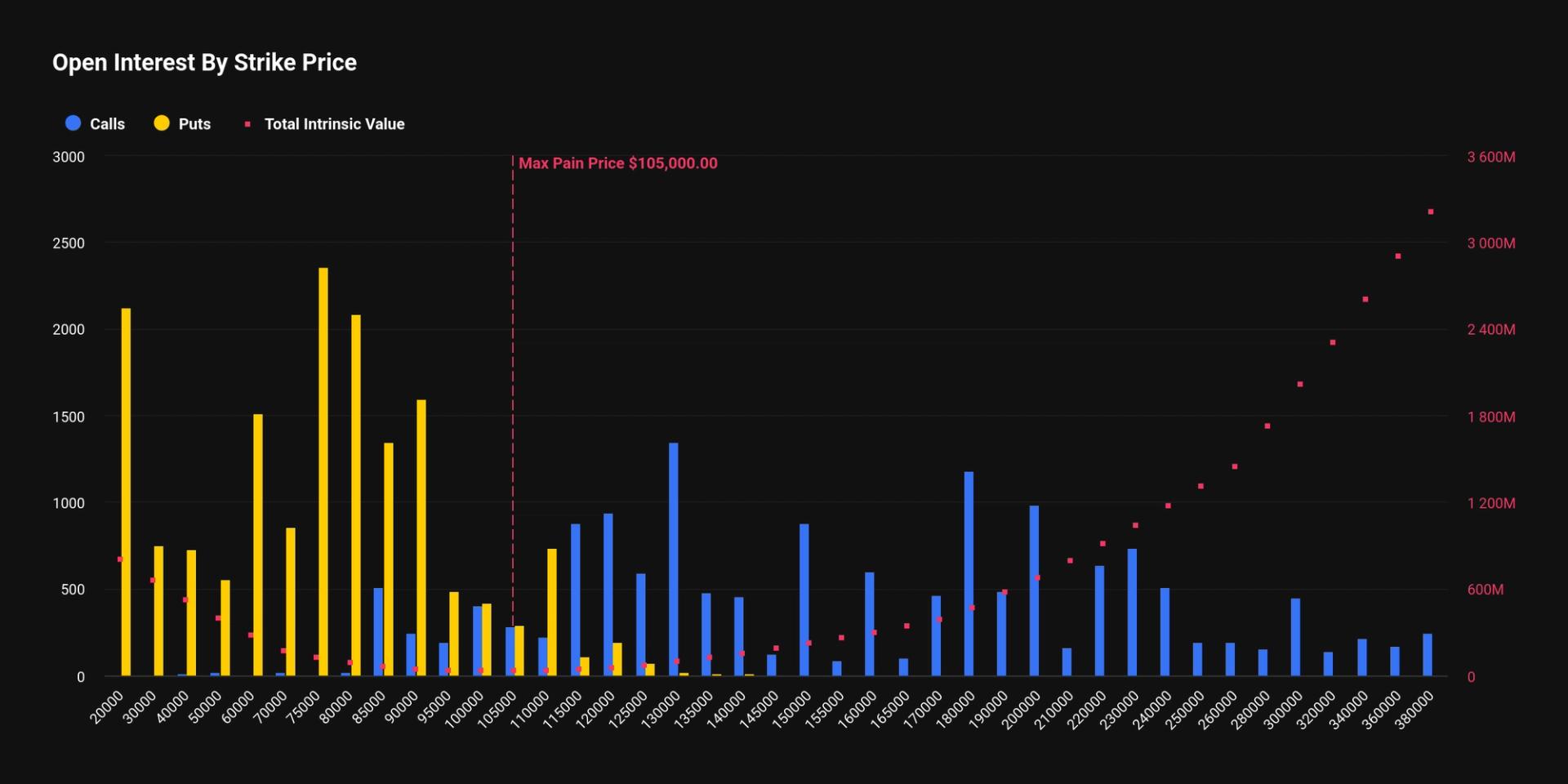

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email Bitcoin Traders Target $20K Bitcoin Strike as Deep Out of the Money Options Gain Traction These flows represent a bullish bet on volatility rather than a downside hedge or outright bearish position. By Omkar Godbole , James Van Straten | Edited by Sam Reynolds Dec 9, 2025, 4:28 a.m. BTC Options Deribit June 2026 What to know : The $20,000 strike put option for June 2026 is notably popular, with over $191 million in notional open interest. These options are seen as bets on volatility rather than price direction, as they are too far from the current BTC spot price to serve as a hedge. Deep out-of-the-money (OTM) bitcoin BTC $ 90,408.34 put options are lighting up in longer-dated expiries, as traders pick up cheap lottery tickets for potential moonshot payoffs if BTC swings wild. On leading crypto options exchange Deribit, the $20,000 strike put is the second most popular among the June 2026 expiry options, boasting a notional open interest of over $191 million. STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy . Notional open interest is the dollar value of the number of active contracts. Put options at strikes below the going market rate of BTC are said to be OTM. These OTM puts tend to be cheaper than those near or above the spot price of BTC. The June expiry also sees significant activity in other OTM puts at $30,000, $40,000, $60,000, and $75,000 strikes. Activity in deep OTM puts is typically read as traders bracing for a price crash. But that's not necessarily the case here, as the exchange has also seen activity on higher-strike calls above $200,000. Taken together, these flows represent a bullish view on long-dated volatility at low cost rather than a bet on price direction, according to Deribit's Global Head of Retail Sidrah Fariq. Think of it as cheap lottery tickets on a potential volatility explosion over the next six months. "There is about 2,117 open interest on the $20K bitcoin put for the June expiry. We also saw some big trades in the $30,000 put and $230,000 call strikes. The combination of these far out of the money options does not suggest directional trading, but rather deep wing trades that professionals use to trade long-dated volatility cheaply and adjust tail risk in their books," Fariq told CoinDesk. She explained that it's essentially volatility positioning, not price positioning, because the $20,000 put or the $230,000 call are simply too far from the spot price to be a purely protective hedge. As of writing, BTC changed hands near $90,500, according to CoinDesk data. Those holding both OTM calls and puts could score asymmetric payoffs from extreme volatility or wild price swings in either direction. But if markets stay flat, these options quickly lose value. Options are derivative contracts that give the purchaser the right to buy or sell the underlying asset at a predetermined price at a later date. A put option provides the right to sell and represents a bearish bet on the market. A call offers the right to buy. The crypto options market, including the one tied to BlackRock's IBIT ETF, has evolved into a sophisticated arena where institutions and whales engage in three-dimensional chess, managing risk and profiting from price direction, time decay, and volatility swings. Broadly speaking, the options market mood appears bearish, as BTC puts continue to trade at a premium to calls across all tenors, according to Amberdata's options risk reversals. This is at least partly due to persistent call overwriting, a strategy aimed at boosting yield on top of spot market holdings. Bitcoin News Deribit More For You Protocol Research: GoPlus Security By CoinDesk Research Nov 14, 2025 Commissioned by GoPlus What to know : As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M. GoPlus Intelligence's Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month. Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B. View Full Report More For You Dogecoin Holds $0.14 Floor as Network Activity Hits 3-Month High By Shaurya Malwa , CD Analytics 1 min. ago Rising active addresses and tightening volatility indicate an impending directional move, with $0.16 as a critical breakout threshold. What to know : Dogecoin marked its 12th anniversary, but market reactions were muted, focusing instead on technical patterns and network activity. The token consolidated within a tight range, with active buying interest at the lower boundary and potential for a bullish breakout. Rising active addresses and tightening volatility indicate an impending directional move, with $0.16 as a critical breakout threshold. Read full story Latest Crypto News Dogecoin Holds $0.14 Floor as Network Activity Hits 3-Month High 1 min. ago XRP Traders Eyes Breakout Above $2.11 as U.S. ETFs Cross $1B Milestone 5 minutes ago Asia Morning Briefing: BTC Steadies Around 90k With Liquidity Drained and a Fed Cut Fully Priced In 2 hours ago CFTC Launches Digital Assets Pilot Allowing Bitcoin, Ether and USDC as Collateral 6 hours ago Bitcoin Treads Water Near $90K as Bitfinex Warns of 'Fragile Setup' to Shocks 7 hours ago U.S. Regulator Pushes Back on Banks Fighting Crypto's Pursuit of Trust Charters 8 hours ago Top Stories CoinDesk's Most Influential 2025 13 hours ago Asia Morning Briefing: BTC Steadies Around 90k With Liquidity Drained and a Fed Cut Fully Priced In 2 hours ago CFTC Launches Digital Assets Pilot Allowing Bitcoin, Ether and USDC as Collateral 6 hours ago Bitcoin Treads Water Near $90K as Bitfinex Warns of 'Fragile Setup' to Shocks 7 hours ago U.S. Regulator Pushes Back on Banks Fighting Crypto's Pursuit of Trust Charters 8 hours ago 40% of Canadian Crypto Users Flagged for Tax Evasion Risk, Canadian Tax Authority Reveals 10 hours ago In this article BTC BTC $ 90,408.34 ◢ 1.00 %