STRF Emerges as Strategy’s Standout Credit Instrument After Nine Months of Trading

Analysis

Price Impact

MedMicrostrategy's (mstr) financial instruments, particularly its preferred stock strf, show improving sentiment and historical correlation with bitcoin's recovery from past lows. this suggests fundamental strength for a major btc holder. however, the broader crypto market faces immediate bearish pressure from significant etf outflows, leading to bitcoin struggling at $91k. the combined effect presents a medium impact with conflicting short-term and long-term signals.

Trustworthiness

HighThe article provides detailed financial performance of microstrategy's credit instruments and explicit correlation to bitcoin's price action at specific historical points, backed by concrete figures. the 'latest crypto news' section also offers real-time market data on bitcoin's current struggle and etf outflows from a reputable source (coindesk).

Price Direction

BearishWhile microstrategy's financial recovery and strong balance sheet, as evidenced by strf's performance and a significant cash buffer, are fundamentally bullish for bitcoin due to mstr's substantial holdings, the immediate market is dominated by bearish pressure. recent reports indicate bitcoin sliding to $91k due to record etf outflows and its struggle to maintain an upward trend, suggesting that short-term selling pressure is currently outweighing the positive long-term fundamentals associated with microstrategy.

Time Effect

ShortThe immediate bearish price action is driven by current market dynamics such as etf outflows, indicating a short-term effect. conversely, microstrategy's sustained financial health and strategic commitment to bitcoin provide a long-term fundamental support base that could contribute to future price appreciation.

Original Article:

Article Content:

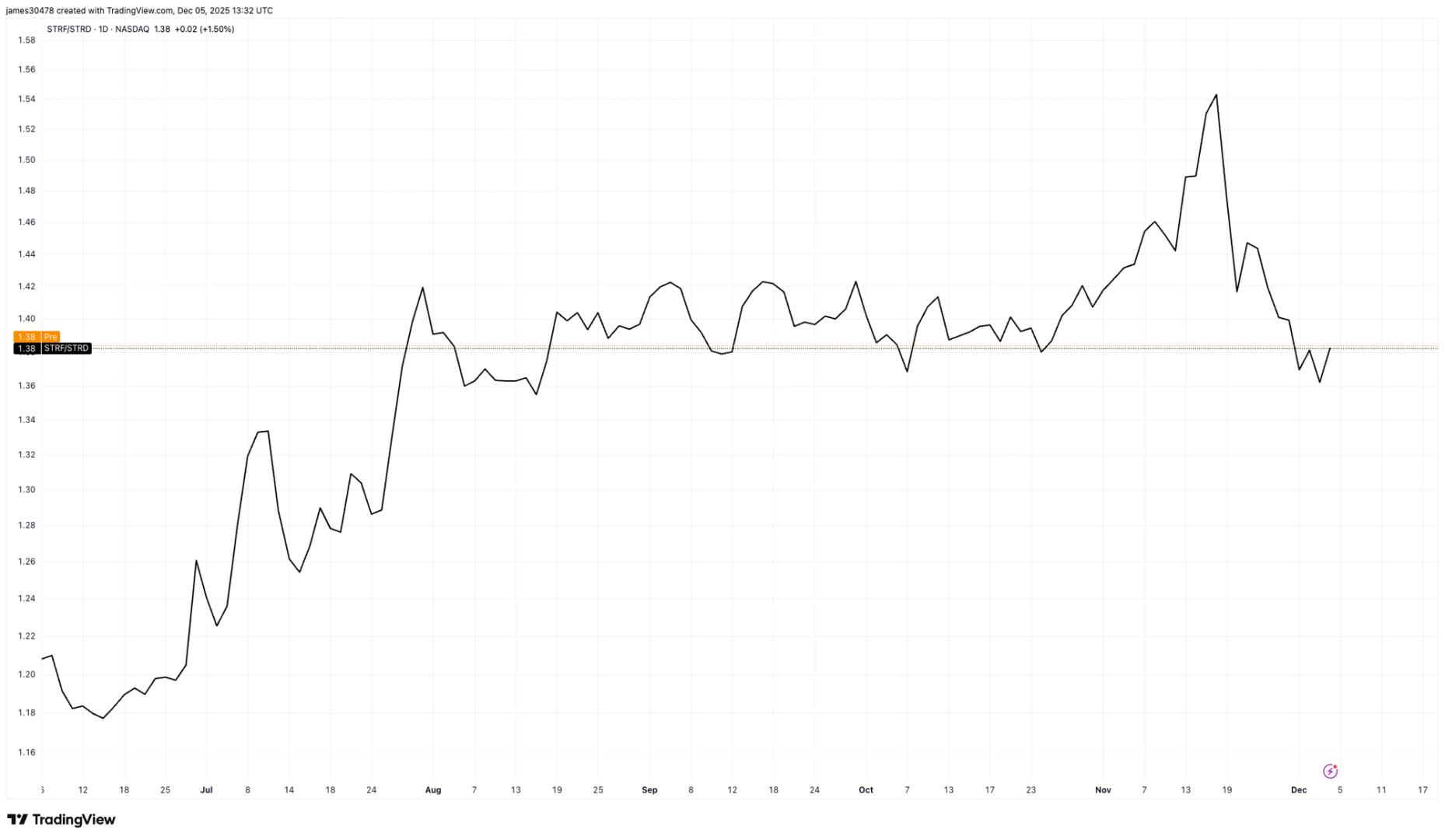

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email STRF Emerges as Strategy’s Standout Credit Instrument After Nine Months of Trading The company's senior preferred stock has rebounded 20% from November lows, with investors apparently favoring that over the more junior issues. By James Van Straten | Edited by Stephen Alpher Dec 5, 2025, 1:49 p.m. STRF/STRD (TradingView) What to know : The credit spread between senior STRF and junior STRD hit a record 1.5 in late November, signaling strong investor preference for senior exposure before normalizing to a 1.3 spread. STRF’s premium price reflects strong demand for senior protections even as its effective yield, at 9.03%, is now the lowest among Strategy’s preferred offerings. Strategy’s stock has recovered from its December low of $155 to about $185, reinforcing improving sentiment across the company’s capital structure. Strategy’s (MSTR) senior perpetual preferred stock, STRF, is increasingly standing out as the company’s most successful credit instrument since its launch in March. Trading at $110, STRF has risen 36% from issuance and has rebounded 20% from its Nov. 21 low of $92. That date also marked bitcoin’s local bottom near $80,000, highlighting the strong correlation between STRF and bitcoin. STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy . STRF occupies the top tier of Strategy’s preferred structure. It pays a fixed 10% annual cash dividend and features governance rights plus penalty based step ups if payments are missed. Even with its premium pricing pushing the effective yield down to about 9.03%, demand remains strong due to the security’s senior protections and long duration credit profile. In late October , executive chairman Michael Saylor highlighted a growing credit spread between STRF and the junior STRD. The spread measures the extra yield investors demand to hold higher risk junior securities, which is now at 12.5%. At the Nov. 21 low, that differential widened to an all time high of 1.5 as investors crowded into senior exposure, STRD was trading as low as $65. The spread has since normalized to around 1.3. Divergence is now visible across Strategy’s preferred suite. STRC, has seen four dividend rate increases to sustain investor interest. Strategy’s equity has also rebounded, climbing from a Dec 1 low of $155 to about $185, reflecting improved sentiment across both the company’s balance sheet and the bitcoin market since announcing a $1.44 billion cash buffer resevere for the preferred dividend payments. Bitcoin News MicroStrategy Michael Saylor More For You Protocol Research: GoPlus Security By CoinDesk Research Nov 14, 2025 Commissioned by GoPlus What to know : As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M. GoPlus Intelligence's Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month. Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B. View Full Report More For You Aptos Drops 6% to $1.85 as Technical Breakdown Accelerates By CD Analytics , Will Canny | Edited by Stephen Alpher 10 minutes ago The token broke through key support levels and underperformed wider crypto markets. What to know : APT fell from $1.98 to $1.85, breaking through critical $1.87 support on heavy volume. A double-bottom pattern has emerged near $1.84 as buyers step in at key technical level. Read full story Latest Crypto News Aptos Drops 6% to $1.85 as Technical Breakdown Accelerates 10 minutes ago JPMorgan Retains Gold-Linked $170K Bitcoin Target Despite Recent Plunge 47 minutes ago Switch to Long-Term Thinking: Crypto Daybook Americas 1 hour ago Crypto Markets Today: Bitcoin Slides to $91K as ETF Outflows Deepen Market Anxiety 2 hours ago EU Seeks to Transfer Crypto Oversight to Bloc's Securities and Markets Authority 2 hours ago BlackRock’s IBIT Faces Record Outflow Run as Bitcoin Struggles to Reclaim Bull Trend 2 hours ago Top Stories Crypto Markets Today: Bitcoin Slides to $91K as ETF Outflows Deepen Market Anxiety 2 hours ago Here's How Much Bitcoin, XRP, Ether, Solana May Move on Friday's Inflation Report 9 hours ago Switch to Long-Term Thinking: Crypto Daybook Americas 1 hour ago BlackRock’s IBIT Faces Record Outflow Run as Bitcoin Struggles to Reclaim Bull Trend 2 hours ago Polymarket Hiring In-House Team to Trade Against Customers — Here's Why It's a Risk 3 hours ago Kraken Launches High-Touch VIP Program for Ultra High Net Worth Clients 6 hours ago