Hedera Drops Alongside Broader Crypto Market Amid Volume Spike

Analysis

Price Impact

HighHedera (hbar) experienced a significant price drop of 2.2%, breaking key support levels ($0.1380) on exceptionally high trading volume (47% above average). this technical breakdown occurred despite broader altcoin gains and emerging institutional interest via etf speculation, indicating strong selling pressure.

Trustworthiness

HighThe article is published by coindesk, a highly reputable source in crypto news. it provides detailed technical analysis, specific price points, volume data, and contextual market information, enhancing its credibility.

Price Direction

BearishHbar's price action shows a clear short-term bearish trend, with the token dropping below critical support levels on high volume. despite indicators of oversold conditions and potential institutional interest (etf), bearish momentum currently dominates, pushing prices towards lower support zones.

Time Effect

ShortThe immediate price action is driven by short-term technical selling and market mechanics. while new etf applications could foster long-term structural demand, their impact is not yet mitigating the current bearish momentum.

Original Article:

Article Content:

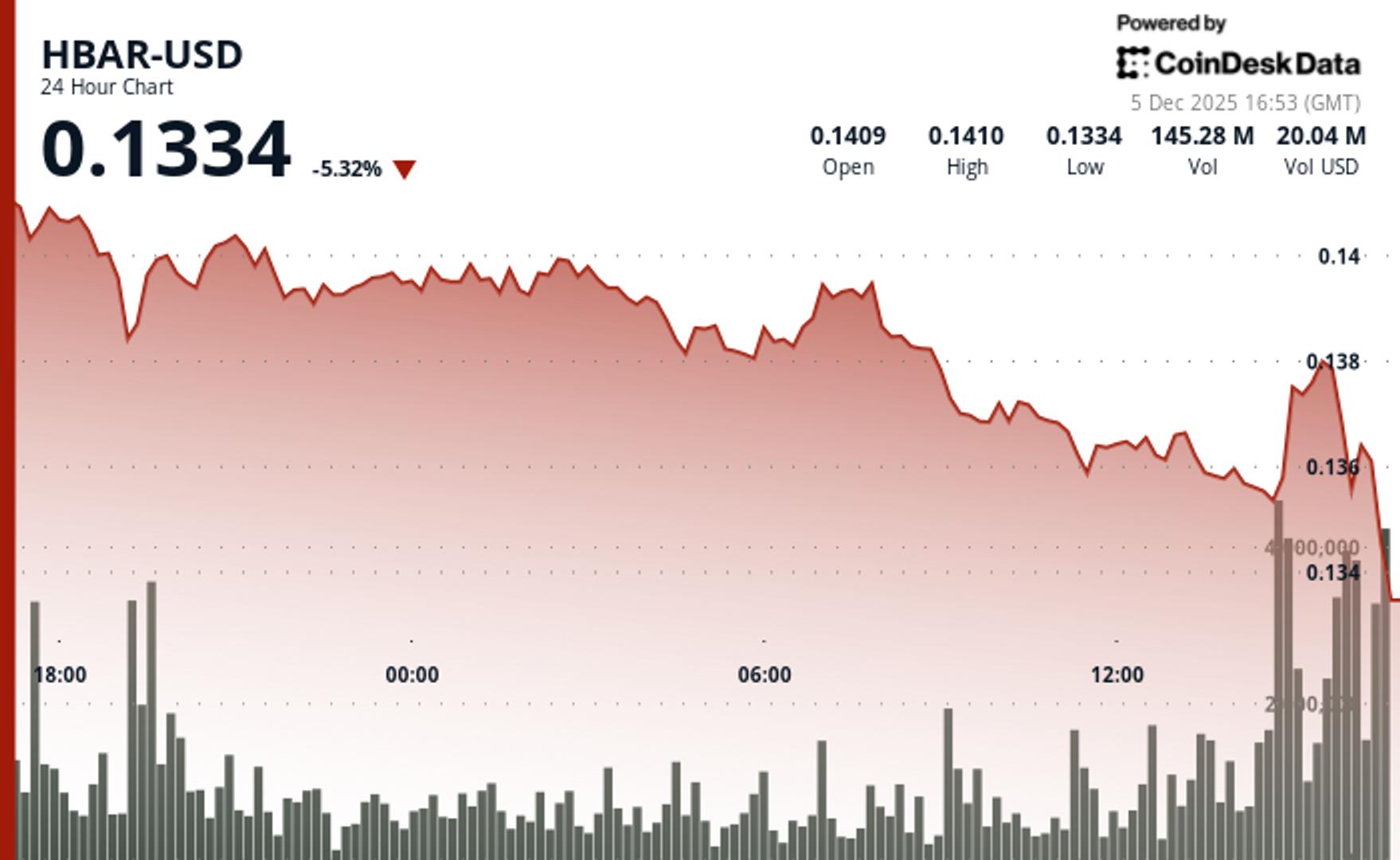

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email Hedera Drops Alongside Broader Crypto Market Amid Volume Spike Hedera's token retreats despite fresh institutional product speculation driving broader altcoin momentum. By CD Analytics , Oliver Knight Updated Dec 5, 2025, 5:05 p.m. Published Dec 5, 2025, 5:05 p.m. "HBAR falls 2.2% to $0.136 amid rising volume and ETF buzz despite broader altcoin gains." What to know : HBAR dropped from $0.1391 to $0.1360, breaking key $0.1380 support level. Trading volume spiked 47% above average during the technical breakdown. New ETF applications surface for HBAR alongside LTC and DOGE tokens. HBAR retreated 2.2% during Thursday's session as technical selling overwhelmed emerging ETF speculation. The token broke decisively below $0.1380 support on volume that peaked 47% above the daily average of 35.5 million tokens. The breakdown accelerated around 09:00 GMT when 52.21 million tokens changed hands. Bears drove prices to session lows near $0.1367 before momentum stalled. STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy . Recent price action shows HBAR testing critical $0.1354 support levels. The token briefly pierced this floor on 2.37 million volume before recovering to current levels around $0.1361. Technical indicators point to oversold conditions, yet bearish momentum persists as traders await clearer directional signals. The bearish technicals contrast with fundamental developments in light of of growing interest around Canary Capital Group's HBAR ETF. Institutional product launches typically drive structural demand over longer timeframes. Short-term price action remains dominated by technical factors as traders weigh oversold conditions against established downtrend momentum. HBAR/USD (TradingView) Key Technical Levels Signal Caution for HBAR Support/Resistance Analysis: Primary support holds at $0.1354 after successful defense during session lows. Resistance cluster forms between $0.1380-$0.1391 from broken support levels. Immediate consolidation floor established at $0.1357 support zone. Volume Analysis: Breakdown volume at 52.21 million confirms technical failure with 47% spike above average. Late-session volume decline suggests selling exhaustion near current levels. Recent hourly periods show data gaps indicating potential reporting issues. Chart Patterns: Established downtrend shows successive lower highs throughout session. Range-bound trading emerges between $0.1354-$0.1380 boundaries. Oversold bounce potential develops from $0.1354 low test. Risk/Reward Assessment: Resistance target sits at $0.1380 for any technical recovery attempt. Support failure below $0.1354 opens deeper retracement scenarios. Current positioning above $0.1357 offers defensive entry for contrarian plays. Disclaimer : Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk's full AI Policy. AI Market Insights More For You Protocol Research: GoPlus Security By CoinDesk Research Nov 14, 2025 Commissioned by GoPlus What to know : As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M. GoPlus Intelligence's Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month. Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B. View Full Report More For You MARA Trades at a Premium Factoring in Its Debt, Not a Discount: VanEck’s Sigel By James Van Straten | Edited by Oliver Knight 1 hour ago VanEck’s Matthew Sigel argues MARA’s valuation looks expensive when adjusted for its leverage and capital structure. What to know : VanEck’s Matthew Sigel argues once you account for MARA's $3.3 billion in convertible debt, it's net bitcoin value sits near $1.6 billion, which means the stock trades at a premium rather the perceived discount to its bitcoin holdings, with a $4.7 billion market cap. Sigel says much of MARA’s short interest and volatility stems from its capital structure, making it a far less direct bitcoin proxy compared to Strategy (MSTR). Read full story Latest Crypto News US Prosecutors Seek 12-Year Sentence for Terraform Founder Do Kwon in Crypto Fraud Case 9 minutes ago Turkey's Paribu Buys CoinMENA in $240M Deal, Expanding Into High-Growth Crypto Markets 1 hour ago MARA Trades at a Premium Factoring in Its Debt, Not a Discount: VanEck’s Sigel 1 hour ago Has the DAT Bubble Already Burst? CoinShares Says In Many Ways, Yes. 1 hour ago The Dollar Is Crumbling. Fiat-Backed Stablecoins Are Next 1 hour ago European Crypto Scam Network Dismantled After Laundering $815M 1 hour ago Top Stories Crypto Sector Lit Up Bright Red as Bitcoin Slips Back to $90K 1 hour ago European Crypto Scam Network Dismantled After Laundering $815M 1 hour ago JPMorgan Maintains Bitcoin's Gold-Linked Target at $170K Despite Recent Drop 4 hours ago Strategy Stock Still a Buy at Cantor After Plunge Forces Major Price Target Cut 1 hour ago MARA Trades at a Premium Factoring in Its Debt, Not a Discount: VanEck’s Sigel 1 hour ago Switch to Long-Term Thinking: Crypto Daybook Americas 4 hours ago