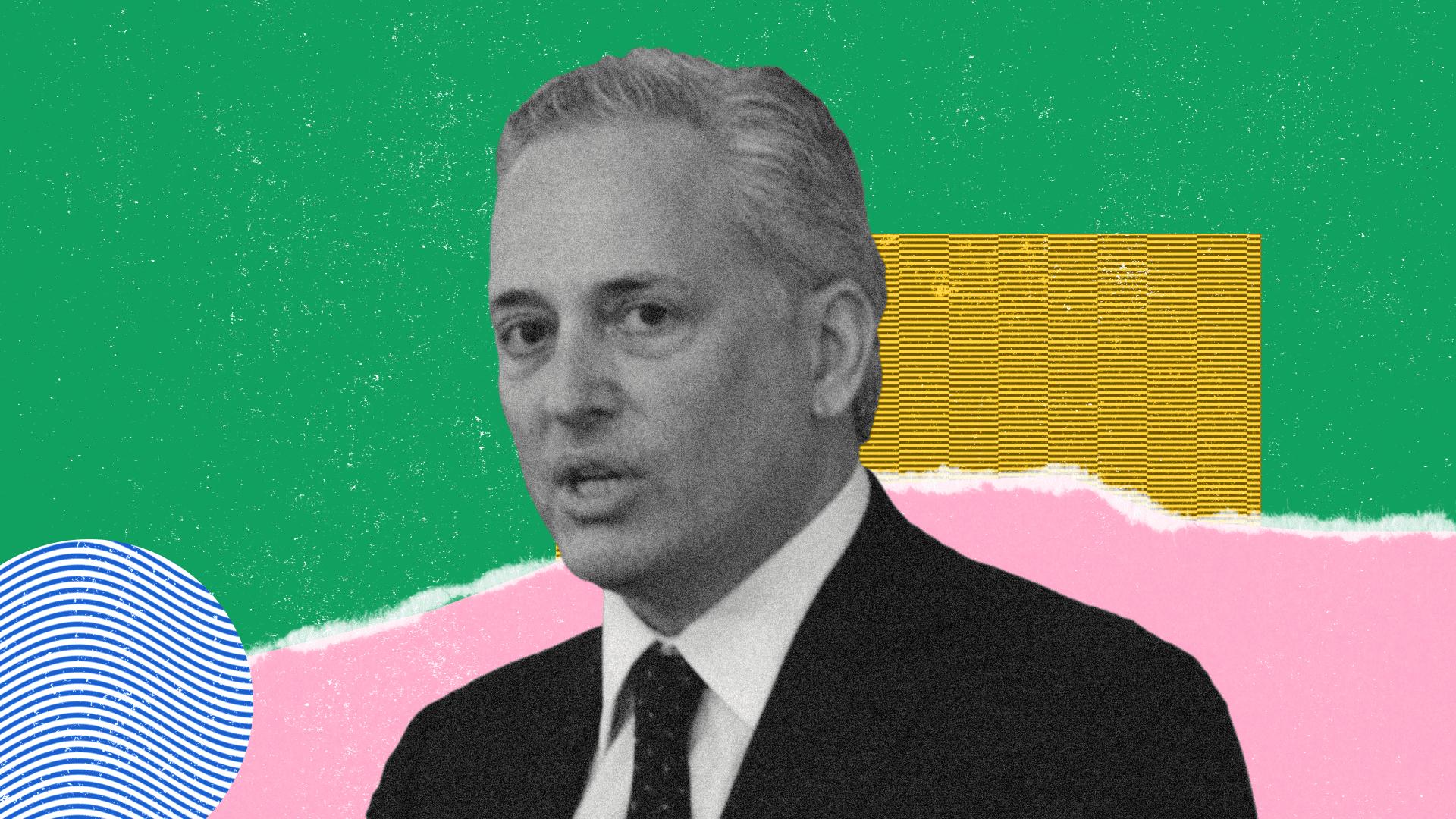

Most Influential: David Sacks

Analysis

Price Impact

HighDavid sacks, as the white house ai and crypto czar, is spearheading significant crypto legislation and executive orders, including the creation of a bitcoin reserve and directing federal agencies to reassess crypto. this level of governmental backing and policy implementation indicates a substantial impact on the crypto market.

Trustworthiness

HighThe information comes from coindesk, a reputable crypto news source, detailing official appointments and policy initiatives within a us presidential administration. while conflict-of-interest concerns are mentioned, they do not invalidate the stated policy directions or the official's role.

Price Direction

BullishThe move to establish a bitcoin reserve and favorable reassessment of crypto by federal agencies signals a strong shift towards institutional acceptance and regulatory clarity in the us. this could significantly boost confidence and demand for cryptocurrencies, particularly bitcoin, in the long term.

Time Effect

LongPolicies such as major crypto legislation, a bitcoin reserve, and federal agency re-evaluations represent fundamental changes to the regulatory and institutional landscape. their full effects will unfold over an extended period, shaping the market for years to come.

Original Article:

Article Content:

Policy Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email Most Influential: David Sacks The White House AI and Crypto Czar was one of the first, and most prominent, Silicon Valley representatives to be named to a major role in Trump’s new administration. By Nikhilesh De | Edited by Cheyenne Ligon Dec 8, 2025, 3:00 p.m. PayPal Mafia alum and Craft Ventures co-founder David Sacks became one of U.S. President Donald Trump’s earliest major picks for a crypto role as he prepared to retake office, naming Sacks the White House AI and Crypto Czar in December 2024. And in that role, Sacks has seen Congress pass the first-ever major piece of crypto legislation and announced multiple executive orders signed by Trump addressing everything from the creation of a Bitcoin BTC $ 90,873.03 reserve to directing federal agencies to reassess how they view crypto. The Silicon Valley veteran is no stranger to the crypto sector, having invested in companies like Bitwise, dYdx and BitGo through his venture capital fund. Alongside Craft Ventures, Sacks is a limited partner at Multicoin Capital. STORY CONTINUES BELOW Don't miss another story. Subscribe to the State of Crypto Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy . "I look forward to working with each of you in creating a golden age in digital assets," he said during a press conference in early February, where he said crypto was a "week-one priority for the administration." Sacks, as a czar and formally a Special Government Employee, enjoys a more prominent role than either Bo Hines or Patrick Witt, the White House’s point persons for Congressional crypto negotiations, but also faces restrictions on his role, an issue Democrats in Congress have taken up . He’s also faced conflict-of-interest concerns since taking on the role, though he said earlier this year that he had divested from most of his actual crypto holdings and direct stakes in crypto firms. According to The New York Times , Sacks still has some financial tie-ups with technology and crypto interests, including companies that market themselves as AI firms. Some of these tie-ups come through the fact that he’s still a partner at Craft Ventures, which in turn invested in a number of companies. Sacks said in a post on X (formerly Twitter) that some of the claims were “baseless” and details “fabricated,” and hired the Clare Locke law firm to write a letter to the Times (which subsequently said it stood by its reporting). White House Most Influential 2025 More For You Protocol Research: GoPlus Security By CoinDesk Research Nov 14, 2025 Commissioned by GoPlus What to know : As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M. GoPlus Intelligence's Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month. Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B. View Full Report More For You Most Influential: Donald Trump By Jesse Hamilton , Shaurya Malwa | Edited by Cheyenne Ligon 3 minutes ago Without the turnaround of Donald Trump on crypto, the road toward a U.S. governmental embrace of the new technology would likely have been a steeper climb. Read full story Latest Crypto News Pye Finance Raises $5M Seed Round Led by Variant and Coinbase Ventures 3 minutes ago Most Influential: Donald Trump 3 minutes ago Most Influential: Rep. French Hill 3 minutes ago Most Influential: Ross Ulbricht 3 minutes ago Most Influential: Sen. Bill Hagerty 3 minutes ago Tom Lee's BitMine Immersion Ramps Up Ether Acquisition, Adding $435M of ETH to Treasury 40 minutes ago Top Stories Perky, With Bearish Overtones: Crypto Daybook Americas 2 hours ago Binance Wins Full ADGM Approval for Exchange, Clearing, and Brokerage Operations 9 hours ago Here's How Bitcoin, Ether, XRP and Solana May Trade Today 10 hours ago Every Major Bitcoin Conference Has Seen Prices Fall in 2025, Will Abu Dhabi Be Different? 3 hours ago Crypto Markets Today: Bitcoin Reclaims $92K as Fed Rate-Cut Expectations Lift Sentiment 3 hours ago BTC Holds Steady as Fed Rate Cut Looms, Rising Treasury Yields Suggest Caution: Analysts 4 hours ago In this article BTC BTC $ 90,873.03 ◢ 2.94 %