XRP Slides to $2.08 as Grayscale’s GXRP ETF Debut Fails to Ignite Market

Analysis

Price Impact

HighDespite the bullish news of grayscale's gxrp etf launch, xrp's price declined significantly, indicating that positive institutional developments are currently overshadowed by strong selling pressure and technical factors. the market failed to ignite, leading to a notable slide.

Trustworthiness

HighThe analysis comes from coindesk, a reputable crypto news and analysis platform, with detailed technical levels and market observations.

Price Direction

BearishXrp's price slid from $2.13 to $2.08, failing to react positively to the etf launch. technical indicators show a short-term downtrend, with critical support at $2.03, and potential further declines toward $1.91 if this level breaks. resistance dominance is confirmed.

Time Effect

ShortThe analysis focuses on immediate price reactions, short-term technical levels, and potential movements within the coming days/weeks, rather than long-term fundamental shifts.

Original Article:

Article Content:

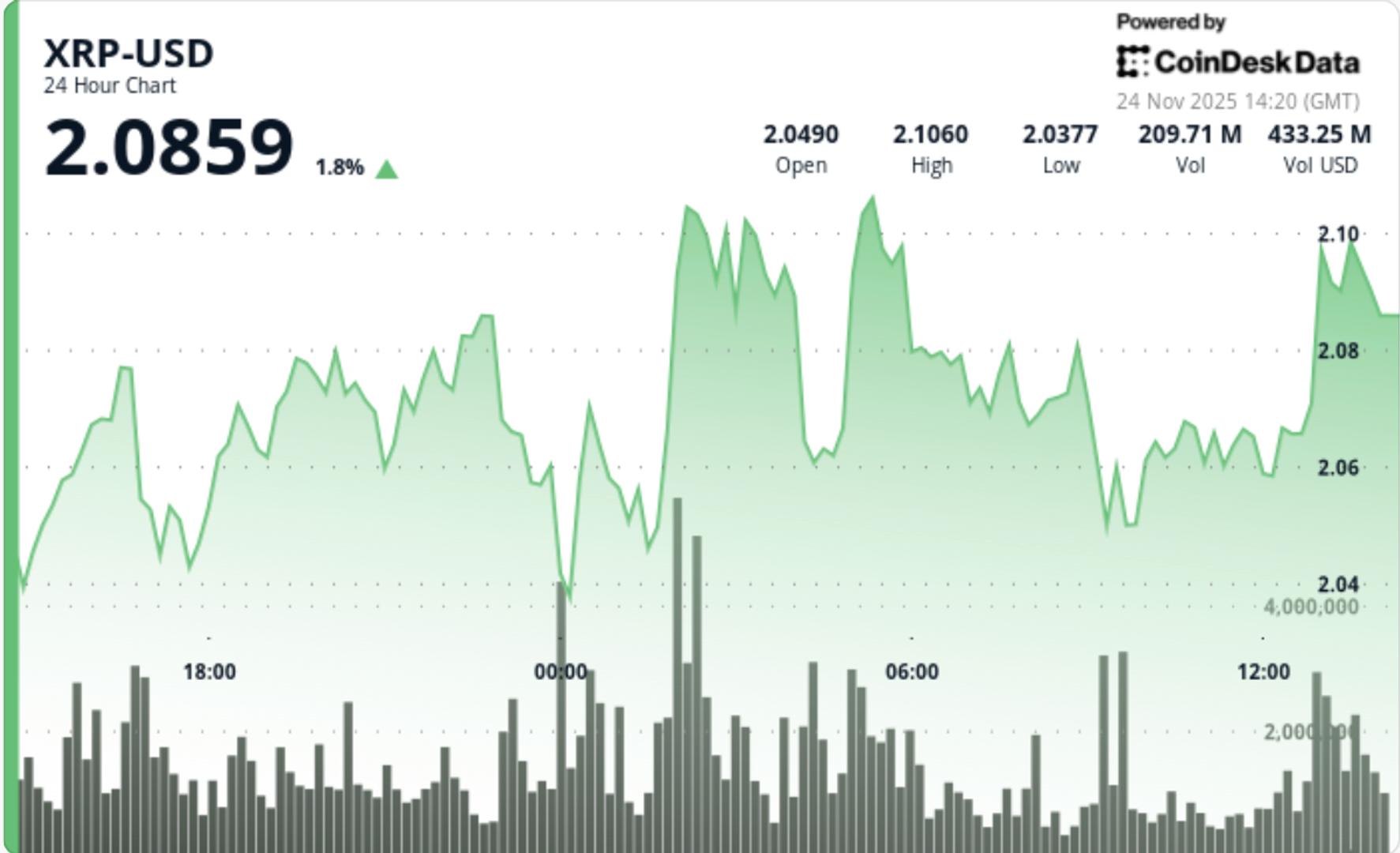

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email XRP Slides to $2.08 as Grayscale’s GXRP ETF Debut Fails to Ignite Market Traders should watch for potential breakdowns below $2.03, which could lead to further declines toward $1.91. By Shaurya Malwa , CD Analytics Updated Nov 24, 2025, 2:54 p.m. Published Nov 24, 2025, 2:53 p.m. (CoinDesk Data) What to know : Grayscale launched the GXRP ETF on NYSE Arca, expanding institutional access to XRP despite the cryptocurrency's price decline. XRP's price fell from $2.13 to $2.08, with technical factors overshadowing the positive ETF news. Traders should watch for potential breakdowns below $2.03, which could lead to further declines toward $1.91. Grayscale launches GXRP ETF on NYSE Arca as latest institutional XRP product. XRP falls despite ETF expansion, slipping toward critical psychological support. News Background Grayscale expanded its exchange-traded product lineup on Monday with the launch of the Grayscale XRP Trust ETF (GXRP) on NYSE Arca, offering investors direct and “straightforward exposure” to XRP. The product—originally introduced as a private placement in September 2024—was formally converted into a spot ETF as part of Grayscale’s dual listing alongside its new Dogecoin ETF. STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy . Krista Lynch, Senior Vice President of ETF Capital Markets at Grayscale, said GXRP’s listing is “another meaningful step in broadening access to the growing XRP ecosystem,” positioning the fund as an efficient gateway for both institutional and retail investors. GXRP joins an expanding roster of XRP-based ETFs, including products from Canary Capital and REX Shares, with several more issuers filing under Section 8(a) for automatic approval. The ETF momentum reflects strong institutional appetite for regulated XRP exposure as the asset continues holding its position as the fourth-largest cryptocurrency by market capitalization. The growing ETF ecosystem emerges despite XRP’s turbulent regulatory past. The U.S. SEC previously accused Ripple of raising $1.3 billion through unregistered XRP sales. A 2023 federal ruling determined that Ripple’s programmatic exchange sales did not violate securities laws due to their blind bid/ask structure, though direct institutional sales were deemed securities offerings. This partial clarity has helped pave the way for broader institutional acceptance—though price action now depends heavily on technical factors rather than purely regulatory developments. Price Action Summary XRP declined steadily through Tuesday’s session, slipping from $2.13 to $2.08 as profit-taking and weak spot flows overshadowed the bullish ETF news cycle. The token traded within a volatile range of $2.03 to $2.15, reflecting persistent uncertainty across crypto markets. • Volume surged 28% above average, hitting 177.9M during the strongest selloff phase • Price briefly tapped the $2.03 demand zone, rebounding toward $2.11 before stalling • Multiple failed attempts to reclaim $2.14–$2.15 confirmed resistance dominance • Late-session selling cracked the $2.10 support floor, turning it into immediate resistance Despite the ETF expansion and strengthening institutional infrastructure around XRP, the immediate reaction in spot markets showed traders prioritizing technical levels over fundamentals. Technical Analysis The breakdown below $2.10 created a new sequence of lower highs and lower lows , confirming the broader short-term downtrend that has been forming since XRP rejected $2.30 earlier in the week. Primary support: $2.03–$2.05 demand zone Immediate resistance: $2.14–$2.15 failure region Mid-term resistance: $2.20–$2.24 cluster Breakdown target: Sub-$2.00 liquidity pocket at $1.91 The $2.03 level remains critical. A clean breakdown would expose deeper retracement levels tied to October’s structure. XRP remains in a short-term descending channel Daily timeframe shows sellers defending every retest of $2.15 A potential base is forming at $2.03–$2.07 but lacks conviction Momentum indicators (RSI/MACD) show oversold signals forming, but no trend reversal confirmation has emerged. What Traders Should Watch A breakdown opens a direct path toward $1.91 and potentially $1.78 if market-wide risk-off intensifies. GXRP and other newly launched ETFs must show sustained inflows, not one-day spikes, for institutional sentiment to translate into spot bid support. This resistance cluster determines whether bulls regain control. Acceptance above here targets $2.20–$2.24. BTC’s renewed weakness directly impacts high-beta tokens like XRP. If Bitcoin continues violating structural support, XRP may not hold $2.00. Whale distribution has slowed—if inflows to exchanges spike again, downside pressure returns immediately. XRP News More For You Protocol Research: GoPlus Security By CoinDesk Research Nov 14, 2025 Commissioned by GoPlus What to know : As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M. GoPlus Intelligence's Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month. Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B. View Full Report More For You Citigroup Warns of Bitcoin Halving-Season Chill as Prices Sink, ETF Outflows Near $4B By Will Canny , AI Boost | Edited by Stephen Alpher 1 hour ago Crypto is stuck in a second-year post-halving slump, with ETF outflows and jittery long-term holders pushing bitcoin toward the bank’s bear-case outlook. What to know : Citi said bitcoin exchange-traded fund outflows have reached nearly $4 billion since Oct. 10. Long-term holders are growing cautious as the historically weak second year of the halving cycle sets in. Without renewed ETF inflows, the bank sees bitcoin drifting toward its $82K year-end bear case. Read full story Latest Crypto News BitMine Immersion Added Nearly 70K Ether Last Week, Now Holding 3% of ETH Supply 18 minutes ago CoinDesk 20 Performance Update: Hedera (HBAR) Gains 11.3%, Leading the Index Higher 26 minutes ago Monad Blockchain Goes Live With 100B Token Supply and Airdrop 55 minutes ago Citigroup Warns of Bitcoin Halving-Season Chill as Prices Sink, ETF Outflows Near $4B 1 hour ago Investors Should Buy the Dip in Coinbase and Circle, Says William Blair 1 hour ago Strategy Apparently Paused Bitcoin Accumulation Last Week 1 hour ago Top Stories BitMine Immersion Added Nearly 70K Ether Last Week, Now Holding 3% of ETH Supply 18 minutes ago Monad Blockchain Goes Live With 100B Token Supply and Airdrop 55 minutes ago Bitcoin ETFs, Led by BlackRock's IBIT, See Record $40B Trading Volume as Institutions Capitulate 9 hours ago Upbit Seeking Nasdaq IPO Following Merger With Naver: Bloomberg 1 hour ago Where Next?: Crypto Daybook Americas 2 hours ago DOGE Beats the Blue Chips as D.O.G.E Calls It Quits 9 hours ago