HBAR Consolidates at $0.2010 as Volume Surge Signals Distribution

Analysis

Price Impact

HighHbar faces significant selling pressure at $0.2055 resistance, with a 137% surge in trading volume signaling institutional distribution. the price action shows a pattern of lower highs, indicating strong bearish momentum.

Trustworthiness

HighThe analysis is provided by coindesk analytics, a reputable source in crypto journalism, offering detailed technical insights and market observations.

Price Direction

BearishDespite a brief boost from a new nasdaq-listed spot hbar etf, sellers have reasserted control. key resistance at $0.2055 has held firm with heavy distribution volume, and a series of lower highs confirms a bearish trend.

Time Effect

ShortThe article focuses on recent intraday price movements, current selling pressure, and short-term technical indicators like resistance levels and volume spikes, suggesting immediate market implications.

Original Article:

Article Content:

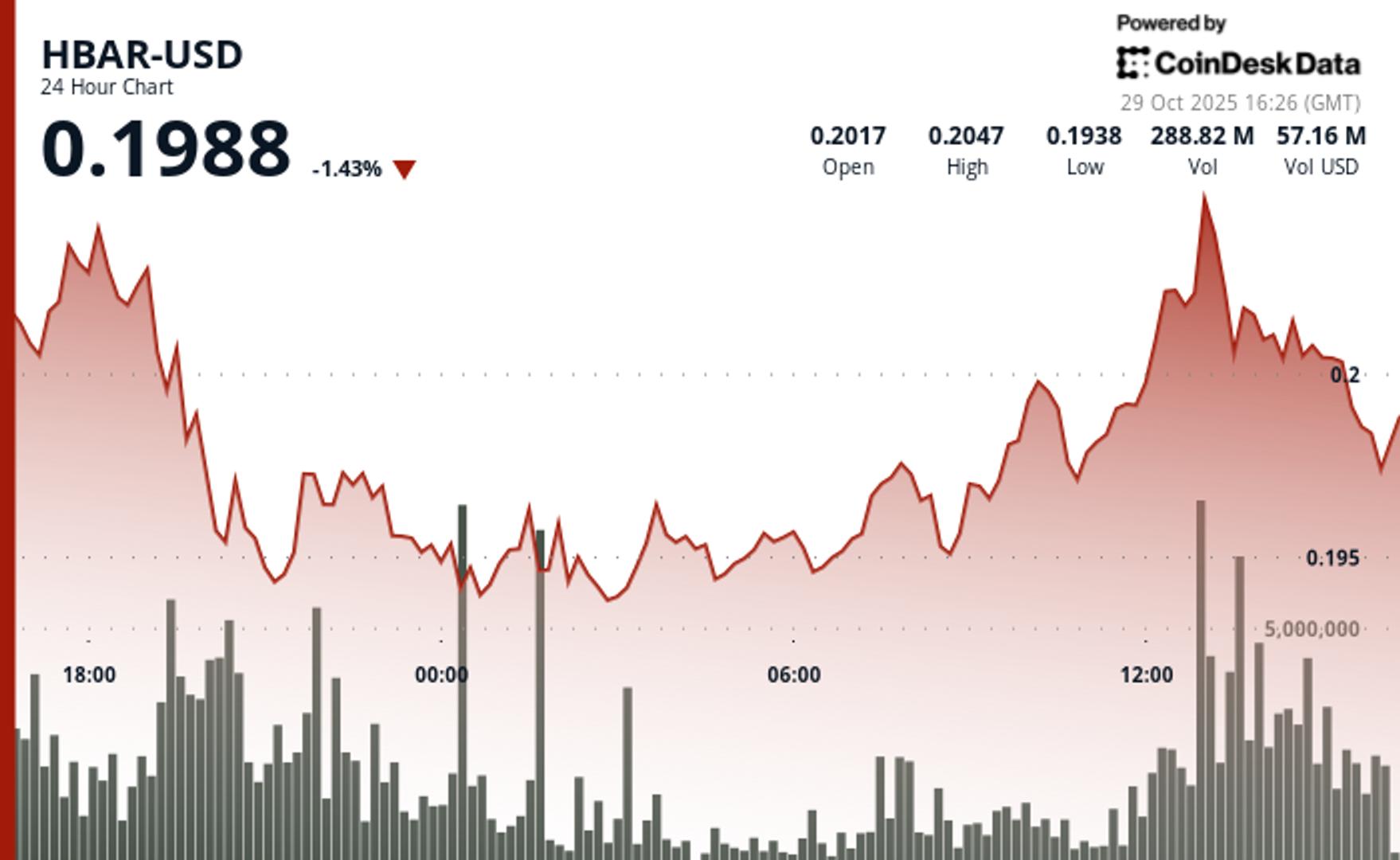

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email HBAR Consolidates at $0.2010 as Volume Surge Signals Distribution Hedera faces selling pressure at $0.2055 resistance as trading volume explodes 137% above average, marking institutional distribution amid choppy price action. By CD Analytics , Oliver Knight Updated Oct 29, 2025, 4:54 p.m. Published Oct 29, 2025, 4:54 p.m. "HBAR drops 0.3% to $0.2010 amid 137% volume surge signaling institutional distribution at $0.2055 resistance." What to know : HBAR faces heavy resistance near $0.2055, with a 137% surge in trading volume signaling possible institutional selling and strong distribution pressure at that level. Support at $0.1938 remains critical, holding firm through multiple tests, but lower highs ($0.2044, $0.2032, $0.2017) reinforce a bearish short-term trend. Despite a temporary boost from the new Nasdaq-listed spot HBAR ETF, momentum has shifted back to sellers as intraday volatility and halted trading point to potential instability. HBAR slipped 0.3% to $0.2010 on Tuesday as sellers reasserted control near key resistance. The token traded within a tight $0.0124 range, fading from a session high of $0.2059 as technical selling capped upside momentum. A surge in trading volume to 249 million tokens—137% above average—confirmed heavy distribution at the $0.2055 level, suggesting institutional selling. Support at $0.1938 has held through repeated tests, but a series of lower highs at $0.2044, $0.2032, and $0.2017 signals persistent bearish momentum. STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy . Intraday volatility intensified between 13:33 and 13:48, with sharp swings from $0.2015 to $0.2029 amid bursts of 20.6 million tokens. Trading abruptly halted at 14:16, pointing to possible market disruption or data issues. The $0.2014 pivot now serves as a key level as traders watch whether HBAR’s $0.1938 support can withstand continued pressure. The price action follows Tuesday's launch of a spot HBAR ETF on the Nasdaq, which led to a significant intraday increase in HBAR. HBAR/USD (TradingView) HBAR Technical Overview Support / Resistance Key support at $0.1938 has held through multiple tests. Strong resistance at $0.2055 remains unbroken after repeated high-volume rejections. Volume Analysis Recent 249M token volume spike marks a 137% increase over the average. Indicates institutional selling pressure and distribution concentrated near resistance. Chart Patterns Descending trendline confirms bearish momentum with successive lower highs at: $0.2044 $0.2032 $0.2017 Price action remains range-bound, but momentum favors sellers. Targets / Risk-Reward Downside target: Break below $0.1938 support could trigger further weakness. Upside potential: Recovery faces resistance at $0.2017 and major supply near $0.2055. Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards . For more information, see CoinDesk's full AI Policy . AI Market Insights More For You OwlTing: Stablecoin Infrastructure for the Future By CoinDesk Research Oct 16, 2025 Commissioned by OwlTing Stablecoin payment volumes have grown to $19.4B year-to-date in 2025. OwlTing aims to capture this market by developing payment infrastructure that processes transactions in seconds for fractions of a cent. View Full Report More For You BNB Slips 2.7% As Traders Focus on Technicals During Crypto Market Drawdown By CD Analytics , Francisco Rodrigues | Edited by Jamie Crawley 54 minutes ago The decline was part of a broader crypto market drop, with traders focusing on technical cues and selling dominating What to know : BNB's price dropped 2.7% to $1,105 after a brief rise following BNB Chain's largest-ever quarterly token burn, which removed 1.44 million BNB from circulation. The decline was part of a broader crypto market drop, with traders focusing on technical cues and selling dominating. Despite the short-term bearish trend, a report from Binance founder's family office YZi Labs framed BNB as a long-term structural asset. Read full story Latest Crypto News Securitize Rolls Out Tokenized Credit Fund with BNY on Ethereum 16 minutes ago Crypto Long & Short: Fast Money, Slow Money 36 minutes ago MegaETH Raises $450M in Oversubscribed Token Sale Backed by Ethereum Founders 41 minutes ago BNB Slips 2.7% As Traders Focus on Technicals During Crypto Market Drawdown 54 minutes ago Michael Saylor's Strategy Drops $18B in Value, but a Rebound May Be Near: 10X Research 1 hour ago Cardano Falls Below Key Support as Institutional Investors Pull Back 1 hour ago Top Stories Michael Saylor's Strategy Drops $18B in Value, but a Rebound May Be Near: 10X Research 1 hour ago MegaETH Raises $450M in Oversubscribed Token Sale Backed by Ethereum Founders 41 minutes ago Nvidia Hits $5T Market Cap as Bitcoin Now Trails U.S. Equities Year to Date 3 hours ago Georgia's ‘Shadow Ruler’ Is Trying to Claw Back a Bitcoin Fortune Worth $1B 3 hours ago Stablecoin Inflows Rise Before Fed Rate Decision: Crypto Daybook Americas 5 hours ago DBS, Goldman Sachs Execute First Over-the-Counter Interbank Crypto Options Trade 8 hours ago