Dogecoin Breaks Multi-Month Range as $0.21 Resistance Flips to Support

Analysis

Price Impact

HighDogecoin has decisively broken a multi-month consolidation range at $0.2026, flipping it to support. this significant technical breakout is accompanied by surging trading volumes (nearly 10% above weekly averages) and strong institutional interest, indicating a major shift in market sentiment and accumulation.

Trustworthiness

HighThe analysis is from coindesk, a reputable crypto news source, citing cd analytics and a quantitative strategist from bluepool digital. it provides detailed technical analysis including price action, volume, rsi, and macd, lending high credibility.

Price Direction

BullishThe breakout above $0.2026, the subsequent retest and confirmation of this level as support, and the sequence of higher highs and higher lows, all point to a strong bullish continuation. the outperformance against broader markets and institutional accumulation further bolster this outlook. a measured advance towards $0.2130 is anticipated.

Time Effect

LongBreaking a multi-month range and flipping a significant resistance to support implies a shift in the longer-term trend. while short-term consolidation may occur, the fundamental technical structure suggests sustained price appreciation and 'early-cycle momentum building' over a longer horizon.

Original Article:

Article Content:

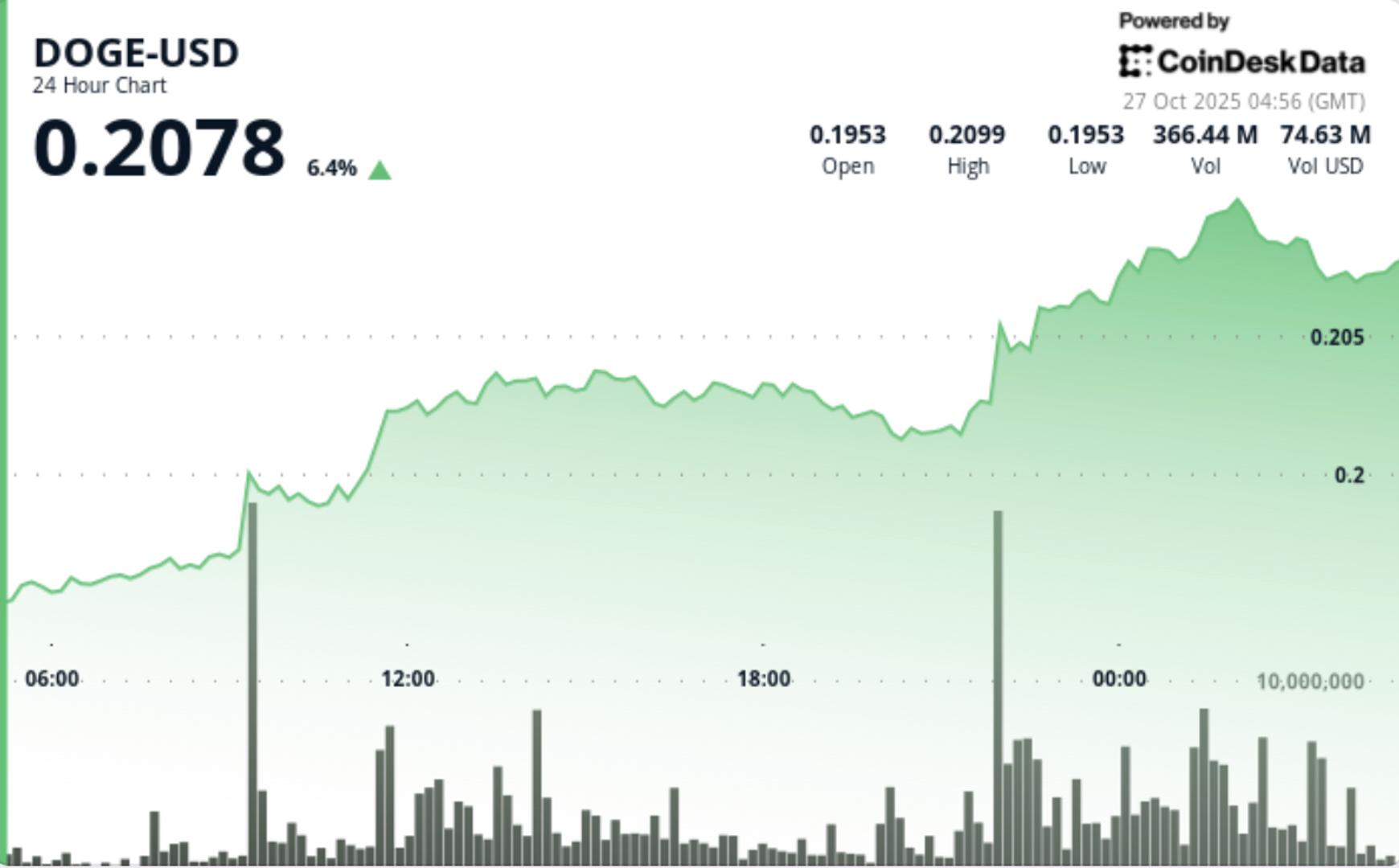

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email Dogecoin Breaks Multi-Month Range as $0.21 Resistance Flips to Support DOGE outperforms broader crypto markets as volume climbs nearly 10% above weekly averages, signaling early accumulation within breakout structure. By Shaurya Malwa , CD Analytics Updated Oct 27, 2025, 5:00 a.m. Published Oct 27, 2025, 5:00 a.m. (CoinDesk Data) What to know : Dogecoin advanced 1.4% to $0.21, breaking above the $0.2026 resistance for the first time since August. Trading volumes surged nearly 10% above weekly averages, indicating strong institutional interest. Analysts suggest DOGE's resilience signals a shift towards higher-beta assets amid broader market consolidation. DOGE outperforms broader crypto markets as volume climbs nearly 10% above weekly averages, signaling early accumulation within breakout structure. News Background Dogecoin advanced 1.4% to $0.21 in Tuesday’s session, marking its first decisive move above the $0.2026 resistance threshold since late August. The meme coin’s price action demonstrated relative strength versus the broader market, outperforming the CD5 index by more than 2%. Trading volumes surged 9.82% above the seven-day average, reflecting sustained institutional participation within the meme-asset segment. STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy . Market analysts said the breakout represents “early-cycle momentum building” following nearly two months of compression in the $0.19–$0.20 corridor. “DOGE’s resilience while Bitcoin and Ethereum consolidate suggests rotation flows are returning to higher-beta assets,” said Rishi Patel, a quantitative strategist at Bluepool Digital. Price Action Summary DOGE climbed steadily from $0.1950 to $0.2072 through the 24-hour window, establishing a sequence of higher highs and higher lows across a $0.0159 intraday range. The key breakout occurred at 22:00 UTC, when volume spiked to 834.5 million tokens —roughly 180% above the 24-hour moving average—and price surged through the pivotal $0.2026 resistance level. Momentum carried into early Wednesday trading, with DOGE briefly touching $0.2087 before encountering mild profit-taking. The retracement held comfortably above $0.2070 support, confirming that former resistance has transitioned into a near-term demand zone. Technical Analysis The technical setup remains constructive. DOGE maintains an ascending trendline from the $0.1949 base, with successful retests of the $0.2060–$0.2070 zone underscoring continued buyer control. RSI readings hover near 58 on the 4-hour chart—consistent with the early stages of an uptrend—while MACD remains positive but narrowing, reflecting short-term consolidation after the breakout burst. Volume analysis shows a healthy distribution pattern rather than capitulation, implying re-accumulation rather than exhaustion. The price structure remains aligned with a bullish continuation phase, though momentum confirmation requires sustained closes above $0.2085. What Traders Should Know DOGE’s break above $0.2026 confirms a technical shift out of its multi-month consolidation range. Institutional flows continue to underpin price stability even as retail participation remains muted. A successful defense of $0.2060–$0.2070 support could pave the way for a measured advance toward $0.2130—the 38.2% Fibonacci retracement level from the May–September decline. Failure to hold current support, however, risks a short-term pullback toward $0.1990. Traders are watching for renewed volume surges above the 800M mark as confirmation that smart money accumulation is still in play. Dogecoin Trading More For You OwlTing: Stablecoin Infrastructure for the Future By CoinDesk Research Oct 16, 2025 Commissioned by OwlTing Stablecoin payment volumes have grown to $19.4B year-to-date in 2025. OwlTing aims to capture this market by developing payment infrastructure that processes transactions in seconds for fractions of a cent. View Full Report More For You XRP’s Clean Technical Break Repositions Bulls for $2.80 Push By Shaurya Malwa 13 minutes ago XRP surged 3% to $2.68 during Sunday’s session, breaking above the critical resistance level at $2.63 on a dramatic volume spike — one of the largest of the month. What to know : XRP surged 3% to $2.68, breaking above the critical resistance level at $2.63 with significant trading volume. Institutional interest and upcoming regulatory developments are driving the current momentum in XRP. Traders are monitoring whether XRP can maintain its support at $2.63 and if volume remains high to support further gains. Read full story Latest Crypto News XRP’s Clean Technical Break Repositions Bulls for $2.80 Push 13 minutes ago Bitcoin Surpasses 50-Day Average, but CoinDesk BTC Trend Indicator Remains Bearish 44 minutes ago Bitcoin Set for Massive Surge as Bank Reserves Near 'Danger Zone,' Says Adam Livingston 1 hour ago Asia Morning Briefing: Bitcoin Holds Above $114K as Whales Absorb Supply and Shorts Rebalance 3 hours ago Bitcoin Rebounds as $319M in Shorts Are Liquidated While Traders Eye U.S.-China Talks 4 hours ago XRP Ledger Validator Sees NFT-to-NFT Trading Potential in Proposed 'Batch' Amendment 13 hours ago Top Stories Asia Morning Briefing: Bitcoin Holds Above $114K as Whales Absorb Supply and Shorts Rebalance 3 hours ago Bitcoin Bid, XRP Retakes 200-Day Average as Fed Rate Cut Looms; 'Mag 7' Earnings, Trump-Xi Summit Eyed 14 hours ago North Korea’s AI-Powered Hackers Are Redefining Crypto Crime Oct 25, 2025 Bitmine’s Tom Lee Sees Crypto Rally Into Year-End, Says S&P 500 Could Climb Another 10% Oct 25, 2025 Tether Eyes Fresh Investments to Push USAT Stablecoin to 100M Americans at December Launch Oct 24, 2025 Bitcoin Treasury Firms Now Valued at Less Than Their BTC Holdings Amid Crumbled Sentiment Oct 25, 2025