XRP Traders Eyes Breakout Above $2.11 as U.S. ETFs Cross $1B Milestone

Analysis

Price Impact

HighInstitutional demand for xrp etfs has surpassed $1 billion, showing strong underlying interest. the price is at a critical juncture, needing to break above $2.11 for a bullish momentum or risk retesting $1.95 if $2.00 support fails.

Trustworthiness

HighThe analysis comes from coindesk analytics, a reputable source, providing detailed technical analysis with specific price points, volume data, and institutional flow insights, enhancing its credibility.

Price Direction

BullishDespite muted retail sentiment, institutional buying absorbed heavy selling pressure at the psychological $2.00 level, confirmed by a v-shaped rebound and higher lows. a breakout above $2.11 would confirm a strong bullish trend towards $2.20-$2.26, driven by etf inflows.

Time Effect

ShortThe immediate focus is on clearing the $2.11 resistance or retesting $1.95-$2.00 support in the near term. while institutional accumulation hints at longer-term potential, the current price action is highly sensitive to immediate technical breakouts.

Original Article:

Article Content:

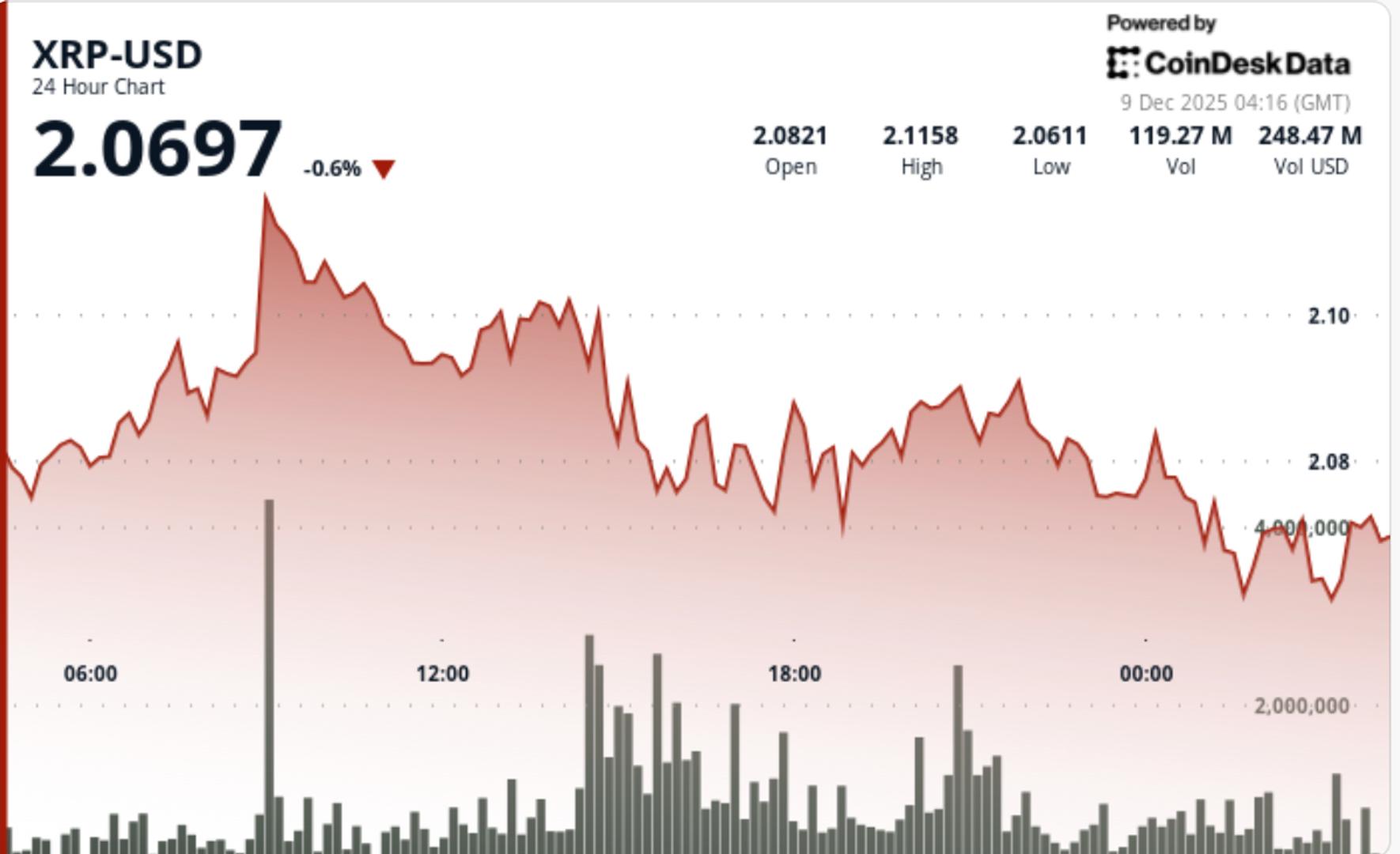

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email XRP Traders Eyes Breakout Above $2.11 as U.S. ETFs Cross $1B Milestone A breakout above $2.11 is needed to trigger momentum towards higher resistance levels, while failure to hold $2.00 could lead to a retest of $1.95. By Shaurya Malwa , CD Analytics Updated Dec 9, 2025, 4:24 a.m. Published Dec 9, 2025, 4:24 a.m. (CoinDesk Data) What to know : XRP's price action was marked by a significant volume surge as it defended the psychological support level at $2.00. Institutional demand for XRP ETFs has surpassed $1 billion, indicating strong interest despite muted retail sentiment. A breakout above $2.11 is needed to trigger momentum towards higher resistance levels, while failure to hold $2.00 could lead to a retest of $1.95. Token breaks above key support while volume surges 251% during psychological level defense at $2.00. News Background U.S. spot XRP ETFs continue pulling in uninterrupted inflows, with cumulative demand now exceeding $1 billion since launch — the fastest early adoption pace for any altcoin ETF. Institutional participation remains strong even as retail sentiment remains muted, contributing to market conditions where large players accumulate during weakness while short-term traders hesitate to re-enter. XRP's macro environment remains dominated by capital rotation into regulated products, with ETF demand offsetting declining open interest in derivatives markets. Technical Analysis The defining moment of the session came during the $2.03 → $2.00 flush when volume spiked to 129.7M — 251% above the 24-hour average. This confirmed heavy selling pressure but, more importantly, marked the exact moment where institutional buyers absorbed liquidity at the psychological floor. The V-shaped rebound from $2.00 back into the $2.07–$2.08 range validates active demand at this level. XRP continues to form a series of higher lows on intraday charts, signaling early trend reacceleration. However, failure to break through the $2.08–$2.11 resistance cluster shows lingering supply overhead as the market awaits a decisive catalyst. Momentum indicators show bullish divergence forming, but volume needs to expand during upside moves rather than only during downside flushes to confirm a sustainable breakout. Price Action Summary XRP traded between $2.00 and $2.08 across the 24-hour window, with a sharp selloff testing the psychological floor before immediate absorption. Three intraday advances toward $2.08 failed to clear resistance, keeping price capped despite improving structure. Consolidation near $2.06–$2.08 into the session close signals stabilization above support, though broader range compression persists. What Traders Should Know The $2.00 level remains the most important line in the sand — both technically and psychologically. Institutional accumulation beneath this threshold hints at larger players preparing for medium-term expansion phases. A clean break above $2.11 is required to ignite momentum toward the next supply zone near $2.20–$2.26. Failure to hold the $2.00 floor risks a retest of the $1.95 area, where ETF-driven buying may reappear. The divergence between rising institutional demand and flat retail participation continues to create asymmetric upside conditions if resistance levels break. More For You Protocol Research: GoPlus Security By CoinDesk Research Nov 14, 2025 Commissioned by GoPlus What to know : As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M. GoPlus Intelligence's Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month. Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B. View Full Report More For You Asia Morning Briefing: BTC Steadies Around 90k With Liquidity Drained and a Fed Cut Fully Priced In By Sam Reynolds 2 hours ago QCP notes participation has collapsed while Polymarket sees a shallow easing path, putting the focus on guidance and cross central bank signals. What to know : Bitcoin remains around $90,000 as thin year-end liquidity leads to volatility and range-bound trading. Traders expect a shallow easing path from the Fed, with more focus on guidance than the anticipated rate cut. Global market movements are influenced by diverging central bank policies and macroeconomic signals. Read full story Latest Crypto News Asia Morning Briefing: BTC Steadies Around 90k With Liquidity Drained and a Fed Cut Fully Priced In 2 hours ago CFTC Launches Digital Assets Pilot Allowing Bitcoin, Ether and USDC as Collateral 6 hours ago Bitcoin Treads Water Near $90K as Bitfinex Warns of 'Fragile Setup' to Shocks 7 hours ago U.S. Regulator Pushes Back on Banks Fighting Crypto's Pursuit of Trust Charters 8 hours ago 40% of Canadian Crypto Users Flagged for Tax Evasion Risk, Canadian Tax Authority Reveals 10 hours ago ICP Rises, Keeping Price Above Key Support Levels 12 hours ago Top Stories CoinDesk's Most Influential 2025 12 hours ago Asia Morning Briefing: BTC Steadies Around 90k With Liquidity Drained and a Fed Cut Fully Priced In 2 hours ago CFTC Launches Digital Assets Pilot Allowing Bitcoin, Ether and USDC as Collateral 6 hours ago Bitcoin Treads Water Near $90K as Bitfinex Warns of 'Fragile Setup' to Shocks 7 hours ago U.S. Regulator Pushes Back on Banks Fighting Crypto's Pursuit of Trust Charters 8 hours ago 40% of Canadian Crypto Users Flagged for Tax Evasion Risk, Canadian Tax Authority Reveals 10 hours ago