CoinDesk 20 Performance Update: Index Falls 1.5% as Nearly All Constituents Decline

Analysis

Price Impact

HighThe coindesk 20 index has fallen by 1.5%, with nearly all constituents declining. bitcoin (btc) is experiencing significant etf outflows, pushing its price down and creating broader market anxiety. aptos (apt) and internet computer (icp) are noted as significant laggards.

Trustworthiness

HighThe information is provided directly by coindesk indices, a reputable source for crypto market data and news, detailing the performance of its own index and constituents.

Price Direction

BearishThe overall market sentiment is bearish due to the decline of the coindesk 20 index and the significant outflows from bitcoin etfs, indicating strong selling pressure across major cryptocurrencies. while bch showed a slight gain, it's an outlier in a generally downward trend.

Time Effect

ShortThis is a daily performance update with recent news headlines (hours old), reflecting immediate market reactions and short-term price movements driven by current events like etf outflows.

Original Article:

Article Content:

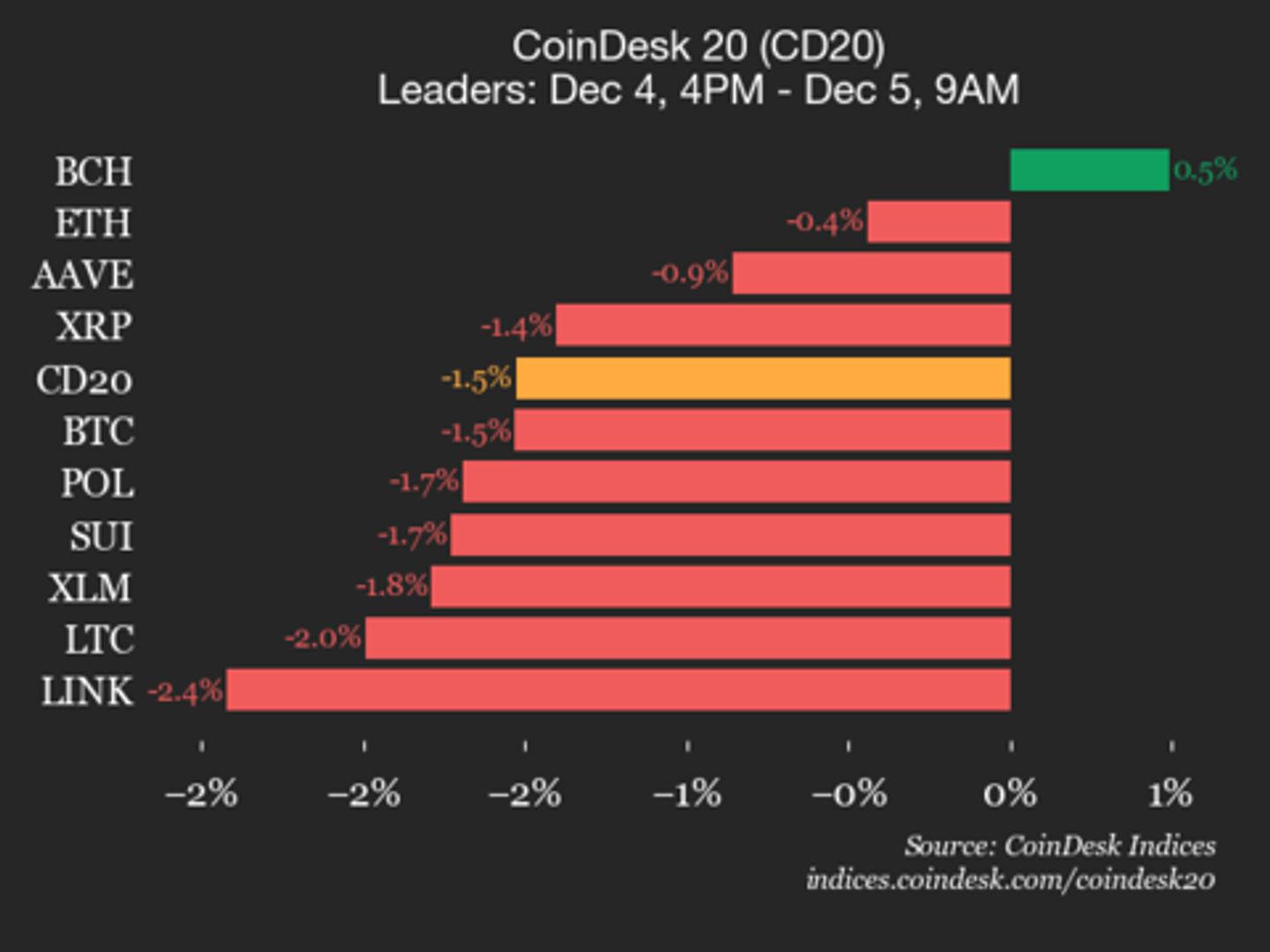

CoinDesk Indices Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email CoinDesk 20 Performance Update: Index Falls 1.5% as Nearly All Constituents Decline Bitcoin Cash (BCH), up 0.5%, was the only gainer from Thursday. By CoinDesk Indices Dec 5, 2025, 3:07 p.m. CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index . The CoinDesk 20 is currently trading at 2903.22, down 1.5% (-45.1) since 4 p.m. ET on Thursday. STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Long & Short Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy . One of 20 assets is trading higher. Leaders: BCH (+0.5%) and ETH (-0.4%). Laggards: APT (-5.5%) and ICP (-4.9%). The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally. CoinDesk Indices CoinDesk 20 charts Prices More For You Protocol Research: GoPlus Security By CoinDesk Research Nov 14, 2025 Commissioned by GoPlus What to know : As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M. GoPlus Intelligence's Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month. Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B. View Full Report More For You Crypto for Advisors: Crypto Yield Products By Gregory Mall | Edited by Sarah Morton 23 hours ago Why systematic crypto yield is emerging as the path to cash-flow-based returns, making it the most durable bridge to mainstream portfolios. What to know : You’re reading Crypto for Advisors , CoinDesk’s weekly newsletter that unpacks digital assets for financial advisors. Subscribe here to get it every Thursday. Read full story Latest Crypto News Russian Banking Giant VTB to Become Country's First to Offer Spot Crypto Trading: Report 29 minutes ago Uniswap's Lindsay Fraser to Run Policy Shop at Blockchain Association 1 hour ago STRF Emerges as Strategy’s Standout Credit Instrument After Nine Months of Trading 1 hour ago Aptos Drops 6% to $1.85 as Technical Breakdown Accelerates 1 hour ago JPMorgan Retains Gold-Linked $170K Bitcoin Target Despite Recent Plunge 2 hours ago Switch to Long-Term Thinking: Crypto Daybook Americas 2 hours ago Top Stories Crypto Markets Today: Bitcoin Slides to $91K as ETF Outflows Deepen Market Anxiety 3 hours ago Here's How Much Bitcoin, XRP, Ether, Solana May Move on Friday's Inflation Report 11 hours ago Switch to Long-Term Thinking: Crypto Daybook Americas 2 hours ago BlackRock’s IBIT Faces Record Outflow Run as Bitcoin Struggles to Reclaim Bull Trend 4 hours ago Polymarket Hiring In-House Team to Trade Against Customers — Here's Why It's a Risk 4 hours ago Kraken Launches High-Touch VIP Program for Ultra High Net Worth Clients 7 hours ago