Stellar's XLM Trades in Tight Range as Traders Exhibit Uncertainty

Analysis

Price Impact

MedXlm has been trading in a tight range, experiencing a significant support breakdown followed by a bullish reversal reclaiming a key resistance level. this suggests underlying technical battle and uncertainty.

Trustworthiness

HighThe analysis is provided by cd analytics and oliver knight from coindesk, a well-established crypto news source, offering detailed technical analysis with specific price levels and volume data.

Price Direction

BullishDespite an earlier support breakdown, the latest 60-minute data shows a bullish reversal reclaiming the $0.2950 resistance. institutional accumulation is noted, and a higher highs/higher lows sequence is emerging on the shorter timeframe, suggesting a potential push towards the next resistance zone.

Time Effect

ShortThe analysis focuses on recent 24-hour and 60-minute price movements, immediate targets, and current consolidation patterns, indicating a near-term outlook.

Original Article:

Article Content:

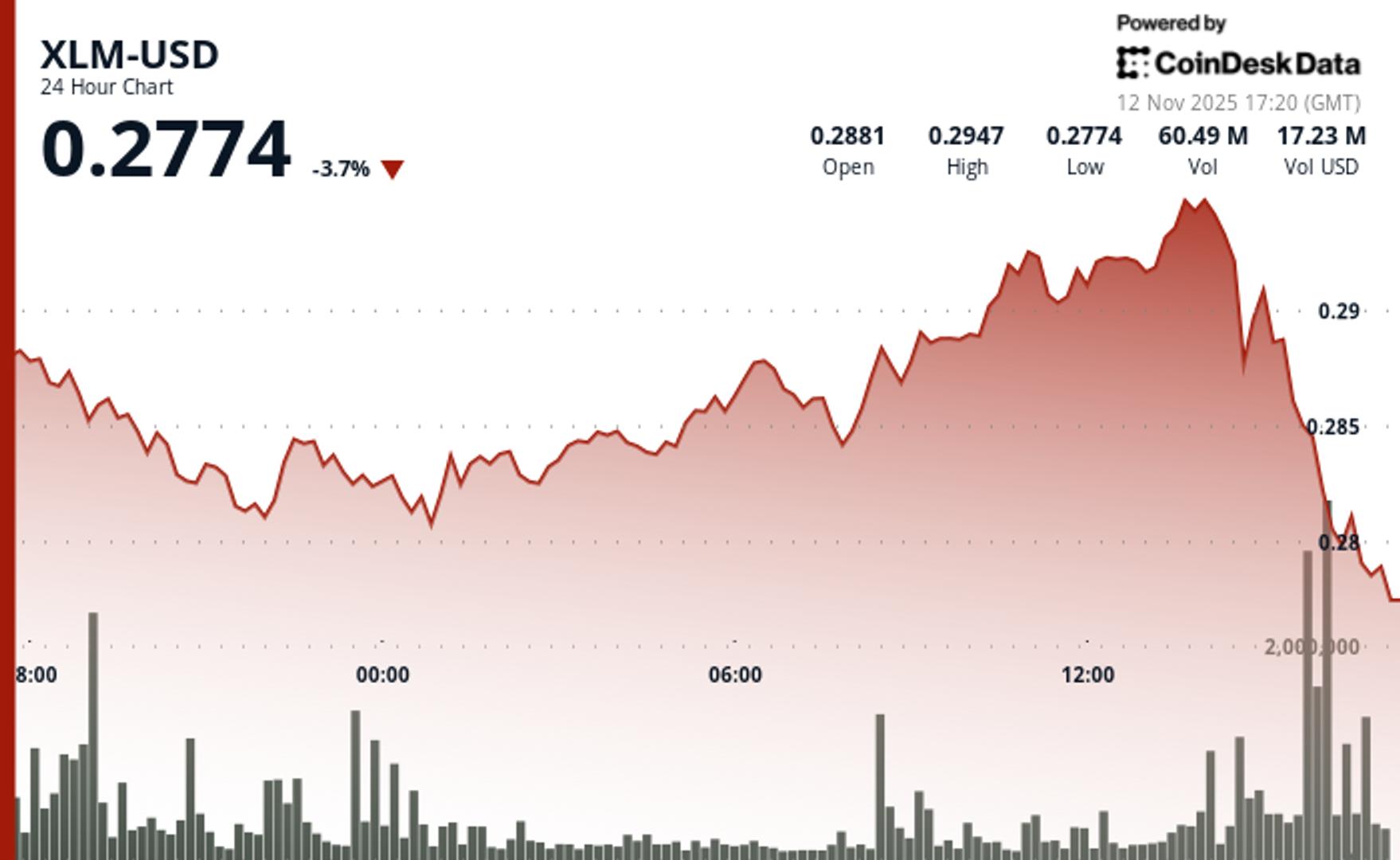

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email Stellar's XLM Trades in Tight Range as Traders Exhibit Uncertainty XLM trades within tight $0.2810-$0.2950 corridor following volume surge that triggered key support breakdown earlier in session. By CD Analytics , Oliver Knight Updated Nov 12, 2025, 5:31 p.m. Published Nov 12, 2025, 5:31 p.m. "Stellar (XLM) slips 0.2% to $0.2944 amid range-bound trading after key support breakdown." What to know : XLM dropped from $0.2949 to $0.2944 across 24 hours in 5.0% trading range. Heavy selling at 11 November 20:00 smashed $0.2845 support on 36.08 million volume spike. Latest 60-minute data shows bullish reversal reclaiming $0.2950 resistance level. Stellar’s performance was muted in Tuesday’s session ending Nov. 12 at 14:00 UTC, with XLM easing from $0.2949 to $0.2944 as traders settled into a tight consolidation range. The token’s modest $0.0148 movement—around 5% of total activity—highlighted uncertainty among market participants, suggesting a lack of directional conviction. STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy . A wave of heavy selling hit late on Nov. 11, with volume surging to 36.08 million tokens—47% above the 24-hour average—forcing a break below key support at $0.2845. The sell-off pushed XLM to lows near $0.2810 before buyers stepped in to stabilize prices. With few Stellar-specific catalysts at play, traders are focusing on technical levels. Accumulation near the $0.2949 zone and increased volume suggest institutional players may be positioning for a move toward the next resistance cluster at $0.2960–$0.2970. The key question is whether the base around $0.2810 can hold firm to support a sustained push higher. XLM/USD (TradingView) Key Technical Levels Signal Mixed Outlook for XLM Support/Resistance: Primary floor established at $0.2810 after volume-driven breakdown. Key $0.2950 resistance reclaimed on latest 60-minute breakout pattern. Next upside target zone positioned at $0.2960-$0.2970 cluster. Volume Analysis: Massive 36.08M volume spike (47% above SMA) marked support failure. Volume surge during $0.2949 retest signals institutional accumulation phase. Normalized activity in final hours confirms consolidation completion. Chart Patterns: Initial descending trendline from session high created bearish setup. Tight $0.2810-$0.2950 range suggests base building structure. Higher highs/higher lows sequence emerges on 60-minute timeframe. Targets & Risk/Reward: Immediate bullish target: $0.2960-$0.2970 resistance zone. Critical support defense: $0.2810 base formation low. Risk/reward tilts bullish above $0.2917 breakout trigger. Disclaimer Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk's full AI Policy. AI Market Insights More For You OwlTing: Stablecoin Infrastructure for the Future By CoinDesk Research Oct 16, 2025 Commissioned by OwlTing Stablecoin payment volumes have grown to $19.4B year-to-date in 2025. OwlTing aims to capture this market by developing payment infrastructure that processes transactions in seconds for fractions of a cent. View Full Report More For You HBAR Drops 0.6% to $0.18 Amid Indecisive Trading Session By CD Analytics , Oliver Knight 12 minutes ago Hedera's native token breaks key support in final trading hour as institutional focus shifts to regulatory-friendly blockchain alternatives. What to know : HBAR declined 0.6% in volatile session, trading between $0.1775-$0.1865 range Token broke below critical $0.1775 support level during final hour selling pressure Technical factors dominated as broader altcoin momentum shifted toward XRP ETF developments Read full story Latest Crypto News HBAR Drops 0.6% to $0.18 Amid Indecisive Trading Session 12 minutes ago BONK Falls 5% to $0.00001223 After Rejection at Key Resistance 23 minutes ago Sui Launches Native Stablecoin USDsui Using Bridge’s Open Issuance Platform 26 minutes ago Toncoin Drops 2.4% as Post-Rally Selling Pressure Caps Gains 33 minutes ago Brazil Proposes Selling Seized Bitcoin to Undercut Organized Crime Networks 42 minutes ago New Strike Force Set to Target Overseas 'Pig Butchering' as U.S. Hits Burma Operation 47 minutes ago Top Stories Key Bitcoin Capitulation Metric Points to Bottoming in Price 4 hours ago U.S. SEC Chief Atkins Says Clarity Coming on Crypto Tied to Investment Contracts 1 hour ago New Strike Force Set to Target Overseas 'Pig Butchering' as U.S. Hits Burma Operation 47 minutes ago Crypto Markets Today: Privacy Tokens Shine, Majors Stall as Market Consolidates 6 hours ago Is Bitcoin Volatility Vacation Over? Chart Suggests So, Analysts Cite 3 Catalysts 8 hours ago Pooled Order Books in the Crosshairs as EU Regulators Look to Tighten MiCA Oversight 4 hours ago