Polkadot's Gain Underperforms Wider Crypto Markets

Analysis

Price Impact

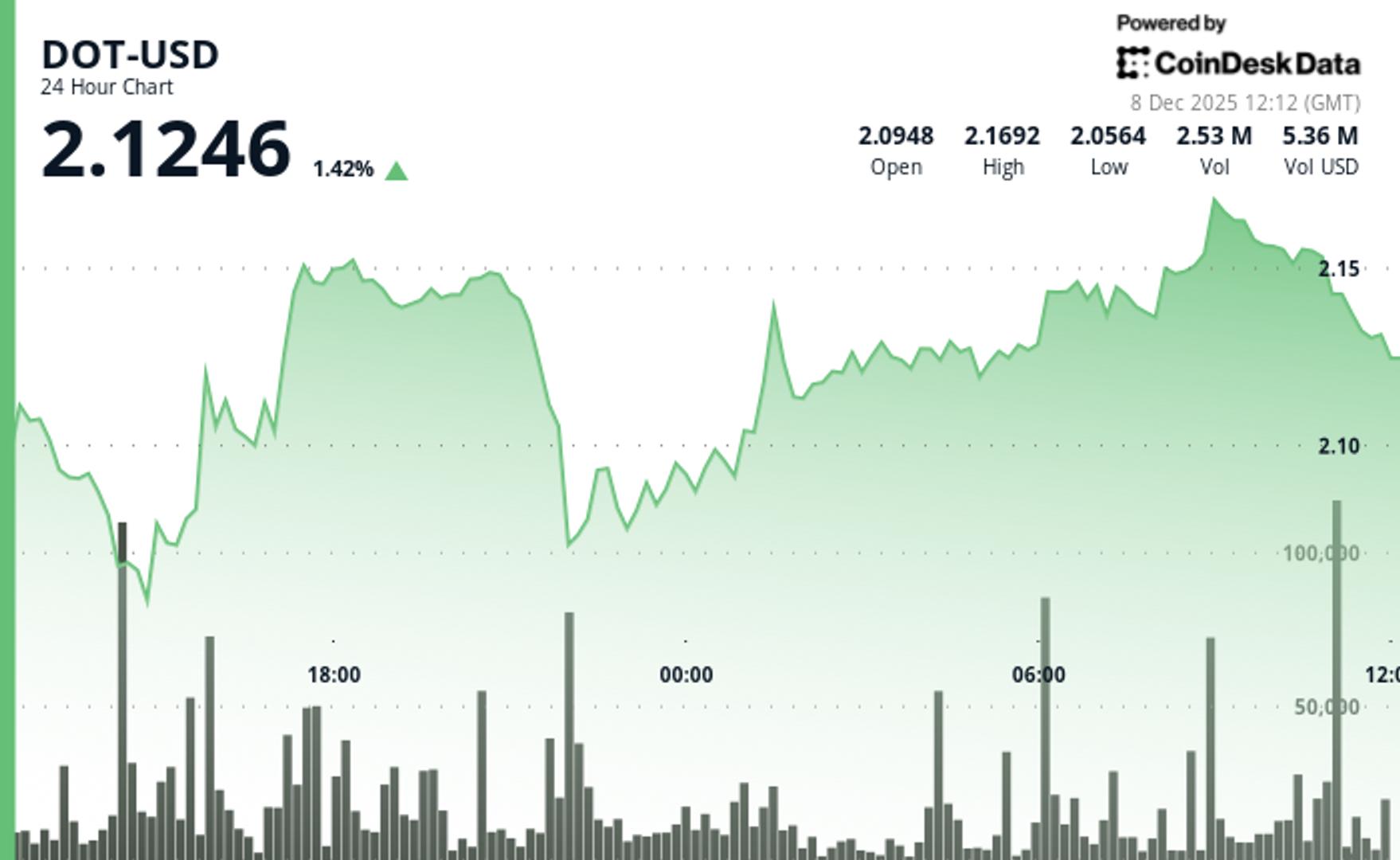

MedPolkadot (dot) gained 0.8% but significantly underperformed the wider crypto market (cd20 up 2.8%), indicating underlying investor hesitation. elevated trading volume suggests deliberate positioning but also profit-taking, limiting upward momentum.

Trustworthiness

HighAnalysis comes from coindesk, a reputable crypto news source, referencing its internal technical analysis model and coindesk research, enhancing its credibility.

Price Direction

NeutralWhile dot saw a modest gain, its inability to match broader market momentum and signs of profit-taking at higher volumes suggest a cautious, neutral stance. technicals show an ascending trend on higher lows but also a conflict with descending channels in shorter timeframes, with resistance at $2.16 and strong support at $2.05.

Time Effect

ShortThe analysis focuses on 24-hour price action, immediate support/resistance levels, and 60-minute volume spikes, indicating a short-term outlook on price movements.

Original Article:

Article Content:

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email Polkadot's Gain Underperforms Wider Crypto Markets The token has support at $2.05 and resistance near the $2.16 level. By CD Analytics , Will Canny | Edited by Sheldon Reback Dec 8, 2025, 12:31 p.m. Polkadot gains 0.8%, underperforms wider Crypto markets. What to know : DOT climbed 0.8% to $2.12, lagging behind the broader crypto market. Trading volume jumped 26% above the seven-day average, signaling heightened institutional activity. DOT $ 2.1239 advanced 0.8% to $2.12 over 24 hours, underperforming the wider cryptocurrency market. The CoinDesk 20 (CD20) index, was 2.8% higher at publication time. STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy . The token's inability to match crypto market momentum, signals underlying hesitation in investor sentiment toward the Polkadot ecosystem, according to CoinDesk Research's technical analysis model. The model showed that the advance occurred on substantially elevated trading volume, with 24-hour activity running 26% higher than the seven-day moving average. This volume pattern suggests deliberate positioning by market participants rather than low-conviction drift, though the relative underperformance indicates profit-taking outweighs fresh accumulation, according to the model. DOT rallied from $2.09 to $2.14 over the session, establishing an ascending trend with higher lows at $2.05 and $2.09, creating a total trading range of $0.13 representing 6.1% volatility, the model said. The most significant volume event occurred with 5.75 million tokens traded at 134% above the 24-hour average, the model showed, driving price through resistance at $2.12 to establish session highs near $2.16. Technical Analysis: Strong support established at $2.05 with resistance forming near $2.16; immediate support at $2.140 becomes critical for maintaining bullish structure Exceptional volume surge of 134% above average during resistance test; recent 60-minute volume spike of 145K tokens coincides with distribution activity Ascending trend with higher lows from $2.05 to $2.09 conflicts with descending channel formation in shorter time frames Upside target toward $2.16 resistance with potential extension if volume confirms; downside risk toward $2.05 support represents 6.1% range vulnerability Disclaimer : Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk's full AI Policy . AI Market Insights Polkadot Technical Analysis More For You Protocol Research: GoPlus Security By CoinDesk Research Nov 14, 2025 Commissioned by GoPlus What to know : As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M. GoPlus Intelligence's Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month. Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B. View Full Report More For You Every Major Bitcoin Conference Has Seen Prices Fall in 2025, Will Abu Dhabi Be Different? By James Van Straten | Edited by Jamie Crawley 56 minutes ago Bitcoin enters the Abu Dhabi conference near $92K after a year of sell-the-news dips at major events, raising questions about another potential pullback. What to know : Bitcoin enters the MENA 2025 conference around $92K, with traders watching for another event-linked correction. All four major bitcoin conferences this year — Las Vegas, Prague, Hong Kong and Amsterdam — coincided with short-term price drops. The bitcoin conference in Abu Dhabi arrives this week with bitcoin over $92,000, raising the possibility of another sell the news move. Read full story Latest Crypto News Perky, With Bearish Overtones: Crypto Daybook Americas 16 minutes ago Every Major Bitcoin Conference Has Seen Prices Fall in 2025, Will Abu Dhabi Be Different? 56 minutes ago Crypto Markets Today: Bitcoin Reclaims $92K as Fed Rate-Cut Expectations Lift Sentiment 1 hour ago Bitcoin’s Long-Term Holders Hit Cyclical Low as Sell Pressure Finally Eases 1 hour ago BTC Holds Steady as Fed Rate Cut Looms, Rising Treasury Yields Suggest Caution: Analysts 1 hour ago U.S. Interest Rates, Do Kwon Sentencing: Crypto Week Ahead 2 hours ago Top Stories Binance Wins Full ADGM Approval for Exchange, Clearing, and Brokerage Operations 7 hours ago Perky, With Bearish Overtones: Crypto Daybook Americas 16 minutes ago Every Major Bitcoin Conference Has Seen Prices Fall in 2025, Will Abu Dhabi Be Different? 56 minutes ago Two Casascius Coins Holding 2K BTC Moved After 13 Years of Inactivity Dec 6, 2025 Crypto Markets Today: Bitcoin Reclaims $92K as Fed Rate-Cut Expectations Lift Sentiment 1 hour ago BTC Holds Steady as Fed Rate Cut Looms, Rising Treasury Yields Suggest Caution: Analysts 1 hour ago