Dogecoin Holds $0.14 Floor as Network Activity Hits 3-Month High

Analysis

Price Impact

HighDogecoin is consolidating within a tight range, with network activity hitting a 3-month high. this tightening volatility and rising active addresses suggest an impending significant directional move, with a critical breakout threshold at $0.16 or a risk of falling to $0.081 if $0.14 support fails.

Trustworthiness

HighThe analysis is provided by coindesk data/cd analytics, a reputable source, and is based on on-chain data (active addresses) and technical analysis (price patterns, macd, volume).

Price Direction

BullishWhile consolidating, the analysis indicates active buying interest at the $0.14 floor, declining sell volume, macd curves converging for a bullish cross, and an early-stage accumulation pattern. a break above $0.16 is identified as a bullish breakout, suggesting an upward bias if current support holds.

Time Effect

ShortThe article explicitly states that the consolidation setup is 'nearing resolution' and an 'impending directional move' is approaching, implying an imminent price movement in the short term.

Original Article:

Article Content:

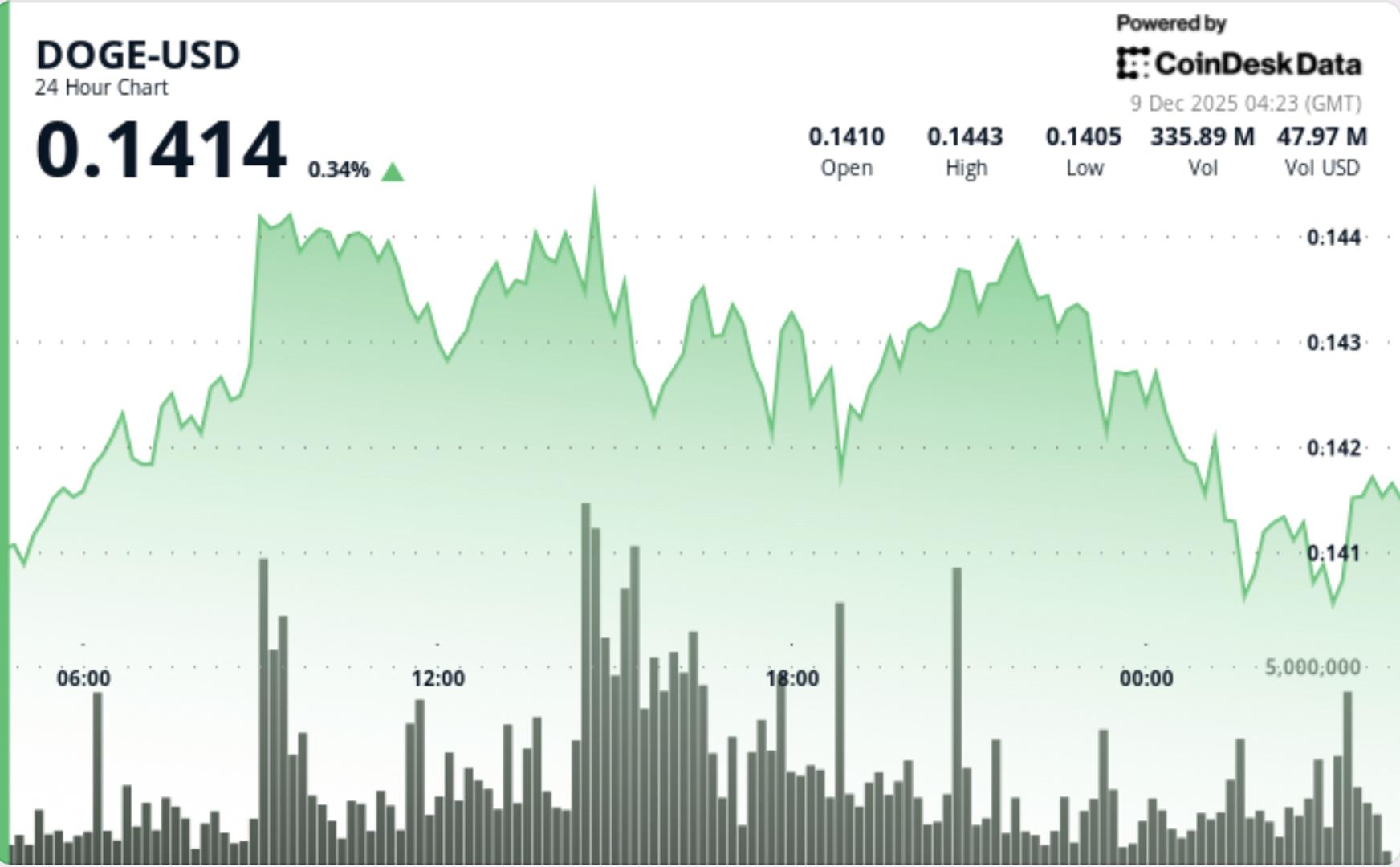

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email Dogecoin Holds $0.14 Floor as Network Activity Hits 3-Month High Rising active addresses and tightening volatility indicate an impending directional move, with $0.16 as a critical breakout threshold. By Shaurya Malwa , CD Analytics Updated Dec 9, 2025, 4:29 a.m. Published Dec 9, 2025, 4:29 a.m. (CoinDesk Data) What to know : Dogecoin marked its 12th anniversary, but market reactions were muted, focusing instead on technical patterns and network activity. The token consolidated within a tight range, with active buying interest at the lower boundary and potential for a bullish breakout. Rising active addresses and tightening volatility indicate an impending directional move, with $0.16 as a critical breakout threshold. Memecoin posts modest advance with elevated trading activity while technical patterns signal consolidation near key support. News Background Dogecoin marked its 12th anniversary on December 6, twelve years after creators Billy Markus and Jackson Palmer introduced the meme-token that would later evolve into a major crypto asset supported by persistent community engagement. Despite the milestone, the market reaction was muted, with trading driven instead by technical structure and network activity. On-chain data showed daily active addresses reaching 67,511 on December 3 — the second-highest level in three months — underscoring renewed user participation even as price action remains contained. Technical Analysis DOGE spent the session consolidating within a tight $0.1406–$0.1450 band, forming a compression structure designed to resolve into a broader move. The token bounced from $0.14 support three separate times, showing active buying interest at the lower boundary of the range. Each rejection of deeper downside came with declining sell volume, a constructive signal for potential upside resolution. Hourly charts revealed a notable volatility pocket around 03:19–03:22 GMT, where price dipped to $0.1405 before recovering, reinforcing an ascending intraday support line. MACD curves continue to converge toward a bullish cross, while range contraction and higher lows hint at an early-stage accumulation pattern rather than distribution. Price Action Summary DOGE advanced from $0.1405 to $0.14155 in a controlled 0.81% gain. Volume jumped 16.96% above weekly averages, with a notable 465.9M spike (+68% vs 24-hour SMA) at 01:00 GMT confirming institutional interest around range lows. The token maintained stable structure despite multiple tests of $0.140–$0.141, while resistance at $0.145 remained unchallenged during the session. What Traders Should Know The consolidation setup is nearing resolution, with $0.16 identified as the critical breakout threshold that would transition DOGE from range-bound action into a trend continuation phase. Failure to hold $0.14 risks sending price toward deeper on-chain support near $0.081, as flagged by UTXO realized distribution clusters. The combination of rising active addresses and tightening volatility suggests a directional move is approaching. Traders should watch for volume expansion above $0.145 or below $0.140 as the likely trigger for the next leg. More For You Protocol Research: GoPlus Security By CoinDesk Research Nov 14, 2025 Commissioned by GoPlus What to know : As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M. GoPlus Intelligence's Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month. Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B. View Full Report More For You Bitcoin Traders Target $20K Bitcoin Strike as Deep Out of the Money Options Gain Traction By Omkar Godbole , James Van Straten | Edited by Sam Reynolds 1 minute ago These flows represent a bullish bet on volatility rather than a downside hedge or outright bearish position. What to know : The $20,000 strike put option for June 2026 is notably popular, with over $191 million in notional open interest. These options are seen as bets on volatility rather than price direction, as they are too far from the current BTC spot price to serve as a hedge. Read full story Latest Crypto News Bitcoin Traders Target $20K Bitcoin Strike as Deep Out of the Money Options Gain Traction 1 minute ago XRP Traders Eyes Breakout Above $2.11 as U.S. ETFs Cross $1B Milestone 5 minutes ago Asia Morning Briefing: BTC Steadies Around 90k With Liquidity Drained and a Fed Cut Fully Priced In 2 hours ago CFTC Launches Digital Assets Pilot Allowing Bitcoin, Ether and USDC as Collateral 6 hours ago Bitcoin Treads Water Near $90K as Bitfinex Warns of 'Fragile Setup' to Shocks 7 hours ago U.S. Regulator Pushes Back on Banks Fighting Crypto's Pursuit of Trust Charters 8 hours ago Top Stories CoinDesk's Most Influential 2025 13 hours ago Asia Morning Briefing: BTC Steadies Around 90k With Liquidity Drained and a Fed Cut Fully Priced In 2 hours ago CFTC Launches Digital Assets Pilot Allowing Bitcoin, Ether and USDC as Collateral 6 hours ago Bitcoin Treads Water Near $90K as Bitfinex Warns of 'Fragile Setup' to Shocks 7 hours ago U.S. Regulator Pushes Back on Banks Fighting Crypto's Pursuit of Trust Charters 8 hours ago 40% of Canadian Crypto Users Flagged for Tax Evasion Risk, Canadian Tax Authority Reveals 10 hours ago