Hedera Tumbles 10% to Crucial Support on Heavy Volume

Analysis

Price Impact

HighHedera (hbar) plunged 10% on heavy volume, breaking key trendline support and confirming a downtrend on multiple timeframes, largely due to institutional selling pressure.

Trustworthiness

HighThe analysis is provided by coindesk, a reputable crypto news source, with detailed technical analysis, volume data (241.5 million tokens, 338% above 24hr average), and institutional insights.

Price Direction

BearishThe 10% drop, coupled with a confirmed downtrend and significant institutional selling, indicates strong bearish pressure. while hbar found temporary support at $0.1307, the inability to sustain gains above $0.1315 suggests continued struggle against bearish momentum and underperformance relative to the broader market.

Time Effect

ShortThe analysis focuses on immediate price action (dec 1st drop), daily candle breakdown, 60-minute consolidation patterns, and near-term momentum, without projecting long-term trends.

Original Article:

Article Content:

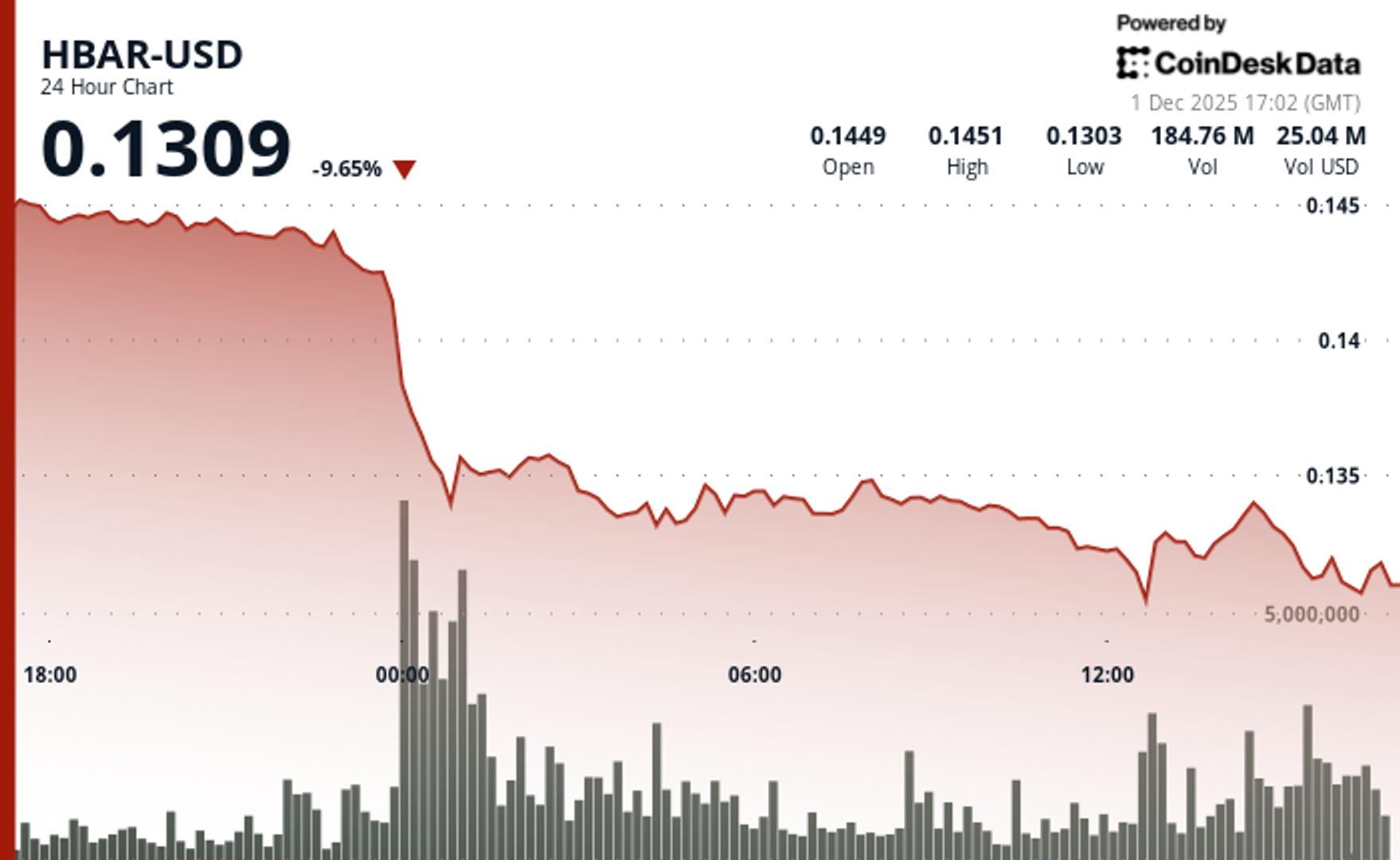

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email Hedera Tumbles 10% to Crucial Support on Heavy Volume Hedera’s 10% drop on Dec. 1 has pushed HBAR back to a key support zone, where consolidation, fading volume, and institutional selling pressure are shaping the next move. By CD Analytics , Oliver Knight Updated Dec 1, 2025, 5:11 p.m. Published Dec 1, 2025, 5:11 p.m. "Hedera (HBAR) dips 1.0% to $0.1308 despite a surge in trading volume, reflecting mixed market signals." What to know : HBAR dropped from $0.1459 to $0.1308, breaking key trendline support on heavy volume. Trading activity jumped 25% above weekly averages, signaling institutional engagement. Price found support near $0.1307 as technical consolidation patterns formed. Hedera (HBAR) plunged 10% on Dec. 1, riding a broader market downturn as it now rests at a key level of support at $0.1308. The breakdown occurred during the daily candle open at 00:00 UTC, also timed alongside the opening trade of bitcoin futures on the CME. STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy . HBAR has now confirmed a downtrend on multiple timeframes after a massive volume spike to 241.5 million tokens, 338% above the 24 hour average. This confirms institutional selling and establishes current support at $0.1307. HBAR underperforms the broader crypto market by 1.35%, indicating rotation toward digital assets with stronger fundamentals. Technical consolidation vs breakdown risk: What traders should watch Recent 60-minute data shows HBAR trading between $0.1306-$0.1325, consolidating around $0.1307 on lighter volume. This stabilization suggests potential accumulation near previous support, though broader technicals remain challenged by the failed breakout and market underperformance. HBAR holds above the $0.1307 floor established during the breakdown, with intermittent volume spikes above 3 million tokens indicating selective buying interest. However, inability to sustain gains above $0.1315 despite elevated activity questions near-term momentum, especially if institutional flows favor alternatives with stronger setups. HBAR/USD (TradingView) Key Technical Levels Signal Consolidation for HBAR Support/Resistance: Primary support sits at $0.1307 following breakdown; resistance cluster between $0.1350-$0.1315 needs reclaim for bullish continuation. Volume Analysis: 241.5 million spike confirms institutional selling; current reduced activity suggests consolidation with selective accumulation near support. Chart Patterns: Descending trendline breakdown complete; trading range formation between $0.1306-$0.1325 indicates potential base-building. Targets & Risk/Reward: Upside capped at $0.1350 resistance without catalysts; downside risk contained near $0.1306 support with institutional interest present. Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk's full AI Policy. AI Market Insights More For You Protocol Research: GoPlus Security By CoinDesk Research Nov 14, 2025 Commissioned by GoPlus What to know : As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M. GoPlus Intelligence's Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month. Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B. View Full Report More For You Chainlink's LINK Slides 11% as Technical Breakdown Overshadows ETF Launch News By CD Analytics , Krisztian Sandor | Edited by Sheldon Reback 12 minutes ago The token broke below $12, breaching key support levels with heavy trading volume, confirming the downtrend. What to know : LINK slid below $12 on Monday as the broader crypto market pulled back. Grayscale's expected conversion of its Chainlink Trust to the first U.S. spot LINK ETF failed to jolt prices. Technical analysis suggests a breakdown with downside target of $11.70–$11.80. Read full story Latest Crypto News Chainlink's LINK Slides 11% as Technical Breakdown Overshadows ETF Launch News 12 minutes ago Bitcoin Mining Profitability Fell for Fourth Consecutive Month in November: JPMorgan 26 minutes ago ICP Slides as Breakdown Below $4.00 Triggers Elevated Volatility 42 minutes ago BONK Slides 9% as Technical Breakdown Overshadows Swiss ETP Debut 45 minutes ago Digital Asset Treasuries Lead Crypto Stock Sell-Off as Bitcoin Falls to $84K 1 hour ago European Authorities Seize $1.51B Bitcoin-Mixing Service Cryptomixer 1 hour ago Top Stories Digital Asset Treasuries Lead Crypto Stock Sell-Off as Bitcoin Falls to $84K 1 hour ago Strategy Establishes $1.44B Cash Reserve, Slashes 2025 Profit, BTC Yield Targets 3 hours ago European Authorities Seize $1.51B Bitcoin-Mixing Service Cryptomixer 1 hour ago Tom Lee's BitMine Acquires 97K ETH, Eyeing Fusaka Upgrade, Fed Policy as Positive Catalysts 2 hours ago Crypto Markets Today: Hawkish BOJ Comments Spur Sharp BTC Downturn 4 hours ago HashKey Leads Hong Kong’s Crypto Market as Losses Deepen Ahead of IPO 9 hours ago