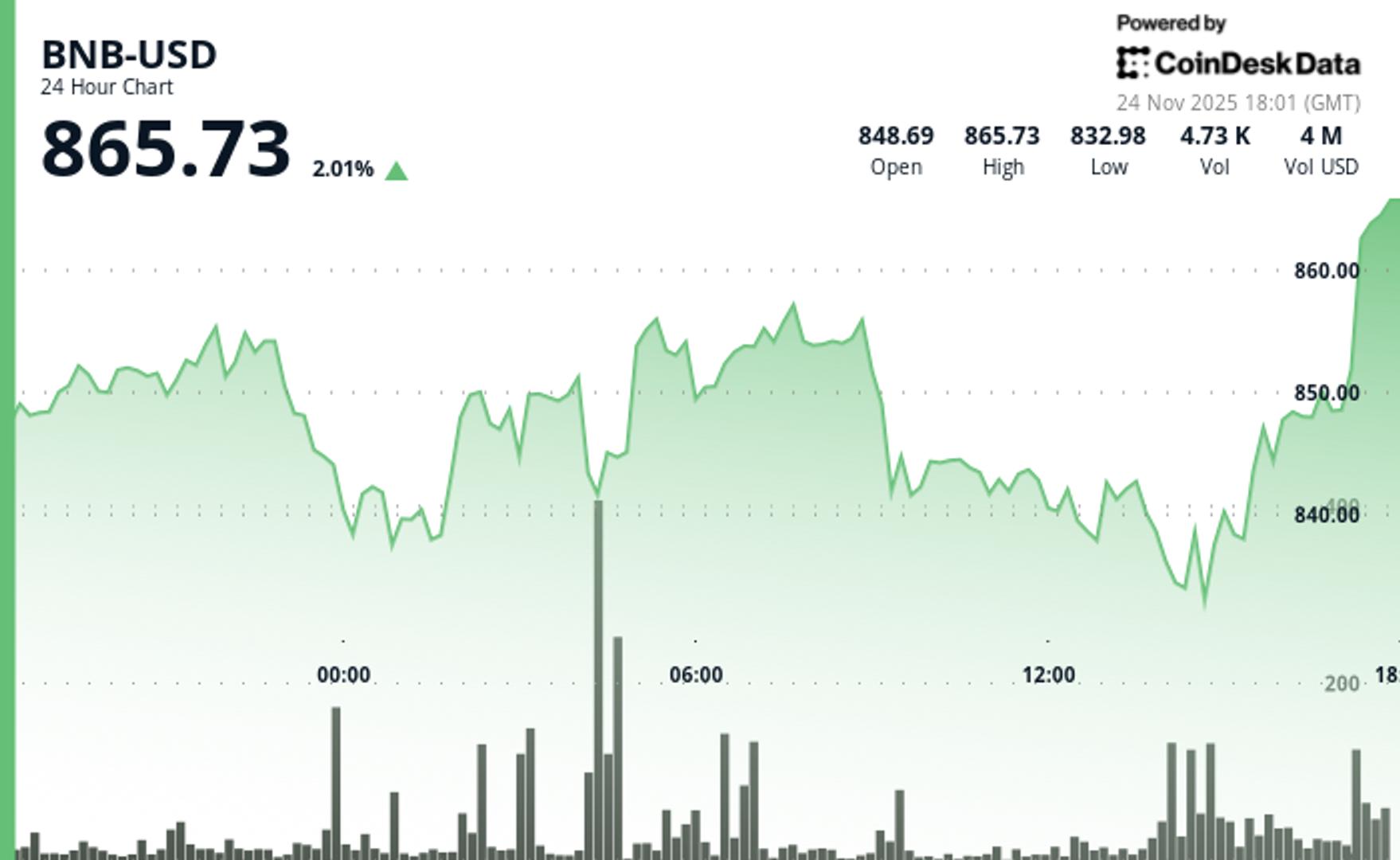

BNB Rebounds Above $860 After Testing Key Support

Analysis

Price Impact

MedBnb rebounded significantly from key support at $833, reclaiming ground above $860 and multiple resistance zones. however, the relatively low volume behind this move and its underperformance compared to the broader crypto market suggest a limited immediate follow-through, making the impact moderate rather than high.

Trustworthiness

HighThe analysis is provided by coindesk analytics and coindesk research, reputable sources within the cryptocurrency industry known for their technical analysis and market insights.

Price Direction

NeutralWhile bnb saw a short-term bullish rebound above $860 after testing $833 support, the low trading volume and prior 'heavy sell pressure' and 'bearish trend' suggest caution. the price is currently in a critical zone; holding above $860 could lead to testing $870, but if sellers return, the $832-$836 band remains a critical floor. this indicates a neutral stance until a clear break with strong volume is observed.

Time Effect

ShortThe analysis focuses on the immediate rebound and the next short-term resistance ($870) and support ($832-$836) levels. the mention of 'short-term stability' and 'limit follow-through' due to low volume emphasizes a short-term outlook.

Original Article:

Article Content:

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email BNB Rebounds Above $860 After Testing Key Support The recovery lifted BNB above multiple resistance zones, but the relatively low volume behind the move may limit follow-through as traders watch the $870 level. By CD Analytics , Francisco Rodrigues | Edited by Aoyon Ashraf Nov 24, 2025, 7:01 p.m. "BNB dips 1% to $836, breaking key support amid strong selling pressure." What to know : BNB rebounded 1.9% to $863 after testing key support around $833, regaining ground after a sharp drop earlier in the month. The recovery lifted BNB above multiple resistance zones, but the relatively low volume behind the move may limit follow-through, and traders are watching $870 as the next level to watch if it holds. Despite the rebound, BNB has underperformed the broader crypto market, which saw a 4% recovery in the CoinDesk 20 (CD20) index over the same period. The native token of the BNB Chain, BNB, regained ground over the last 24-hour period, seeing a 1.88% rise to $863 after slipping to a session low of $833. The rebound follows a sharp drop earlier in the month, when BNB broke through a key support range around $800 but found buying interest below that level. The last 24 hours saw BNB peak above $866 as it carved out a broad range before recovering in the last few hours. The bounce lifted the token above multiple resistance zones that had formed after a series of failed attempts earlier in the week, according to CoinDesk Research's technical analysis data model. STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy . Although the volume remained moderate in comparison to the figures seen during the recent major sell-off, it was enough to reverse the earlier breakdown. For traders, the recovery could signal short-term stability, though the relatively low volume behind the move may limit follow-through. Earlier this week, heavy sell pressure and a string of lower highs confirmed a bearish trend, capped by repeated rejections near $855. BNB’s return above $860 brings it back into a zone that had served as resistance. If it holds, $870 could become the next level to watch. But if sellers return, the $832-$836 band remains the critical floor. The token has nevertheless underperformed the wider crypto market’s recovery, with the CoinDesk 20 (CD20) index rising 4% in the last 24-hour period. Disclaimer : Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk's full AI Policy. AI Market Insights BNB Technical Analysis More For You Protocol Research: GoPlus Security By CoinDesk Research Nov 14, 2025 Commissioned by GoPlus What to know : As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M. GoPlus Intelligence's Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month. Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B. View Full Report More For You Stellar Climbs 3.5% to $0.25 as Technical Recovery Gains Momentum By CD Analytics , Oliver Knight 46 minutes ago Network fundamentals improved alongside price action as token demonstrated resilience following recent consolidation period. What to know : XLM advanced from $0.2436 to $0.2508 with elevated trading volume. Volume surged 23% above weekly average, confirming genuine buying interest. Late-session selling pressure created new support test near $0.2449. Read full story Latest Crypto News Celestia’s TIA Token Rises as ‘Matcha’ Upgrade Preps Network for Cross-Chain Future 7 minutes ago Stellar Climbs 3.5% to $0.25 as Technical Recovery Gains Momentum 46 minutes ago HBAR Gains 2.4% From Major Support as Axelar Integration Drives DeFi Activity 1 hour ago Franklin Templeton Joins XRP ETF Race, Calling It ‘Foundational’ to Global Finance 1 hour ago Crypto Market Mood Lifted as Amazon Pours $50B Into AI Infrastructure 1 hour ago Rumble Gains 13% After Tether Boosts Stake by 1M Shares 2 hours ago Top Stories Crypto Market Mood Lifted as Amazon Pours $50B Into AI Infrastructure 1 hour ago Monad’s MON Token Stumbles Out of the Gate in Trading Debut After Slow Token Sale 3 hours ago Bitcoin’s $1T Rout Exposes Fragile Market Structure, Deutsche Bank Says 4 hours ago BitMine Immersion Added Nearly 70K Ether Last Week, Now Holding 3% of ETH Supply 4 hours ago Bitcoin ETFs, Led by BlackRock's IBIT, See Record $40B Trading Volume as Institutions Capitulate 13 hours ago Upbit Seeking Nasdaq IPO Following Merger With Naver: Bloomberg 5 hours ago