XRP Slumps as $2.15 Level Collapses, Bearish Structure Deepens

Analysis

Price Impact

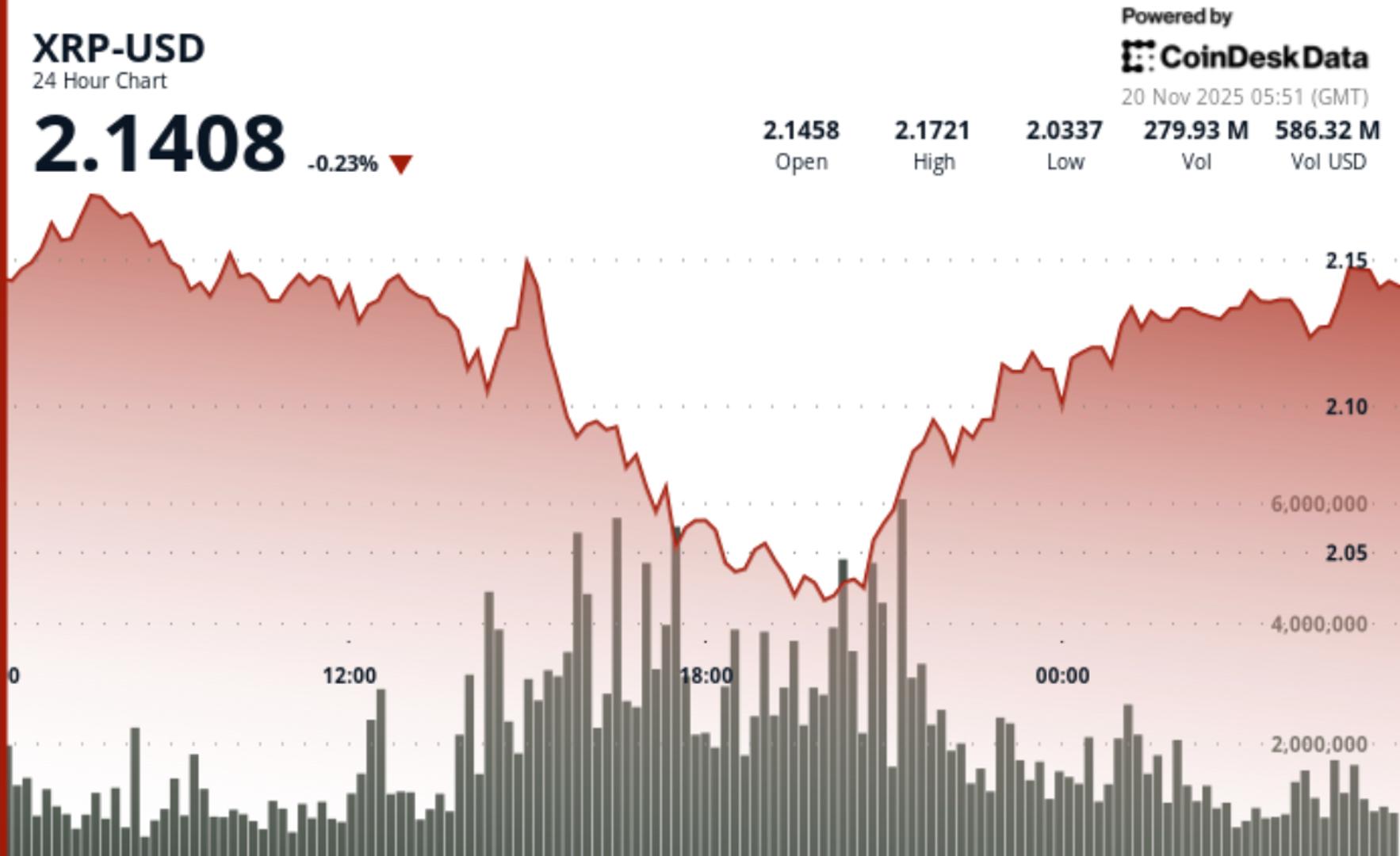

HighXrp slumped 3.6%, breaking the critical $2.15 support level with significantly increased volume, indicating strong selling pressure and a deepening bearish technical structure.

Trustworthiness

HighCoindesk is a reputable and widely recognized source for crypto news and analysis, providing detailed technical insights and market context.

Price Direction

BearishThe price action shows a clear technical breakdown with xrp forming a lower-high, lower-low structure after collapsing below key support. broader market weakness, including bitcoin's 'death cross,' contributes to the negative sentiment, suggesting further downside risk.

Time Effect

ShortThe analysis focuses on immediate technical support and resistance levels. traders are watching if xrp can reclaim $2.15 in the short term to neutralize immediate bearish bias, indicating near-term price sensitivity.

Original Article:

Article Content:

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email XRP Slumps as $2.15 Level Collapses, Bearish Structure Deepens Despite no major catalysts, broader crypto market weakness and Bitcoin's 'Death Cross' contributed to XRP's decline. By Shaurya Malwa , CD Analytics Updated Nov 20, 2025, 6:01 a.m. Published Nov 20, 2025, 6:01 a.m. (CoinDesk Data) What to know : XRP fell 3.6% amid heavy selling, breaking the critical $2.15 support level before stabilizing above $2.11. Despite no major catalysts, broader crypto market weakness and Bitcoin's 'Death Cross' contributed to XRP's decline. Traders are watching if XRP can reclaim $2.15 to neutralize bearish momentum, as current conditions suggest continued volatility. XRP breaks critical technical level amid heavy selling pressure, finding temporary support at $2.05 before stabilizing above $2.11 in volatile session. News Background • No major fundamental catalysts accompanied the decline, though broader crypto markets weakened • Sentiment remains fragile as Bitcoin’s “Death Cross” heightens risk-off conditions across majors • Institutional flows rotated defensively with XRP underperforming CD5 despite recent ETF launches • Analysts warn that support failures across altcoins may signal early-stage distribution cycles STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy . Price Action Summary • XRP dropped 3.6% from $2.21 → $2.13 , breaking the critical $2.15 support • Daily trading range expanded 7.8% with price testing the $2.04–$2.05 demand zone • Volume surged to 177.9M (+76% above average) during the breakdown sequence • Recovery attempts lifted price back above $2.11 , but follow-through faded on declining volume Technical Analysis XRP endured another technical breakdown Tuesday, sliding 3.6% to $2.13 as institutional selling intensified below the key $2.15 support level. The decline unfolded across a volatile $0.17 range, with volume spiking 76% above 24-hour norms to 177.9M tokens — confirming large-order participation during the structural failure. Sellers overwhelmed bids during evening trade, forcing XRP into the $2.04–$2.05 demand pocket where buyers finally emerged. The rebound pushed the token back toward $2.11–$2.12, but the recovery lacked depth as volume evaporated into the session close. Market structure now reflects a clear lower-high, lower-low formation consistent with persistent bearish momentum. Despite ETF-linked inflow narratives, XRP underperformed broader crypto benchmarks — a sign that structural supply outweighs fundamental optimism in the near term. What Traders Should Watch The rejection at $2.21 and subsequent collapse below $2.15 underline the market’s sensitivity to technical failure points. The $2.05 support reaction suggests oversold conditions temporarily halted the decline, but the rebound lacks sufficient volume to confirm a durable shift in momentum. Traders now watch whether XRP can reclaim $2.15 , which would neutralize immediate bearish bias. Failure to do so keeps downside targets open, especially as lower-timeframe charts show supply clusters forming at $2.13–$2.15 with no sign of aggressive bid absorption. Momentum remains pressured by macro correlations. Bitcoin’s Death Cross, weakening liquidity, and risk-off flows across altcoins suggest volatility may persist, and XRP — typically a high-beta asset — remains exposed to sector-wide unwind scenarios. XRP News More For You Protocol Research: GoPlus Security By CoinDesk Research Nov 14, 2025 Commissioned by GoPlus What to know : As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M. GoPlus Intelligence's Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month. Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B. View Full Report More For You Asia Morning Briefing: Market Turns Defensive as Bitcoin Loses Its Bid By Sam Reynolds 3 hours ago With CryptoQuant flagging an exhausted demand wave and Polymarket traders clustering around an 85,000 retest, the market is trading without the catalysts that drove last year’s gains. What to know : Bitcoin's market structure is weakening as demand diminishes, with rallies likely stalling below the 365-day moving average. Short-term Bitcoin holders are realizing losses rapidly, and derivatives markets are in risk-off mode, signaling potential bearish momentum. Bitcoin is trading around $92,000, while Ether is at $3,038, both reflecting a broader defensive market tone. Read full story Latest Crypto News Asia Morning Briefing: Market Turns Defensive as Bitcoin Loses Its Bid 3 hours ago Stablecoin Spending Goes Mainstream With Opera MiniPay’s LatAm Integration 6 hours ago Samourai Wallet Co-Founder Bill Hill Sentenced to 4 Years in Prison for Unlicensed Money Transmitting 7 hours ago Nvidia Earnings Beat, Strong Outlook Calm Jittery Markets; Bitcoin Re-Takes $90K 8 hours ago DeFi Giant Spark Shelves Crypto App Plans to Focus on Institutional Infrastructure 8 hours ago Trump's Pick to Run CFTC, Selig, Tells Senators Crypto a 'Critical Mission' at Agency 8 hours ago Top Stories Asia Morning Briefing: Market Turns Defensive as Bitcoin Loses Its Bid 3 hours ago Nvidia Earnings Beat, Strong Outlook Calm Jittery Markets; Bitcoin Re-Takes $90K 8 hours ago Fed Rate Cut Odds Plunge Further on Jobs Data Delays 9 hours ago DeFi Giant Spark Shelves Crypto App Plans to Focus on Institutional Infrastructure 8 hours ago Trump's Pick to Run CFTC, Selig, Tells Senators Crypto a 'Critical Mission' at Agency 8 hours ago Crypto Leverage Hits Record High in Q3 as DeFi Dominance Reshapes Market Structure: Galaxy 10 hours ago