Privacy-Focused Aztec Network's Ignition Chain Lights Up on Ethereum

Analysis

Price Impact

Trustworthiness

Price Direction

Time Effect

Original Article:

Article Content:

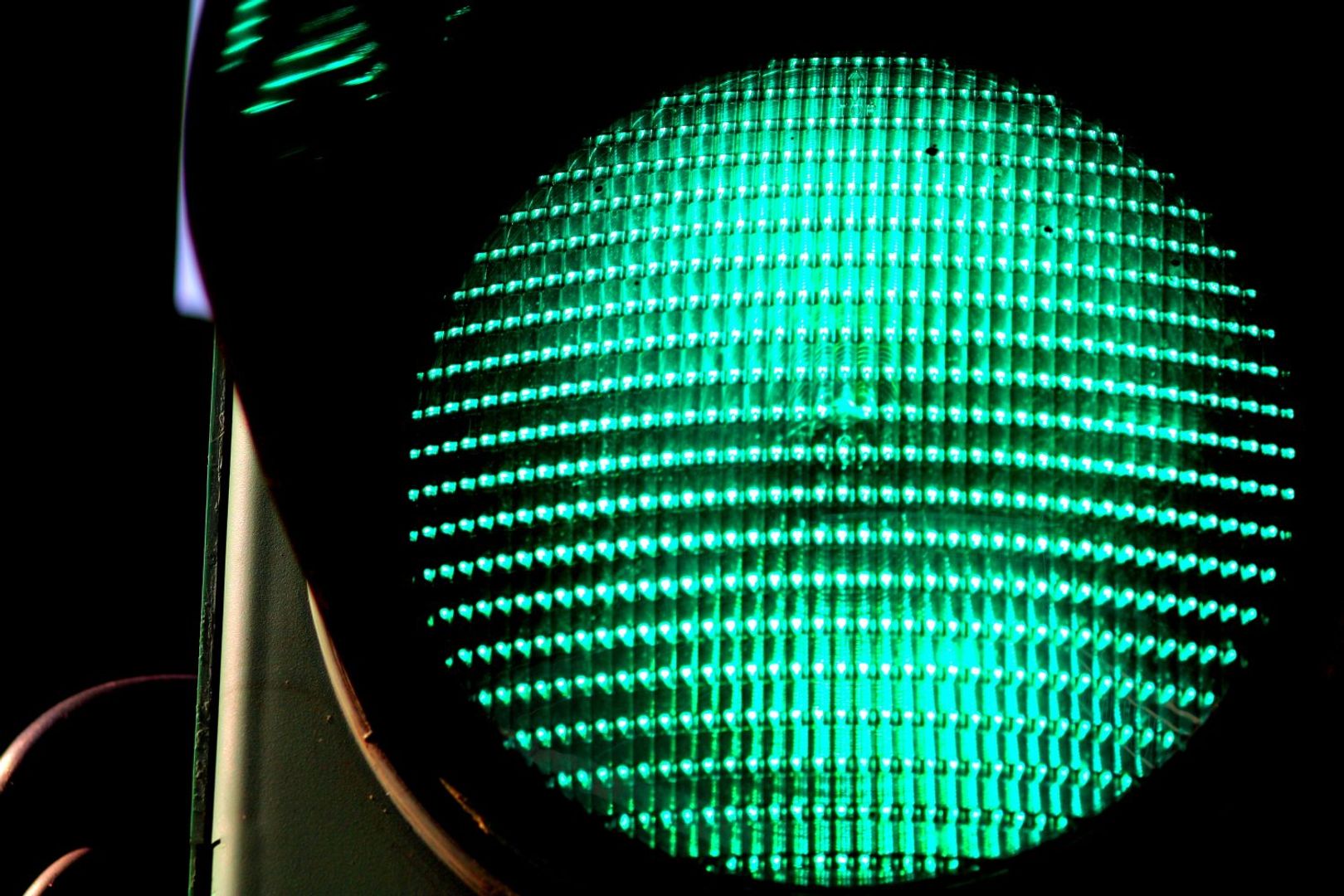

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email Privacy-Focused Aztec Network's Ignition Chain Lights Up on Ethereum Aztec Network launched its Ignition Chain, becoming the first fully decentralized Layer 2 protocol on Ethereum's mainnet. By Omkar Godbole , AI Boost | Edited by Sam Reynolds Nov 20, 2025, 6:45 a.m. Aztec's Ignition Chain debuts on Ethereum. What to know : Aztec Network launched its Ignition Chain, becoming the first fully decentralized Layer 2 protocol on Ethereum's mainnet. The Ignition Chain uses zero-knowledge proofs to provide private and scalable blockchain transactions, enhancing DeFi applications. Privacy-focused Ethereum Layer 2 Aztec Network's Ignition Chain flipped the switch on Wednesday, becoming the first fully decentralized Layer 2 protocol on the mainnet. "Aztec just shipped the Ignition Chain, the first fully decentralized L2 on Ethereum. This launches the decentralized consensus layer that powers the Aztec Network," Aztec announced on X . STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy . The event happened when the validator queue hit 500, a key checkpoint that signals readiness to secure the network and initiate block production The Ignition Chain is the engine powering Aztec's goal of being a fully decentralized "private world computer," enabling developers to create DeFi applications while maintaining total secrecy. It combines zero-knowledge proofs with Ethereum’s robust security, enabling truly private, scalable blockchain transactions. So, users get the speed and cost savings of L2, plus privacy that’s been missing in many decentralized finance (DeFi) applications. Anyone can become a validator or sequencer by staking AZTEC tokens to earn rewards and early birds get a bonus to jumpstart decentralization. The AZTEC token auction is scheduled for Dec. 2, opening the doors for more community involvement. The debut means privacy-focused, decentralized L2 networks are not just experimental projects, they’re about to become vital infrastructure shaping the future of blockchain. Why 500 validators? Ethereum’s consensus depends on distributed trust—meaning lots of independent validators confirm transactions. But if too many validators try to join all at once, network stability risks taking a hit. So new validators queue up, entering in stages. Reaching 500 validators means Aztec Ignition Chain has hit a critical mass: a strong, resilient base of participants ready to defend the network. More validators mean better decentralization, a lower risk of a bad actor taking control, and a network secure enough to launch fully on Ethereum. Ethereum News Privacy AI Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards . For more information, see CoinDesk's full AI Policy . Більше для вас Protocol Research: GoPlus Security Автор CoinDesk Research 14 лист. 2025 р. Commissioned by GoPlus Що варто знати : As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M. GoPlus Intelligence's Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month. Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B. View Full Report More For You India's Debt-Backed ARC Token Eyes Tentative Q1 2026 Debut, Sources Say By Omkar Godbole | Edited by Sam Reynolds 24 minutes ago The ARC will operate within a two-tier framework, complementing the RBI's Central Bank Digital Currency. What to know : India's Asset Reserve Certificate (ARC) is a stable digital asset set to launch in the first quarter of 2026, backed 1:1 by the Indian rupee. ARC aims to prevent liquidity outflow into dollar-backed stablecoins, supporting India's domestic economy and public debt demand. The ARC will operate within a two-tier framework, complementing the RBI's Central Bank Digital Currency. Read full story Latest Crypto News India's Debt-Backed ARC Token Eyes Tentative Q1 2026 Debut, Sources Say 24 minutes ago Dogecoin Hits Multi-Month Lows as Exchange Flows Turn Bullish for First Time in 6 Months 38 minutes ago XRP Slumps as $2.15 Level Collapses, Bearish Structure Deepens 45 minutes ago Asia Morning Briefing: Market Turns Defensive as Bitcoin Loses Its Bid 4 hours ago Stablecoin Spending Goes Mainstream With Opera MiniPay’s LatAm Integration 7 hours ago Samourai Wallet Co-Founder Bill Hill Sentenced to 4 Years in Prison for Unlicensed Money Transmitting 7 hours ago Top Stories Asia Morning Briefing: Market Turns Defensive as Bitcoin Loses Its Bid 4 hours ago Nvidia Earnings Beat, Strong Outlook Calm Jittery Markets; Bitcoin Re-Takes $90K 9 hours ago Fed Rate Cut Odds Plunge Further on Jobs Data Delays 10 hours ago DeFi Giant Spark Shelves Crypto App Plans to Focus on Institutional Infrastructure 9 hours ago Trump's Pick to Run CFTC, Selig, Tells Senators Crypto a 'Critical Mission' at Agency 9 hours ago Crypto Leverage Hits Record High in Q3 as DeFi Dominance Reshapes Market Structure: Galaxy 11 hours ago