Bitcoin, Ether Brace for $17B Options Expiry Amid Fed Meeting, Tech Company Earnings

Analysis

Price Impact

HighA massive $17 billion options expiry for btc and eth, coupled with a federal reserve meeting and major tech company earnings, is expected to trigger significant short-term volatility in the crypto markets.

Trustworthiness

HighThe analysis is from coindesk, a reputable source, citing specific options data from deribit, including open interest and max pain levels, alongside widely recognized macroeconomic events.

Price Direction

NeutralWhile there's high anticipation for sharp price moves (indicated by out-of-the-money options clustering), the exact direction is uncertain. bitcoin is near its 'max pain' level of $114,000, and ether near $4,110, suggesting potential short-term gravitation towards these points due to market maker hedging. the confluence of events points to increased volatility rather than a clear directional trend.

Time Effect

ShortOptions expiry is imminent (this friday), and the fed meeting and tech earnings are happening this week, suggesting an immediate and short-term market reaction.

Original Article:

Article Content:

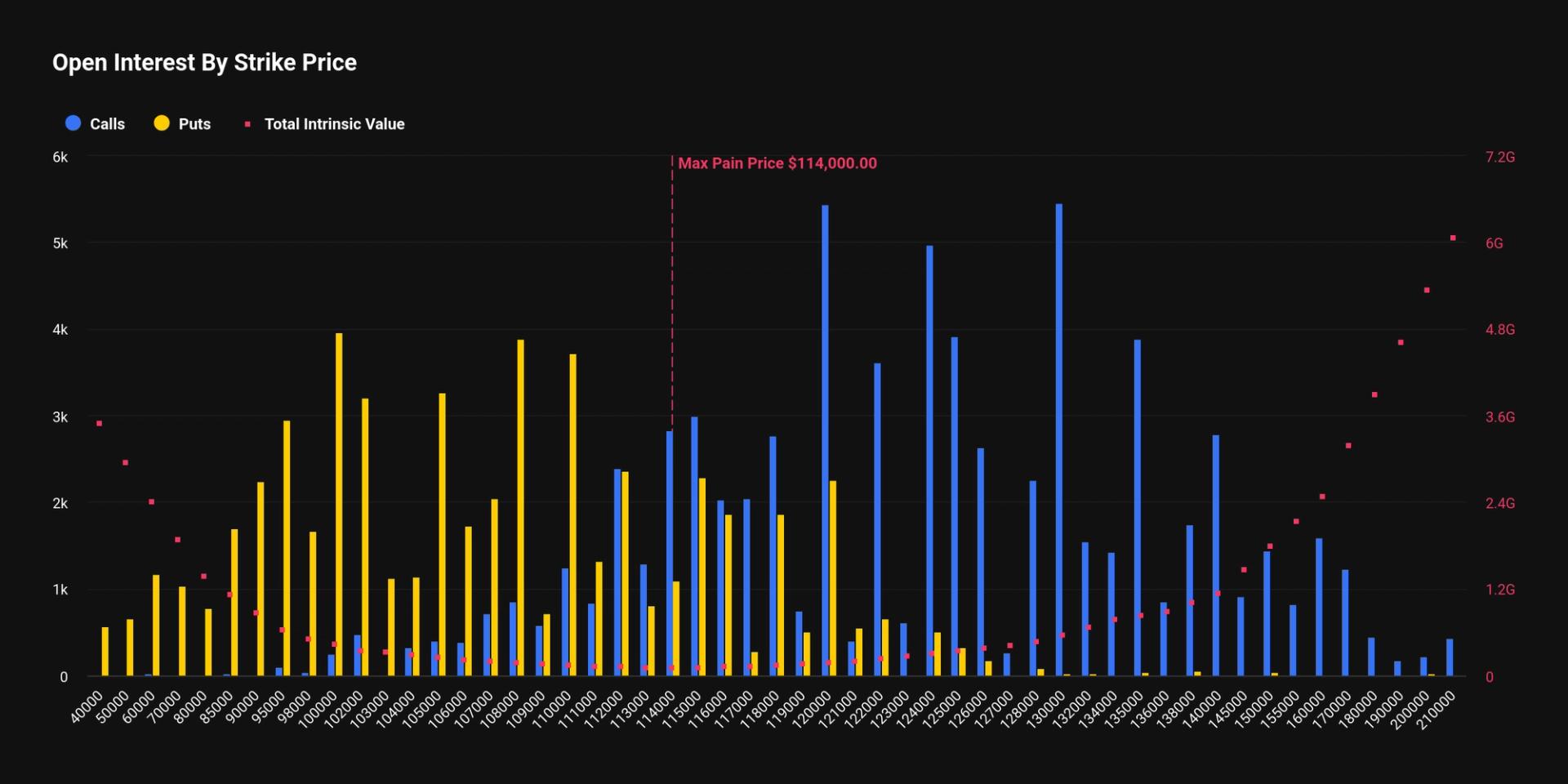

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email Bitcoin, Ether Brace for $17B Options Expiry Amid Fed Meeting, Tech Company Earnings Traders eye potential volatility as bitcoin hovers near max pain around $114,000 and ether nears $4,000. By James Van Straten | Edited by Sheldon Reback Oct 29, 2025, 10:25 a.m. Open Interest (Deribit) What to know : Options expiry for bitcoin hold a notional value of $14.4 billion, while ether options total about $2.6 billion. Heavy clustering of out-of-the-money options shows traders positioning for sharp price moves. The combination of the Fed decision and major tech earnings could amplify short-term volatility across crypto markets. Bitcoin BTC $ 113,092.08 and ether ETH $ 4,004.62 options worth roughly $17 billion are set to expire on Friday on Deribit in one of the largest monthly options expiry of the year. There are 72,716 BTC call option contracts and 54,945 BTC put option contracts due for settlement, representing a combined notional open interest of about $14.4 billion. STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy . With the Federal Reserve meeting today to set U.S. interest rates and major tech company earnings scheduled this week, markets are bracing for a potential spike in volatility. Options are derivative contracts that give investors the right, but not the obligation, to buy or sell an underlying asset at a predetermined price before a specific date. A put option acts as insurance against price declines and a call option provides the right to buy and represents a bullish bet on the underlying asset. At 82.5% of open interest, out-of-the-money (OTM) options dominate traders' holdings, showing a clear preference for speculative positioning. This suggests that while some traders may be using OTM options as a hedge against sharp price moves, the overall positioning reflects an expectation of heightened volatility and significant market swings. Both calls and puts cluster heavily in the OTM region, with significant call open interest around strike prices of $120,000 and $130,000, while puts dominate at $100,000 and $110,000. Open Interest By Expiration (Deribit) With bitcoin trading near $113,000, the market is gravitating toward the max pain level of $114,000. That represents the price at which the greatest number of options contracts — both calls and puts — expire worthless, causing the least financial loss for option writers and the most for options holders. As bitcoin trades near the max pain level, price action sometimes gravitates toward it ahead of expiry due to market makers’ hedging activity, however this is just a theory. Ether options show 375,225 ETH in call open interest and 262,850 ETH in put open interest, representing a notional total of $2.6 billion, with a max pain level at $4,110 compared with a current price of about $4,000. According to Checkonchain , before IBIT launched options in November 2024, Deribit controlled nearly 80% of the global bitcoin options open interest. That share has since declined to 44%, equal to IBIT’s market share . Bitcoin Ether Deribit Options More For You OwlTing: Stablecoin Infrastructure for the Future By CoinDesk Research Oct 16, 2025 Commissioned by OwlTing Stablecoin payment volumes have grown to $19.4B year-to-date in 2025. OwlTing aims to capture this market by developing payment infrastructure that processes transactions in seconds for fractions of a cent. View Full Report More For You DBS, Goldman Sachs Execute First Over-the-Counter Interbank Crypto Options Trade By Sam Reynolds , AI Boost | Edited by Sheldon Reback 2 hours ago DBS said the deal involved trading cash-settled OTC bitcoin and ether options. What to know : DBS and Goldman Sachs said they completed the first-ever over-the-counter cryptocurrency options trade between banks, marking a significant step in institutionalizing digital assets in Asia. The trade involved cash-settled bitcoin and ether options, allowing both banks to hedge exposure tied to crypto-linked products. The transaction highlights the growing demand for digital asset derivatives and the integration of traditional finance practices into the digital asset ecosystem. Read full story Latest Crypto News Deutsche Digital Assets and Safello to List Staked Bittensor ETP on SIX Swiss Exchange 1 hour ago DBS, Goldman Sachs Execute First Over-the-Counter Interbank Crypto Options Trade 2 hours ago World Liberty Financial to Airdrop 8.4M WLFI Tokens to Early USD1 Users 2 hours ago Bitwise Says Its Solana Staking ETF (BSOL) Had a 'Big First Day'; GSOL to List on NYSE 3 hours ago Bitcoin Holds $113K as Liquidity Thins, Traders Turn Defensive Before Fed Week 3 hours ago Ether Holds Above $4,000, Arkham Says Tom Lee's 'BitMine Is Buying the Dip' 4 hours ago Top Stories DBS, Goldman Sachs Execute First Over-the-Counter Interbank Crypto Options Trade 2 hours ago Bitcoin Holds $113K as Liquidity Thins, Traders Turn Defensive Before Fed Week 3 hours ago Asia Morning Briefing: Bitcoin Holds Ground as Traders Sit on Stablecoins Before Fed Decision 8 hours ago Western Union to Launch Stablecoin on Solana With Anchorage Digital 16 hours ago Wealth Managers Scramble to Add Crypto as UAE's Ultra-Rich Demand Digital Assets 18 hours ago Deutsche Digital Assets and Safello to List Staked Bittensor ETP on SIX Swiss Exchange 1 hour ago In this article BTC BTC $ 113,075.26 ◢ 1.14 % ETH ETH $ 4,002.81 ◢ 2.71 %