Solana Drops 4.9% Breaking Below Key Support as Alameda Unlocks Continue

Analysis

Price Impact

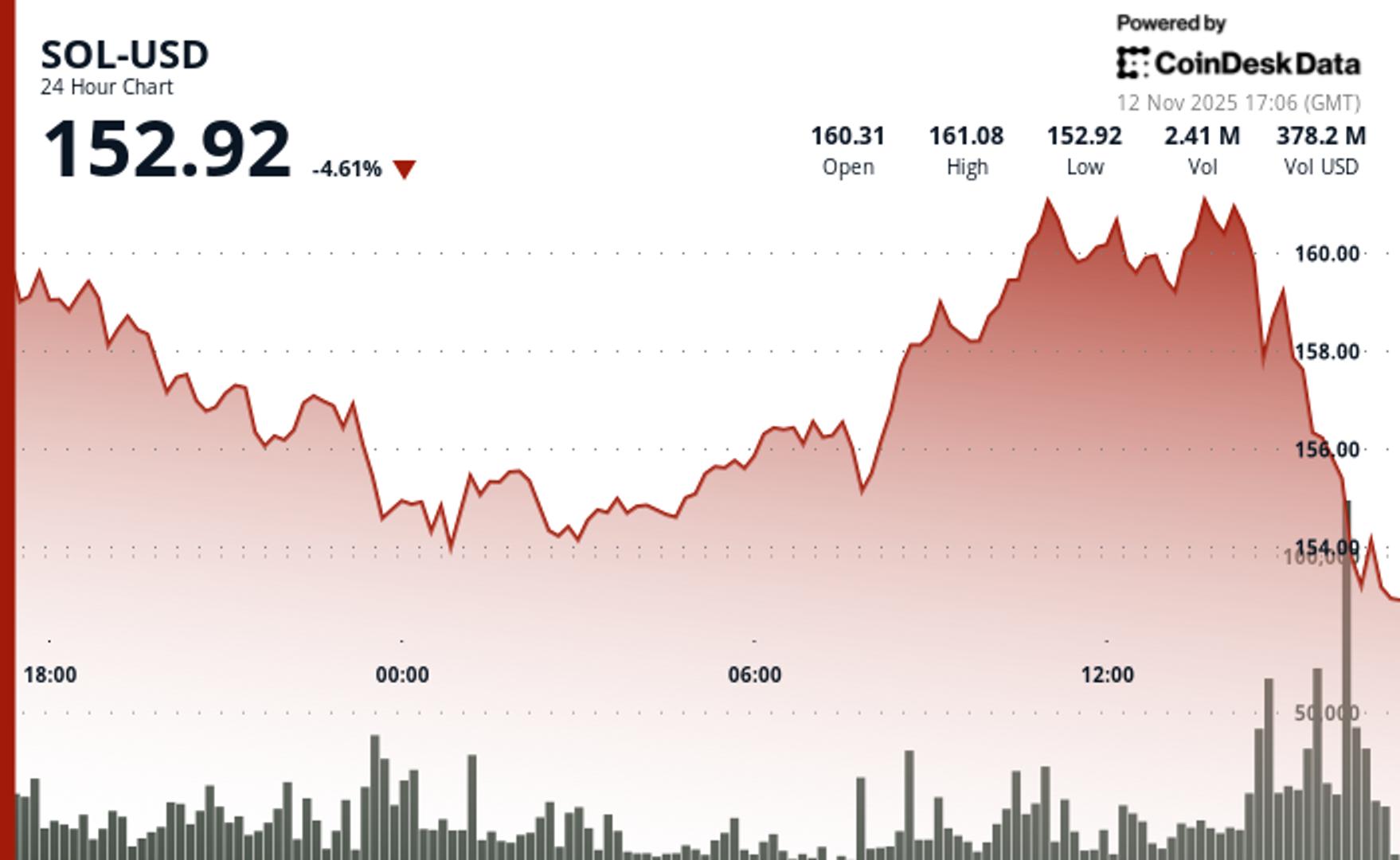

HighSolana's price dropped 4.9%, breaking a key technical support level at $156, primarily due to ongoing token unlocks from alameda research, which added significant selling pressure. this occurred despite robust institutional inflows, indicating a strong battle between supply and demand currently favoring sellers.

Trustworthiness

HighThe article is from coindesk, a reputable source, and provides specific figures for price drops, token unlocks, and institutional inflows. it includes detailed technical analysis and mentions relevant market participants and analysts.

Price Direction

BearishThe breakdown below critical $156 support on elevated volume, coupled with the formation of a descending channel, suggests continued bearish momentum targeting demand zones around $152.80-$150. the immediate selling pressure from alameda unlocks is overriding institutional buying in the short term.

Time Effect

ShortThe analysis focuses on the immediate 4.9% price drop, current token unlocks, and short-term technical breakdown (60-minute chart analysis) below key support levels, indicating an immediate market reaction and short-term outlook.

Original Article:

Article Content:

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email Solana Drops 4.9% Breaking Below Key Support as Alameda Unlocks Continue Institutional inflows of $336 million fail to offset selling pressure as SOL falls to $153 amid fresh token releases. By CD Analytics , Siamak Masnavi Nov 12, 2025, 5:37 p.m. "Solana falls 4.9% to $153 despite $336M institutional inflows, breaking key support as Alameda unlocks continue." What to know : SOL dropped 4.9% to $153.49 despite recording $336 million in weekly ETF inflows. Alameda Research unlocked another 193,000 SOL tokens valued at approximately $30 million. Technical breakdown below $156 support accelerates selling toward $152.80 demand zone. Market Overview Solana SOL $ 153.61 faces renewed selling pressure as the token tumbles from $160.72 to $152.81, posting a 4.9% decline despite continued institutional support through exchange-traded fund products. The drop occurs on elevated volume running 17.25% above the seven-day average. Active repositioning dominates rather than passive drift. Selling intensifies following another scheduled token unlock from bankrupt Alameda Research and the FTX estate on November 11. Analyst MartyParty reports approximately 193,000 SOL tokens worth $30 million get released as part of ongoing monthly vesting. The program has been gradually distributing over 8 million tokens since November 2023. These structured releases, managed under bankruptcy oversight, typically flow to major exchanges for creditor repayment. STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy . Institutional demand remains robust with solana spot ETFs recording their tenth consecutive day of inflows totaling $336 million for the week. Major financial institutions including Rothschild Investment and PNC Financial Services disclosed new holdings in Solana-based products. Grayscale introduced options trading for its Solana Trust ETF (GSOL) to provide additional hedging tools for institutional traders. Supply Pressure vs Institutional Demand: What Traders Should Watch Alameda's systematic token releases create predictable selling pressure while institutional flows provide underlying support. SOL finds itself caught between opposing forces. The bankruptcy estate maintains approximately 5 million tokens in locked or staked positions. Smaller monthly unlocks continue through 2028 based on pre-2021 investment agreements. The 60-minute analysis reveals accelerating bearish momentum as SOL breaks critical support at $156 amid explosive selling volume. The breakdown occurs during 15:00-16:00 UTC when price collapses from $155.40 to $152.86 on 212,000 volume—123% above the hourly average. This technical failure confirms the earlier support breach and establishes a descending channel targeting the $152.50-$152.80 demand zone. However, underlying strength in ETF flows suggests institutional accumulation at lower levels. Bitwise's BSOL leads weekly inflows with $118 million while maintaining its yield-focused strategy through staking rewards averaging over 7% annually. Key Technical Levels Signal Consolidation Phase for SOL Support/Resistance: Primary support establishes at $152.80 demand zone with secondary levels at $150; immediate resistance at $156 (former support) and $160 Volume Analysis: 24-hour volume surges 17% above weekly average during breakdown, confirming institutional repositioning rather than retail capitulation Chart Patterns: Descending channel formation with lower highs at $156.71 and $156.13; break above $160 needed to invalidate bearish structure Targets & Risk/Reward: Bounce potential toward $160-$165 resistance if $152.80 holds; breakdown below $150 accelerates toward $145 support levels CoinDesk 5 Index (CD5) Drops 1.85% in Volatile Session CoinDesk 5 Index fell from $1,792.49 to $1,759.24, declining $33.25 (-1.85%) across a $74.31 total range as strong bearish momentum emerges after failing resistance at $1,824.82, with significant institutional volume during the 15:00-16:00 selloff confirming the downward break below key support at $1,767. Disclaimer : Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk's full AI Policy. AI Market Insights Technical Analysis More For You OwlTing: Stablecoin Infrastructure for the Future By CoinDesk Research Oct 16, 2025 Commissioned by OwlTing Stablecoin payment volumes have grown to $19.4B year-to-date in 2025. OwlTing aims to capture this market by developing payment infrastructure that processes transactions in seconds for fractions of a cent. View Full Report More For You Bitcoin Plunges Below $102K Amid Weak U.S. Demand, Fed Divided on December Cut By Krisztian Sandor | Edited by Nikhilesh De 5 minutes ago Bitcoin's Coinbase Premium, a popular gauge for U.S. demand, is having its longest negative streak since the April correction, coinciding with the Fed turning more hawkish. What to know : Bitcoin dropped back below $102K as cryptos erased overnight gains during U.S. trading hours. ETH, XRP, SOL plunged around 5%. Crypto miners and equities slid, led by double-digit losses in AI-linked data center stocks. Fed's December rate cut odds dim as officials grow split over inflation versus labor risks. Read full story Latest Crypto News Bitcoin Plunges Below $102K Amid Weak U.S. Demand, Fed Divided on December Cut 5 minutes ago Stellar's XLM Trades in Tight Range as Traders Exhibit Uncertainty 7 minutes ago HBAR Drops 0.6% to $0.18 Amid Indecisive Trading Session 19 minutes ago BONK Falls 5% to $0.00001223 After Rejection at Key Resistance 30 minutes ago Sui Launches Native Stablecoin USDsui Using Bridge’s Open Issuance Platform 32 minutes ago Toncoin Drops 2.4% as Post-Rally Selling Pressure Caps Gains 40 minutes ago Top Stories Key Bitcoin Capitulation Metric Points to Bottoming in Price 4 hours ago U.S. SEC Chief Atkins Says Clarity Coming on Crypto Tied to Investment Contracts 1 hour ago New Strike Force Set to Target Overseas 'Pig Butchering' as U.S. Hits Burma Operation 54 minutes ago Crypto Markets Today: Privacy Tokens Shine, Majors Stall as Market Consolidates 6 hours ago Is Bitcoin Volatility Vacation Over? Chart Suggests So, Analysts Cite 3 Catalysts 8 hours ago Pooled Order Books in the Crosshairs as EU Regulators Look to Tighten MiCA Oversight 5 hours ago In this article SOL SOL $ 153.61 ◢ 3.76 %