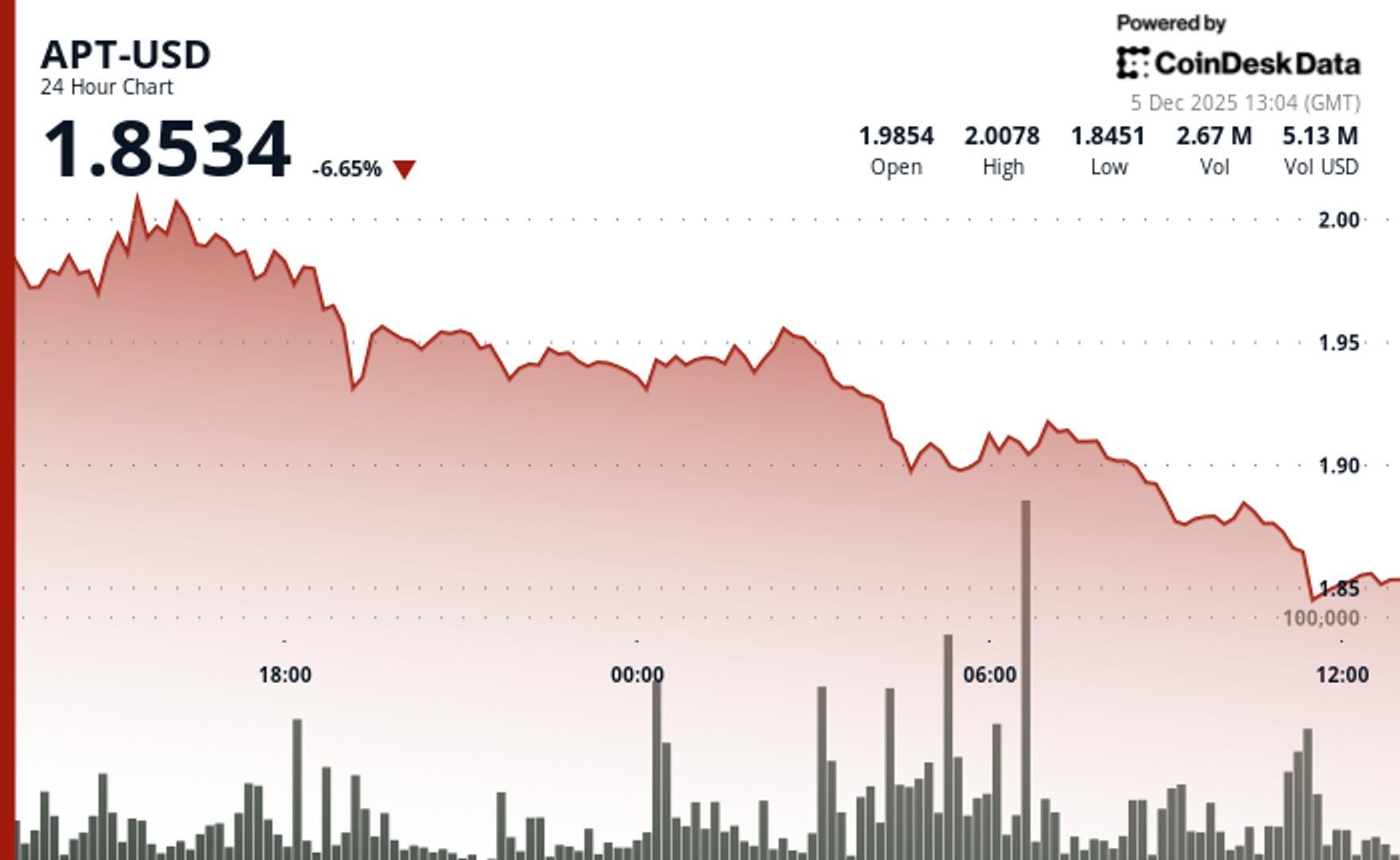

Aptos Drops 6% to $1.85 as Technical Breakdown Accelerates

Analysis

Price Impact

MedApt dropped 6% to $1.85, breaking through critical $1.87 support on heavy volume, indicating strong selling pressure. however, a double-bottom pattern has emerged near $1.84, suggesting potential stabilization and buyers stepping in at these levels.

Trustworthiness

HighThe analysis is provided by coindesk research, a reputable crypto news and analysis outlet, leveraging its technical analysis model and observing direct price action.

Price Direction

NeutralWhile apt experienced a sharp bearish breakdown, the formation of a double-bottom pattern at $1.84 indicates that institutional buyers are potentially stepping in, suggesting a possible floor and stabilization. immediate resistance is at $1.87, which was previously a support level, with psychological resistance at $1.90.

Time Effect

ShortThe analysis focuses on immediate price movements, technical breakdown levels, and the formation of a double-bottom pattern, all of which are short-term trading signals and indicators of current market sentiment.

Original Article:

Article Content:

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email Aptos Drops 6% to $1.85 as Technical Breakdown Accelerates The token broke through key support levels and underperformed wider crypto markets. By CD Analytics , Will Canny | Edited by Stephen Alpher Dec 5, 2025, 1:39 p.m. Aptos drops 6% to $1.85 as technical breakdown accelerates. What to know : APT fell from $1.98 to $1.85, breaking through critical $1.87 support on heavy volume. A double-bottom pattern has emerged near $1.84 as buyers step in at key technical level. APT $ 1.8429 weakened sharply during Friday's session, dropping 6% to $1.85 as technical selling overwhelmed buyers. The token lagged the broader crypto market, with the CoinDesk 20 index down 2.5% at publication time. STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy . Trading volume remained subdued at just 10.8% of the 30-day average, suggesting APT's decline lacks broad participation, according to CoinDesk Research's technical analysis model. The model showed that Aptos carved out a $0.17 trading range representing 8.5% volatility as multiple waves of selling pressure established fresh session lows. Recent price action shows signs of stabilization. The token formed a potential double-bottom pattern near $1.842, suggesting that institutional buyers have emerged at these depressed levels, according to the model. This constructive development provides the first technical bright spot after days of persistent weakness, the model said. Technical Analysis: Double-bottom support holds at $1.842 with psychological resistance at $1.90 and breakdown level at $1.87 now acting as overhead supply Heavy selling volume of 3.54 million confirms breakdown legitimacy while subsequent light volume suggests reduced selling pressure Descending trendline break completes $0.17 range decline with double-bottom formation indicating potential floor Immediate resistance targets $1.87 former support with downside exposure to $1.80 if double-bottom fails Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk's full AI Policy . AI Market Insights Aptos Technical Analysis More For You Protocol Research: GoPlus Security By CoinDesk Research Nov 14, 2025 Commissioned by GoPlus What to know : As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M. GoPlus Intelligence's Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month. Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B. View Full Report More For You JPMorgan Retains Gold-Linked $170K Bitcoin Target Despite Recent Plunge By Will Canny , AI Boost | Edited by Stephen Alpher 37 minutes ago The bank’s volatility-adjusted bitcoin-to-gold model still points to a theoretical price around $170K over the next six to twelve months. What to know : JPMorgan’s volatility-adjusted bitcoin-versus-gold model still implies a theoretical price near $170K over the next six to twelve months. Strategy’s enterprise value-to-bitcoin holdings ratio (mNAV) is currently holding above 1.00, which the bank sees as encouraging. The company's $1.4 billion reserve fund is a buffer which can fund roughly two years of dividend and interest payments, the report said. Read full story Latest Crypto News JPMorgan Retains Gold-Linked $170K Bitcoin Target Despite Recent Plunge 37 minutes ago Switch to Long-Term Thinking: Crypto Daybook Americas 1 hour ago Crypto Markets Today: Bitcoin Slides to $91K as ETF Outflows Deepen Market Anxiety 1 hour ago EU Seeks to Transfer Crypto Oversight to Bloc's Securities and Markets Authority 2 hours ago BlackRock’s IBIT Faces Record Outflow Run as Bitcoin Struggles to Reclaim Bull Trend 2 hours ago Polymarket Hiring In-House Team to Trade Against Customers — Here's Why It's a Risk 3 hours ago Top Stories Crypto Markets Today: Bitcoin Slides to $91K as ETF Outflows Deepen Market Anxiety 1 hour ago Here's How Much Bitcoin, XRP, Ether, Solana May Move on Friday's Inflation Report 9 hours ago Switch to Long-Term Thinking: Crypto Daybook Americas 1 hour ago BlackRock’s IBIT Faces Record Outflow Run as Bitcoin Struggles to Reclaim Bull Trend 2 hours ago Polymarket Hiring In-House Team to Trade Against Customers — Here's Why It's a Risk 3 hours ago Kraken Launches High-Touch VIP Program for Ultra High Net Worth Clients 6 hours ago In this article APT APT $ 1.8402 ◢ 6.71 %