Bitcoin’s Long-Term Holders Hit Cyclical Low as Sell Pressure Finally Eases

Analysis

Price Impact

HighThe easing of sell pressure from long-term holders, marked by lth supply hitting a cyclical low, suggests a major structural reduction in overhead supply. this has already contributed to a 15% price rebound from $80k to $90k, indicating strong underlying demand absorbing remaining supply.

Trustworthiness

HighBased on on-chain data from glassnode, a reputable analytics firm, providing specific metrics on long-term holder supply. the analysis is data-driven and logical.

Price Direction

BullishWith long-term holder selling pressure largely exhausted and supply hitting a cyclical low, a major source of overhead resistance has been removed. this creates a more favorable environment for price appreciation, having already seen a 15% rebound from the $80k low.

Time Effect

LongThe analysis focuses on cyclical trends and a fundamental shift in long-term holder behavior, suggesting a more enduring change in market dynamics rather than a fleeting event. reduced structural sell pressure supports sustained price recovery.

Original Article:

Article Content:

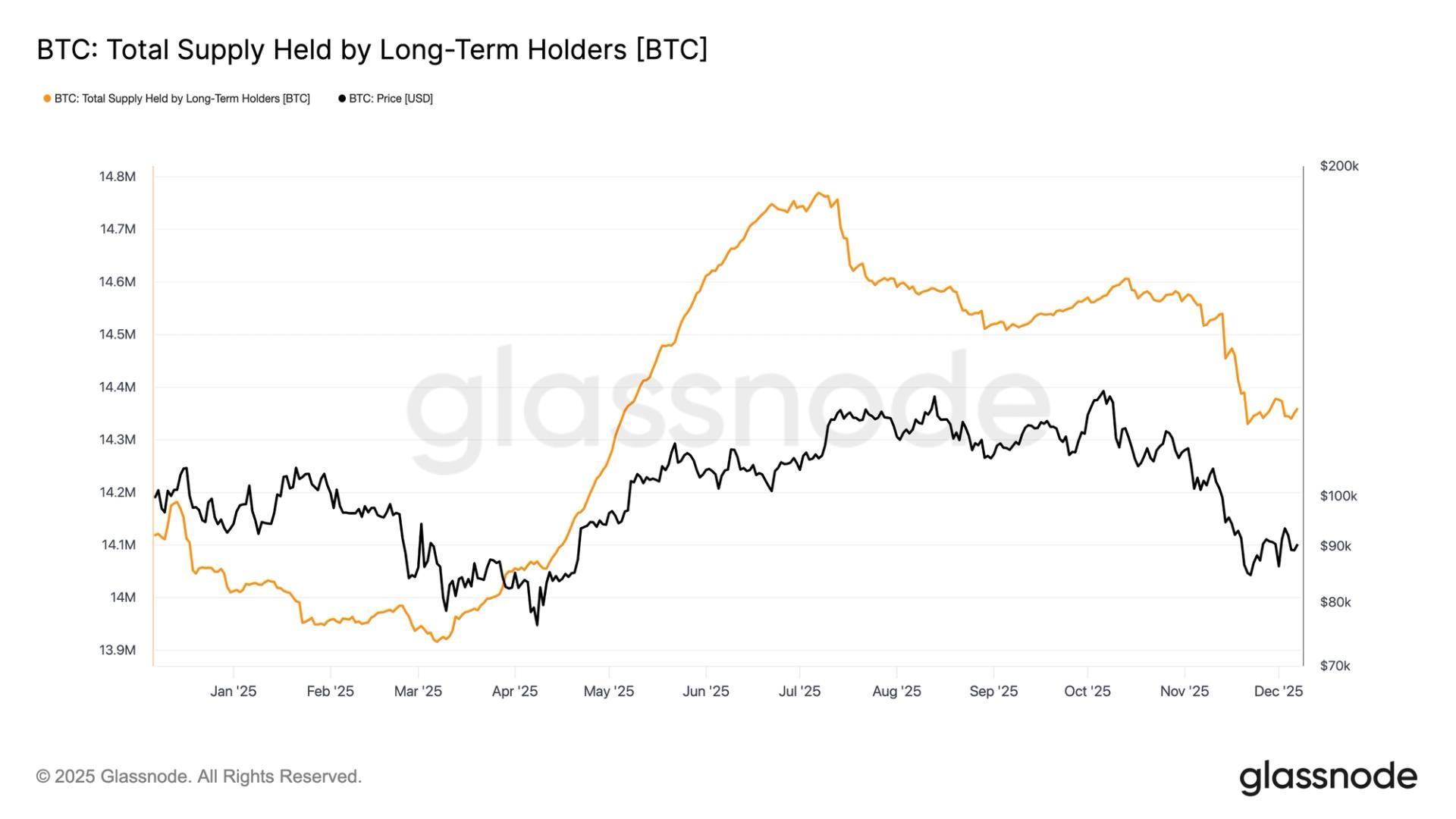

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email Bitcoin’s Long-Term Holders Hit Cyclical Low as Sell Pressure Finally Eases Long-term holder supply bottomed when bitcoin sank to $80K, signaling that the wave of spot-driven selling may be nearing exhaustion as prices rebound to $90K. By James Van Straten , AI Boost | Edited by Jamie Crawley Dec 8, 2025, 10:41 a.m. Long-Term Holder Supply (Glassnode) What to know : Long-term holder supply fell to 14.33M BTC in November, its lowest level since March, coinciding with bitcoin’s $80K correction low. The rebound to $90K suggests the bulk of spot-driven selling from seasoned holders has passed after a 36% peak-to-trough decline. Unlike prior cycles, LTH behavior in 2025 shows more measured distribution rather than blow-off-top capitulation, signaling a shift in market structure. Long-term holder (LTH) supply reached a cyclical low on Nov. 21, the same day bitcoin BTC $ 92,179.17 bottomed out around $80,000. With the bitcoin price now back at $90,000, about 15% higher from the low, the data suggests that most spot-driven sell pressure has already washed through the market following the 36% peak to trough correction. This trend has become a key narrative in 2025, since persistent spot selling has been the primary reason bitcoin has traded largely flat year-to-date. STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy . Long-term holders are defined as entities that have held their coins for at least 155 days. As coins age from short-term holders into this cohort, long-term holder supply naturally increases. The recent stabilization and early upturn suggest that the wave of distribution from these more seasoned holders is easing significantly, reducing structural sell pressure in the market. Since the summer, long-term holders have reduced their holdings from 14,769,512 BTC in July to 14,330,128 BTC in November. The previous two troughs in long-term holder supply occurred in April 2024 and March 2025. The April 2024 decline took place soon after bitcoin reached its all-time high of $73,000, which showed long-term holders were distributing into strength. The March 2025 low arrived during the correction driven by the Trump tariff concerns, which ultimately saw bitcoin bottom in April at roughly $76,000. Looking across previous cycles, long-term holder supply typically sees sharp declines during the retail driven mania phases that accompany cycle peaks, most notably in 2017 and 2021. This cycle, however, appears differently. Instead of a dramatic blow-off top followed by aggressive distribution, the pattern has been more measured, featuring steadier ebbs and flows. This indicates that market structure and holder behavior have evolved, which puts a dent in the four-year cycle structure as the onchain behaviour is different. Bitcoin News Glassnode long-term holder AI Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards . For more information, see CoinDesk's full AI Policy . More For You Protocol Research: GoPlus Security By CoinDesk Research Nov 14, 2025 Commissioned by GoPlus What to know : As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M. GoPlus Intelligence's Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month. Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B. View Full Report More For You BTC Holds Steady as Fed Rate Cut Looms, Rising Treasury Yields Suggest Caution: Analysts By Omkar Godbole , AI Boost | Edited by Sheldon Reback 4 minutes ago The Federal Reserve is expected to cut U.S. interest rates by 25 basis points on Wednesday. What to know : The Fed is expected to cut U.S. interest rates on Wednesday. Bitcoin rose, as did the 10-year Treasury yield. Analysts said the impending rate cut could be accompanied by a hawkish forward guidance. Read full story Latest Crypto News BTC Holds Steady as Fed Rate Cut Looms, Rising Treasury Yields Suggest Caution: Analysts 4 minutes ago U.S. Interest Rates, Do Kwon Sentencing: Crypto Week Ahead 55 minutes ago Canadian Province Wins Forfeiture of $1M QuadrigaCX Co-Founder's Cash, Gold via Default Judgment 2 hours ago Farcaster Switches to Wallet-First Strategy to Grow Its Social App 2 hours ago Coinbase Reopens India Signups, Targets Fiat On-Ramp in 2026 After Two-Year Freeze 4 hours ago ETH, ADA, XRP Lead Gains as Bitcoin Edges Higher on Fed Rate Cut Expectations 5 hours ago Top Stories Binance Wins Full ADGM Approval for Exchange, Clearing, and Brokerage Operations 5 hours ago BTC Holds Steady as Fed Rate Cut Looms, Rising Treasury Yields Suggest Caution: Analysts 4 minutes ago Here's How Bitcoin, Ether, XRP and Solana May Trade Today 5 hours ago Bitcoin Faces Japan Rate Hike: Debunking The Yen Carry Trade Unwind Alarms, Real Risk Elsewhere Dec 7, 2025 Two Casascius Coins Holding 2K BTC Moved After 13 Years of Inactivity Dec 6, 2025 French Banking Giant BPCE to Roll Out Crypto Trading for 2M Retail Clients Dec 6, 2025 In this article BTC BTC $ 92,179.17 ◢ 3.26 %