XRP Drops With Market as Bitcoin Weakness Pulls Altcoins Into Oversold Territory

Analysis

Price Impact

HighSignificant whale selling of nearly 200 million xrp (~$400m) combined with broader bitcoin weakness caused a sharp price drop, pulling xrp into oversold territory with notable institutional distribution.

Trustworthiness

HighThe analysis is from coindesk, a reputable source, providing detailed technical indicators, specific price levels, and volume data to support its claims.

Price Direction

BullishDespite the recent sharp drop due to whale selling, xrp is now in deeply oversold conditions. technical indicators are flashing early reversal signals, and a capitulation bottom followed by late-session buying suggests a strong potential for a near-term bounce from current levels.

Time Effect

ShortThe oversold conditions and early accumulation behavior point to a potential short-term bounce. however, the macro structure remains fragile, meaning a sustained long-term bullish reversal requires a clear break above $1.96.

Original Article:

Article Content:

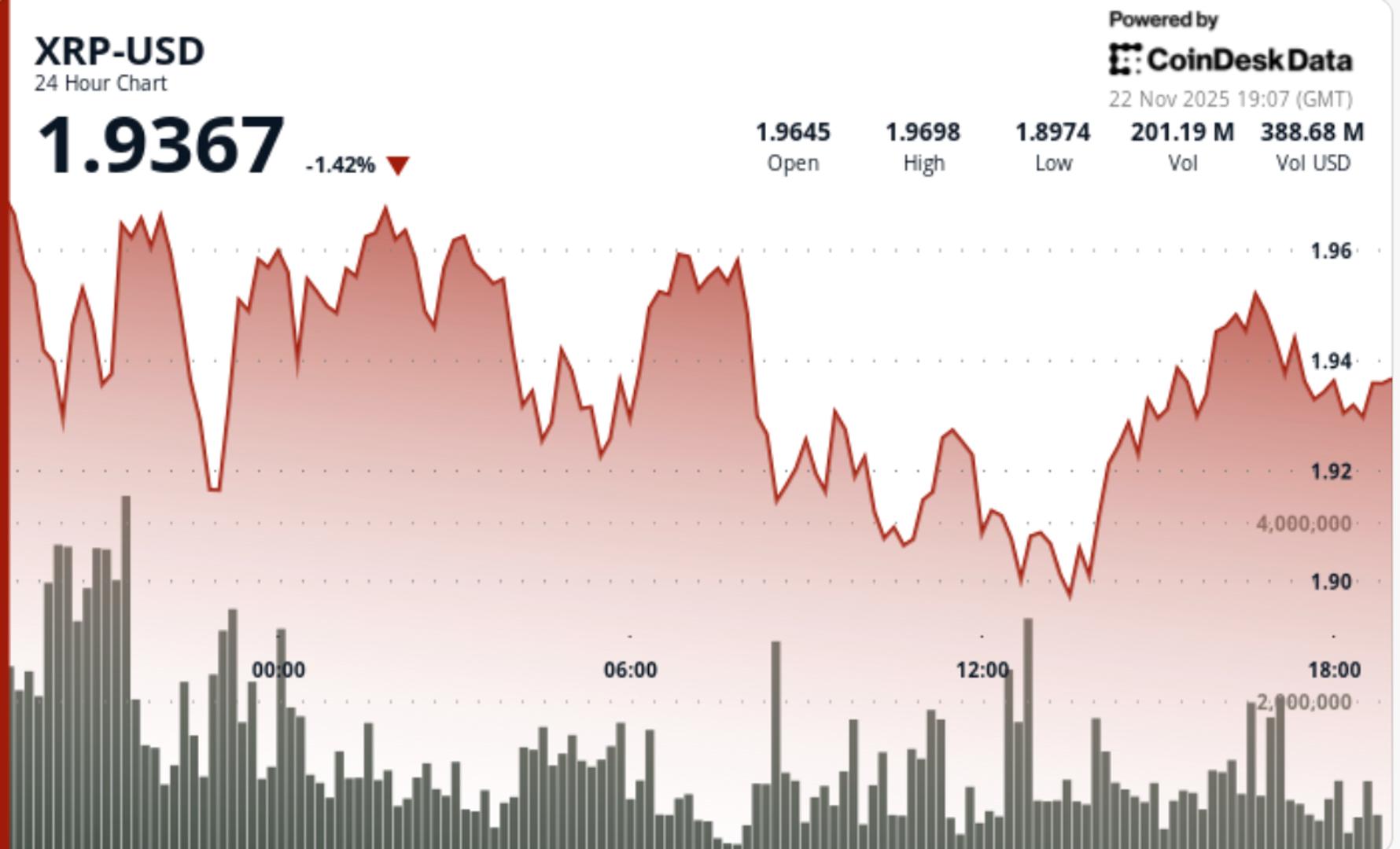

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email XRP Drops With Market as Bitcoin Weakness Pulls Altcoins Into Oversold Territory Technical indicators suggest oversold conditions, but a break above $1.96 is needed to reverse the current downward trend. By Shaurya Malwa , CD Analytics Updated Nov 22, 2025, 7:26 p.m. Published Nov 22, 2025, 7:26 p.m. (CoinDesk Data) What to know : Whale wallets sold nearly 200 million XRP, causing significant supply pressure and a drop in price. XRP's price fell to its lowest in three sessions, with a notable increase in trading volume indicating institutional selling. Technical indicators suggest oversold conditions, but a break above $1.96 is needed to reverse the current downward trend. Technical reversal signals emerge amid extreme oversold conditions following an aggressive institutional distribution wave. News Background • Whale wallets dumped nearly 200 million XRP (~$400M) over 48 hours, triggering acute supply pressure • Market-wide risk-off intensified as Bitcoin slipped below $90,000, pulling altcoins into deeper volatility • Bitwise’s new XRP ETF posted $25.7M first-day volume and $107.6M AUM, signaling strong institutional demand • Sentiment across majors remains fragile, with total crypto market cap still drifting under heavy outflows STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy . Price Action Summary • XRP fell from $1.96 → $1.91, marking its lowest close in three sessions • Volume spiked 67% above average to 182.1M, confirming institutional selling • A descending channel dominated the session with 5.1% intraday volatility • Capitulation bottom formed at $1.895, followed by a 0.5% late-session reversal • Final-hour volume surged to 2.76M, breaking the pattern of declining activity Technical Analysis XRP’s session reflected a classic distribution-driven decline followed by early-stage reversal signals. Whale selling created sustained downward pressure as major holders offloaded nearly 200M tokens, overwhelming the $1.96 resistance band and pushing XRP into a descending channel that persisted through most of the session. Support at $1.90–$1.91 emerged as the key battleground. The psychological level attracted aggressive buying after a capitulation event at $1.895, where institutional inflows reversed the intraday trend. Momentum indicators—including RSI and short-term stochastic—flashed deep oversold conditions, creating the first bullish divergence since last week’s major breakdown. The strong 2.76M-volume spike during the bounce suggests early accumulation behavior, contradicting the prior multi-hour decline in participation. Still, the macro structure remains fragile. Bulls must force a clean break above $1.96 to invalidate the descending channel and attempt a trend reversal. Failure to defend $1.90 would expose the chart to a fast extension toward $1.82, then $1.73. What Traders Should Watch • $1.90 remains the line in the sand. A close below opens the path toward October’s deep liquidity pockets • Reclaiming $1.96 is essential to neutralize the descending channel and restore short-term bullish momentum • ETF flows—especially Bitwise’s AUM trajectory—may provide upside catalysts if volume accelerates • Divergences and oversold signals favor near-term bounce attempts, but whale distribution remains the dominant risk • Market-wide fear levels remain elevated; XRP will continue to overreact to Bitcoin volatility Trading More For You Protocol Research: GoPlus Security By CoinDesk Research Nov 14, 2025 Commissioned by GoPlus What to know : As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M. GoPlus Intelligence's Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month. Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B. View Full Report More For You Coinbase to Add 24/7 Trading for SHIB, Bitcoin Cash, Dogecoin, and Others By Shaurya Malwa 40 minutes ago The exchange plans to introduce U.S. perpetual-style futures for altcoins, settling on a five-year expiry. What to know : Coinbase Markets will offer 24/7 futures trading for major altcoins starting December 5. The exchange plans to introduce U.S. perpetual-style futures for altcoins, settling on a five-year expiry. Coinbase aims to attract institutional investors by providing a compliant alternative to offshore trading venues. Read full story Latest Crypto News As DATs Face Pressure, Institutions Could Soon Look to BTCFi for Their Next Strategic Shift 27 minutes ago Coinbase to Add 24/7 Trading for SHIB, Bitcoin Cash, Dogecoin, and Others 40 minutes ago Hobbyist Miner Beats "1 in 180 Million Odds" to Win $265K Bitcoin Block Using Just One Old ASIC 51 minutes ago Is Strategy Stock the Preferred Hedge Against Crypto Losses? Tom Lee Thinks So 2 hours ago 'Liquidity Crisis': $12B in DeFi Liquidity Sits Idle as 95% of Capital Goes Unused 3 hours ago Coinbase 'Negative Premium' at Widest Level since Q1, Signalling Weak U.S. Demand 3 hours ago Top Stories Hobbyist Miner Beats "1 in 180 Million Odds" to Win $265K Bitcoin Block Using Just One Old ASIC 51 minutes ago Is Strategy Stock the Preferred Hedge Against Crypto Losses? Tom Lee Thinks So 2 hours ago Turning ‘$11K to Half a Billion Dollars From Trading Memecoins’: Tales From a Crypto Wealth Manager 4 hours ago 'Liquidity Crisis': $12B in DeFi Liquidity Sits Idle as 95% of Capital Goes Unused 3 hours ago Coinbase 'Negative Premium' at Widest Level since Q1, Signalling Weak U.S. Demand 3 hours ago Aerodrome Finance Hit by 'Front-End' Attack, Users Urged to Avoid Main Domain 3 hours ago