XRP Rejects $2.67 Breakout in Risk of Deeper Pullback as Fed Cuts Cause Bitcoin Slide

Analysis

Price Impact

HighXrp failed to break out above the $2.67 resistance, leading to a significant price drop to $2.59 with a 658% surge in trading volume during the rejection. on-chain data indicates large xrp holders are selling off, contributing to the downward pressure.

Trustworthiness

HighAnalysis is based on coindesk data, including on-chain metrics (whale selling), technical analysis (rsi/macd divergence, support/resistance levels), and significant trading volume spikes during key price actions.

Price Direction

BearishThe failed breakout at $2.67, coupled with significant whale selling and momentum indicator divergence, suggests a short-term bearish pivot. a break below $2.58 support could lead to further downside toward $2.53 and $2.50.

Time Effect

ShortThe analysis focuses on immediate price action, failed resistance tests, and the implications of current whale movements and open interest for the very near term. it highlights critical short-term support/resistance levels.

Original Article:

Article Content:

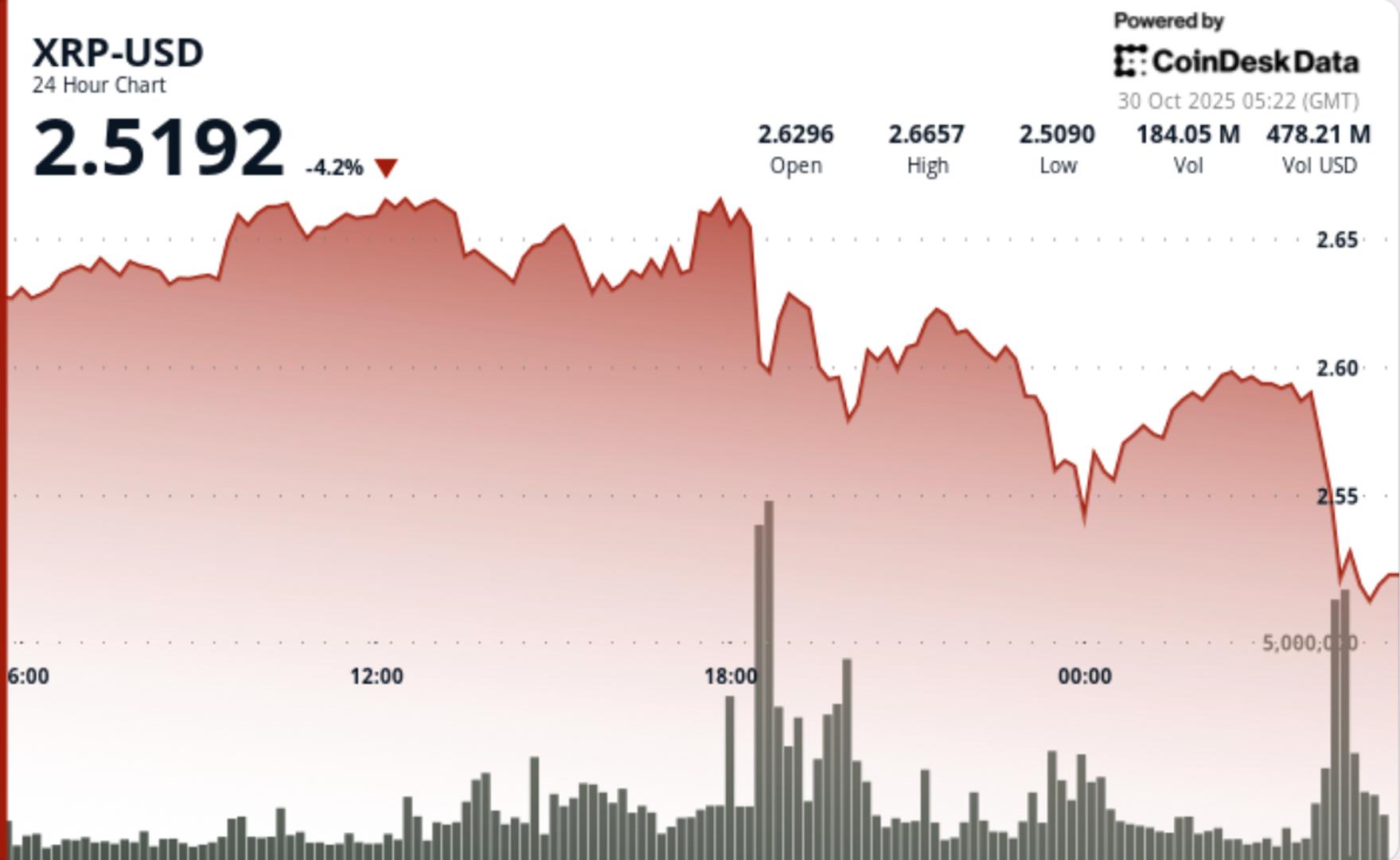

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email XRP Rejects $2.67 Breakout in Risk of Deeper Pullback as Fed Cuts Cause Bitcoin Slide XRP slid from $2.63 to $2.59 after a failed breakout above the $2.67 zone, with trading volume spiking to roughly 392.6 million tokens—about 658% above its recent average—during the rejection. By Shaurya Malwa Updated Oct 30, 2025, 5:53 a.m. Published Oct 30, 2025, 5:53 a.m. (CoinDesk Data) What to know : XRP faced a failed breakout at the $2.67 resistance, leading to a price drop to $2.59 with a significant increase in trading volume. On-chain data indicates large XRP holders are selling, raising concerns about profit-taking amid high futures open interest. Traders should watch the $2.58 support level, as a break below could signal further downside, while a bounce could target higher resistance levels. The $2.67-$2.69 zone now stands as critical overhead supply. Meanwhile support in the $2.580 area and the 200-day EMA near ~$2.61 are acting as anchors. News Background XRP slid from $2.63 to $2.59 after a failed breakout above the $2.67 zone, with trading volume spiking to roughly 392.6 million tokens—about 658% above its recent average—during the rejection. This move coincides with elevated open interest in XRP futures near early-2025 highs (~$2.9 billion). Meanwhile, on-chain data suggest major wallets are offloading large amounts of XRP, raising profit-taking concerns even amid broader institutional interest. Price Action Summary Over the 24-hour window, XRP moved from ~$2.63 to ~$2.59 while carving out a $0.12 trading band. The decisive cap occurred at ~$2.67 resistance, where volume exploded and price faltered. A late-session drop from ~$2.590 to ~$2.579 around 04:04-04:05 UTC occurred on ~2.18 million token volume—≈355% above the hourly average—before briefly freezing trading between 04:08-04:10 at near-zero volume. The breakdown breached the support cluster near $2.580, establishing fresh lower-lows beneath prior consolidation levels. Technical Analysis The rejection at resistance affirms the short-term bearish pivot: while long-term structure still shows accumulation, the immediate risk has shifted back to the downside. Futures open interest remains elevated, but whale wallet sell-off data suggest distribution—not accumulation—is currently dominant. RSI/MACD momentum indicators show divergence (higher highs on price, lower highs on momentum), further warning of potential correction. What Traders Should Know Traders should treat current levels as a high-risk / high-reward pivot zone. A bounce from $2.58–$2.60 on renewed volume could reset momentum and aim toward $2.70–$3.00. But a clear break below $2.58 would open downside toward ~$2.53 and perhaps $2.50, especially if whale outflows continue and open interest drops. Monitoring large wallet flows, futures OI dynamics and volume spikes will be key to judge whether this is just consolidation or the start of a deeper correction. XRP More For You OwlTing: Stablecoin Infrastructure for the Future By CoinDesk Research Oct 16, 2025 Commissioned by OwlTing Stablecoin payment volumes have grown to $19.4B year-to-date in 2025. OwlTing aims to capture this market by developing payment infrastructure that processes transactions in seconds for fractions of a cent. View Full Report More For You Crypto Traders Take on $800M Liquidations as Fed’s Caution Sparks ‘Sell-the-News’ Reversal By Shaurya Malwa 3 minutes ago Large clusters of long liquidations can signal capitulation and potential short-term bottoms, while heavy short wipeouts may precede local tops as momentum flips. What to know : Bitcoin experienced significant volatility, falling to nearly $108,000 before rising above $110,000, with $817 million in leveraged futures liquidations. The Federal Reserve's 25-basis-point rate cut was followed by cautious remarks from Chair Jerome Powell, impacting market optimism. Analysts suggest that while short-term volatility persists, macroeconomic conditions may support Bitcoin's rise if liquidity increases as expected. Read full story Latest Crypto News Crypto Traders Take on $800M Liquidations as Fed’s Caution Sparks ‘Sell-the-News’ Reversal 3 minutes ago BTC Drops, Then Pops, as Trump Lowers China Tariffs 1 hour ago Asia Morning Briefing: What's the Real Use for a Yen Stablecoin? An On-Chain Carry Trade 4 hours ago Chainlink Drops, Then Bounces 4% as FOMC Volatility Drives Crypto Market 9 hours ago Consensys Plans Public Debut, Taps JPMorgan and Goldman Sachs to Lead IPO: Axios 9 hours ago Mastercard Eyes Zero Hash Acquisition for Nearly $2B Bet on Stablecoins: Report 9 hours ago Top Stories Asia Morning Briefing: What's the Real Use for a Yen Stablecoin? An On-Chain Carry Trade 4 hours ago BTC Drops, Then Pops, as Trump Lowers China Tariffs 1 hour ago Crypto Traders Take on $800M Liquidations as Fed’s Caution Sparks ‘Sell-the-News’ Reversal 3 minutes ago Fed Delivers Expected 25 Basis Point Rate Cut as Markets Await Powell’s Comments 12 hours ago Bitcoin Tumbles Back to $110K on Fed's Powell's Hawkish Comments 11 hours ago Michael Saylor's Strategy Drops $18B in Value, but a Rebound May Be Near: 10X Research 14 hours ago