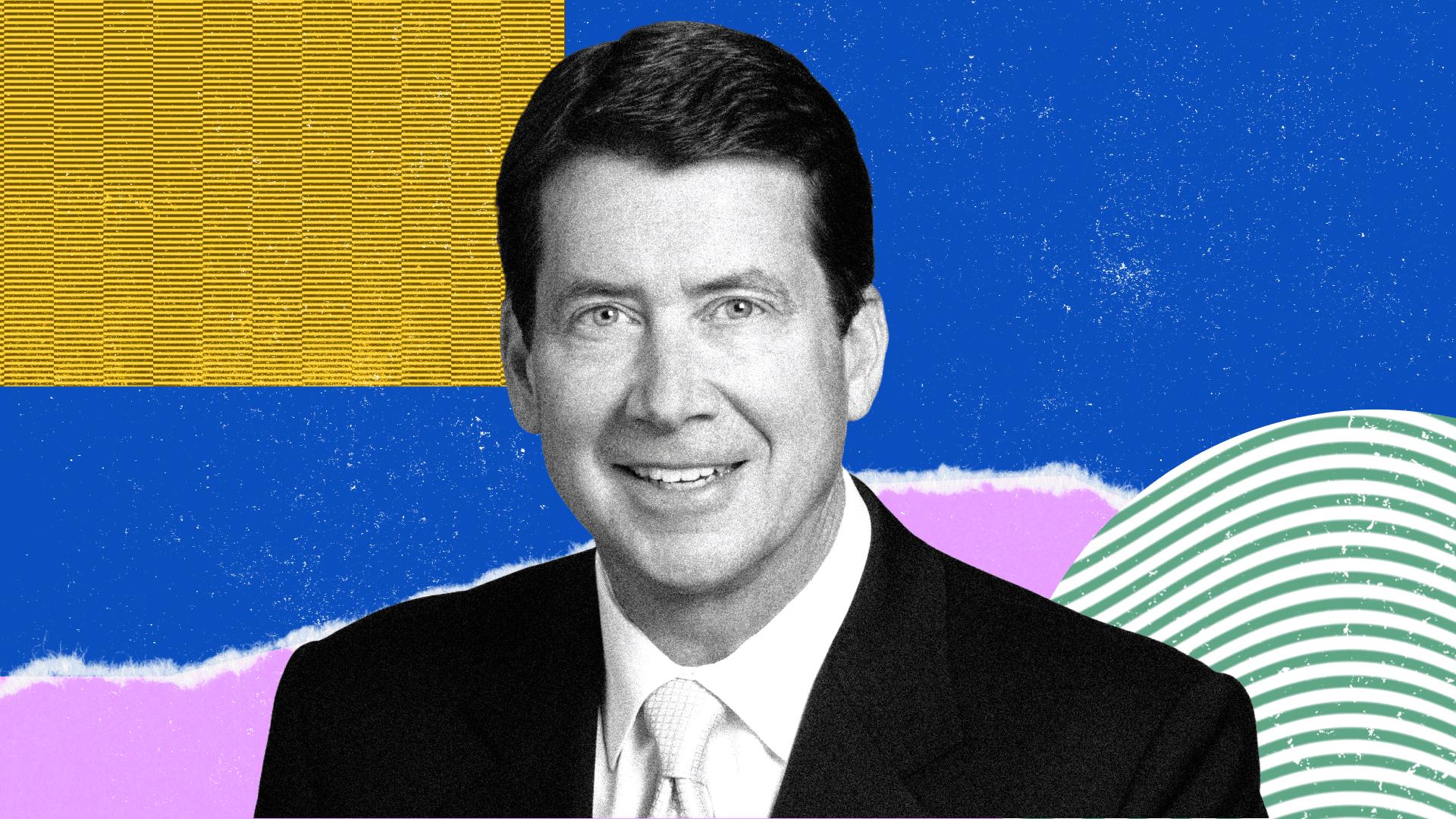

Most Influential: Sen. Bill Hagerty

Analysis

Price Impact

HighThe passage of the genius act, the first u.s. law primarily addressing crypto issues, specifically provides a regulatory framework for stablecoin issuers. this dramatically reduces uncertainty, enhances legitimacy, and paves the way for wider institutional and retail adoption of stablecoins, which are a cornerstone of the broader crypto market. this positive development can lead to increased capital inflows and innovation.

Trustworthiness

HighThe information is from coindesk, a reputable crypto news source, reporting on a signed u.s. federal law (genius act) with specific details on its sponsor and purpose. the event (law signing) is a factual and verifiable occurrence.

Price Direction

BullishRegulatory clarity and a defined legal framework for stablecoins are inherently bullish. it reduces counterparty risk, cuts transaction costs, and is explicitly aimed at reinforcing dollar dominance in the digital asset space. this legitimizes a significant part of the crypto ecosystem, fostering trust and encouraging greater participation from traditional finance and new market entrants.

Time Effect

LongWhile the immediate market reaction might be positive, the full implications of a new regulatory framework – including the development of specific guidelines by federal regulators, increased institutional adoption, and the flow of new capital – will unfold over an extended period, leading to sustained growth and integration rather than just a short-term price spike.

Original Article:

Article Content:

Policy Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email Most Influential: Sen. Bill Hagerty The Tennessee Republican sponsored the first piece of stablecoin legislation to become a U.S. law. By Nikhilesh De | Edited by Cheyenne Ligon Dec 8, 2025, 3:00 p.m. When U.S. President Donald Trump signed the first major piece of legislation primarily addressing crypto issues into law in July 2025, it was only the final step in a years-long campaign to have lawmakers craft dedicated rules for the crypto industry. The president’s signature on July 18, 2025 kicked off a new process by federal regulators to define specific regulations and explain how they would enforce those regulations around stablecoins, which itself is only a small segment of the broader overall crypto market. STORY CONTINUES BELOW Don't miss another story. Subscribe to the State of Crypto Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy . Sen. Bill Hagerty, a Republican representing Tennessee, introduced the Guiding and Establishing National Innovation for U.S. Stablecoins Act — better known as the GENIUS Act — in February, kicking off the process for a law that set rules for stablecoin issuers wanting to do business in the U.S. and directed federal bank and financial regulators to get to work creating specific guidelines for these firms. To be sure, Hagerty is among a group of lawmakers which included both Republicans and Democrats who drafted the bill, voted it out of committee, pushed it through the Senate and ultimately through the House of Representatives (which originally had its own stablecoin bill which was eventually dropped in favor of the Senate draft). In remarks at Bitcoin 2025 in Las Vegas earlier this year, Hagerty called the bill the most bipartisan product the Senate Banking Committee had produced in a decade. “It’s taken a tremendous amount of work,” he said on the panel a few months prior to the bill’s passage. He argued that the bill would reduce counterparty risk, cut transaction costs and lower the working capital necessary for operating accounts receivables. “If I think about the major selling points to my colleagues, the cost savings, the efficiencies, that’s all good,” he said about the bill. “But if you think about what this does for dollar dominance around the world, the dollar has been the reserve currency of the world, and we've seen a slow degradation of that. This is going to turn the tables on this and move us right back to the fore.” Stablecoins, already a rapidly growing part of the crypto market, continue to see new issuers enter the market and are anticipated to reach a nearly $2 trillion market cap by the end of the decade, according to some analyses . stablecoin regulation US Congress Most Influential 2025 More For You Protocol Research: GoPlus Security By CoinDesk Research Nov 14, 2025 Commissioned by GoPlus What to know : As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M. GoPlus Intelligence's Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month. Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B. View Full Report More For You Most Influential: Donald Trump By Jesse Hamilton , Shaurya Malwa | Edited by Cheyenne Ligon 2 minutes ago Without the turnaround of Donald Trump on crypto, the road toward a U.S. governmental embrace of the new technology would likely have been a steeper climb. Read full story Latest Crypto News Pye Finance Raises $5M Seed Round Led by Variant and Coinbase Ventures 2 minutes ago Most Influential: Donald Trump 2 minutes ago Tom Lee's BitMine Immersion Ramps Up Ether Acquisition, Adding $435M of ETH to Treasury 38 minutes ago ZKsync Lite to Shut Down in 2026 as Matter Labs Moves On 40 minutes ago CoinDesk 20 Performance Update: Index Gains 3.3% as All Constituents Trade Higher 48 minutes ago BlackRock Files for Staked Ethereum ETF 1 hour ago Top Stories Perky, With Bearish Overtones: Crypto Daybook Americas 2 hours ago Binance Wins Full ADGM Approval for Exchange, Clearing, and Brokerage Operations 9 hours ago Here's How Bitcoin, Ether, XRP and Solana May Trade Today 10 hours ago Every Major Bitcoin Conference Has Seen Prices Fall in 2025, Will Abu Dhabi Be Different? 3 hours ago Crypto Markets Today: Bitcoin Reclaims $92K as Fed Rate-Cut Expectations Lift Sentiment 3 hours ago BTC Holds Steady as Fed Rate Cut Looms, Rising Treasury Yields Suggest Caution: Analysts 4 hours ago