What Next for DOGE Price as Grayscale's GDOG ETF Debuts?

Analysis

Price Impact

HighDespite the debut of grayscale's doge etf (gdog), dogecoin's price fell 1.4% as institutional demand failed to counteract significant selling pressure and persistent resistance levels. major whale distribution (nearly 7 billion tokens sold since september) creates a substantial supply overhang.

Trustworthiness

HighThe analysis is from coindesk, a well-regarded crypto news source, and is supported by detailed on-chain data and technical analysis, providing a credible outlook.

Price Direction

BearishDoge remains locked in a tight neutral-to-bearish consolidation range between $0.144 and $0.1495. repeated rejections at resistance, coupled with lower highs and continuous whale distribution, suggest vulnerability to further downside if the $0.144 support breaks.

Time Effect

ShortThe analysis focuses on the immediate aftermath of the etf launch, short-term technical levels (48-72 hours for etf flows), and existing structural weakness that continues to exert pressure in the near term.

Original Article:

Article Content:

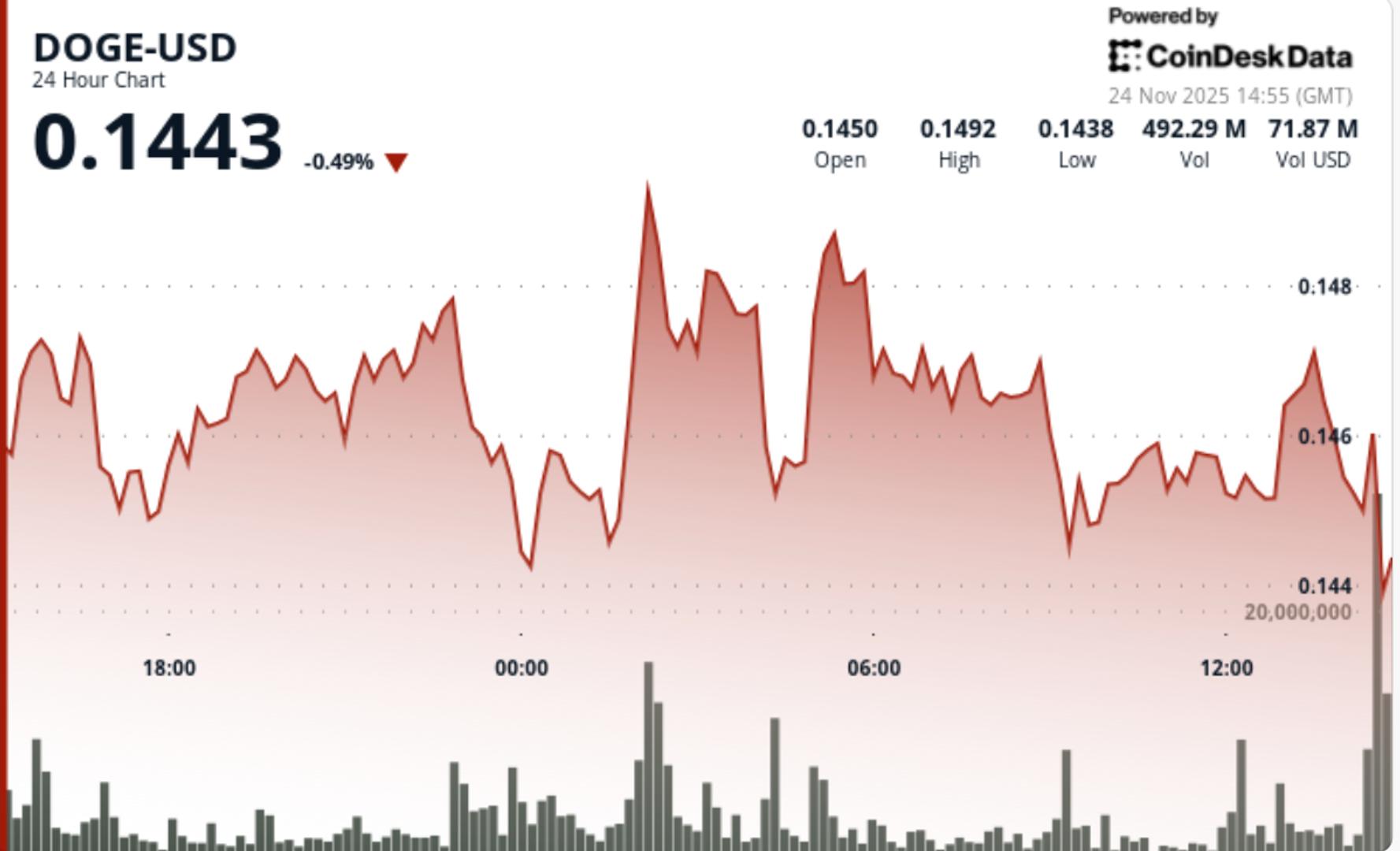

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email What Next for DOGE Price as Grayscale's GDOG ETF Debuts? The $0.1495 resistance level remains a significant barrier, while $0.144 serves as the last short-term support. By Shaurya Malwa , CD Analytics Updated Nov 24, 2025, 3:21 p.m. Published Nov 24, 2025, 3:21 p.m. (CoinDesk Data) What to know : Dogecoin's price fell 1.4% after Grayscale's DOGE ETF debut failed to counteract selling pressure and resistance levels. The $0.1495 resistance level remains a significant barrier, while $0.144 serves as the last short-term support. Institutional demand from the ETF launch will be crucial in determining future price momentum. Dogecoin retreats from early-session strength as Grayscale’s DOGE ETF debut fails to offset selling pressure and persistent resistance levels. News Background Grayscale launched its DOGE ETF (GDOG) on the New York Stock Exchange, expanding institutional access to the meme coin. The debut follows ongoing ETF expansion across the crypto industry, including XRP and broader altcoin products. However, the ETF launch arrives during a period of structural weakness for DOGE. STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy . Whale distribution remains a major headwind. On-chain data shows wallets holding 10–100 million DOGE sold nearly 7 billion tokens between September 19 and November 23, forming a sizeable supply overhang. These sales follow DOGE’s decline from its $0.27 peak and continue to suppress upside momentum despite increased institutional infrastructure. Technical Analysis Dogecoin remains locked in a tight consolidation range between $0.144 and $0.149. The top of the range at $0.1495 continues to act as a hard ceiling, rejecting every attempt at a breakout. This aligns with the broader downtrend that began earlier in November. The structure remains neutral-to-bearish, with lower highs forming beneath the $0.149–$0.152 zone. The $0.144 support has held multiple tests, forming the current floor. Momentum indicators show no confirmed reversal signals, and shrinking volume during recovery attempts highlights a lack of sustained buying pressure. The ETF launch generated interest but not enough demand to overcome the broader technical deterioration, leaving DOGE vulnerable to further downside if support gives way. Price Action Summary DOGE traded between $0.1449 and $0.1495 through the session ending November 24, ultimately closing at $0.1456 for a 1.4% decline. The early-session surge came on a large 850 million volume spike at 02:00 UTC, about 180% above average, pushing the token to the intraday high. However, repeated rejections at $0.1495 prevented continuation, and afternoon selling pushed the price lower. Multiple breakdown attempts confirmed weakness around $0.147, and the session ended with DOGE sitting just above its established $0.144 support. Volume faded into the close, reinforcing the idea that buyers remain hesitant despite the ETF catalyst. What Traders Should Know • The $0.144 support is the last meaningful short-term floor; a break exposes a slide toward $0.138 • The $0.1495 resistance must be reclaimed to signal any reversal of momentum • ETF flows over the next 48–72 hours will indicate whether institutional demand is meaningful or short-lived • Whale distribution remains the dominant bearish force despite improved traditional market access • Broader market beta remains high; Bitcoin weakness continues to spill into DOGE’s structure Dogecoin Trading More For You Protocol Research: GoPlus Security By CoinDesk Research Nov 14, 2025 Commissioned by GoPlus What to know : As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M. GoPlus Intelligence's Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month. Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B. View Full Report More For You Bitcoin’s $1T Rout Exposes Fragile Market Structure, Deutsche Bank Says By Will Canny , AI Boost | Edited by Sheldon Reback 24 minutes ago The bitcoin price drop to $80,000 last week reflected a mix of macro pressure, fading regulatory momentum and thinning liquidity that has tested bitcoin’s maturity. What to know : Bitcoin fell to about $80,000 last week, down roughly 35% from its early-October peak, Deutsche Bank said. The bank attributed the decline to risk-off sentiment, hawkish Federal Reserve signals, stalled regulation, institutional outflows and long-term holder profit-taking. These pressures raise questions about whether the crypto's latest drawdown is a brief correction or a deeper reset, the report said. Read full story Latest Crypto News Bitcoin’s $1T Rout Exposes Fragile Market Structure, Deutsche Bank Says 24 minutes ago XRP Slides to $2.08 as Grayscale’s GXRP ETF Debut Fails to Ignite Market 28 minutes ago BitMine Immersion Added Nearly 70K Ether Last Week, Now Holding 3% of ETH Supply 45 minutes ago CoinDesk 20 Performance Update: Hedera (HBAR) Gains 11.3%, Leading the Index Higher 53 minutes ago Monad Blockchain Goes Live With 100B Token Supply and Airdrop 1 hour ago Citigroup Warns of Bitcoin Halving-Season Chill as Prices Sink, ETF Outflows Near $4B 1 hour ago Top Stories BitMine Immersion Added Nearly 70K Ether Last Week, Now Holding 3% of ETH Supply 45 minutes ago Monad Blockchain Goes Live With 100B Token Supply and Airdrop 1 hour ago Bitcoin ETFs, Led by BlackRock's IBIT, See Record $40B Trading Volume as Institutions Capitulate 9 hours ago Upbit Seeking Nasdaq IPO Following Merger With Naver: Bloomberg 2 hours ago Where Next?: Crypto Daybook Americas 3 hours ago DOGE Beats the Blue Chips as D.O.G.E Calls It Quits 9 hours ago