XRP’s Clean Technical Break Repositions Bulls for $2.80 Push

Analysis

Price Impact

HighXrp experienced a significant technical breakout above the $2.63 resistance level, supported by a dramatic volume spike and growing institutional interest, positioning it for further gains.

Trustworthiness

HighThe analysis is from coindesk, a reputable crypto news source. it provides detailed technical indicators, specific price levels, and fundamental drivers like institutional interest and regulatory developments.

Price Direction

BullishXrp cleared critical resistance at $2.63, establishing new support with high volume. the breakout, combined with institutional inflows and anticipated regulatory/etf news, suggests a strong upward momentum towards $2.80.

Time Effect

ShortThe analysis focuses on immediate price movements, breakout validation (holding $2.63 support), and short-term targets ($2.70-$2.75, with an ultimate push towards $2.80).

Original Article:

Article Content:

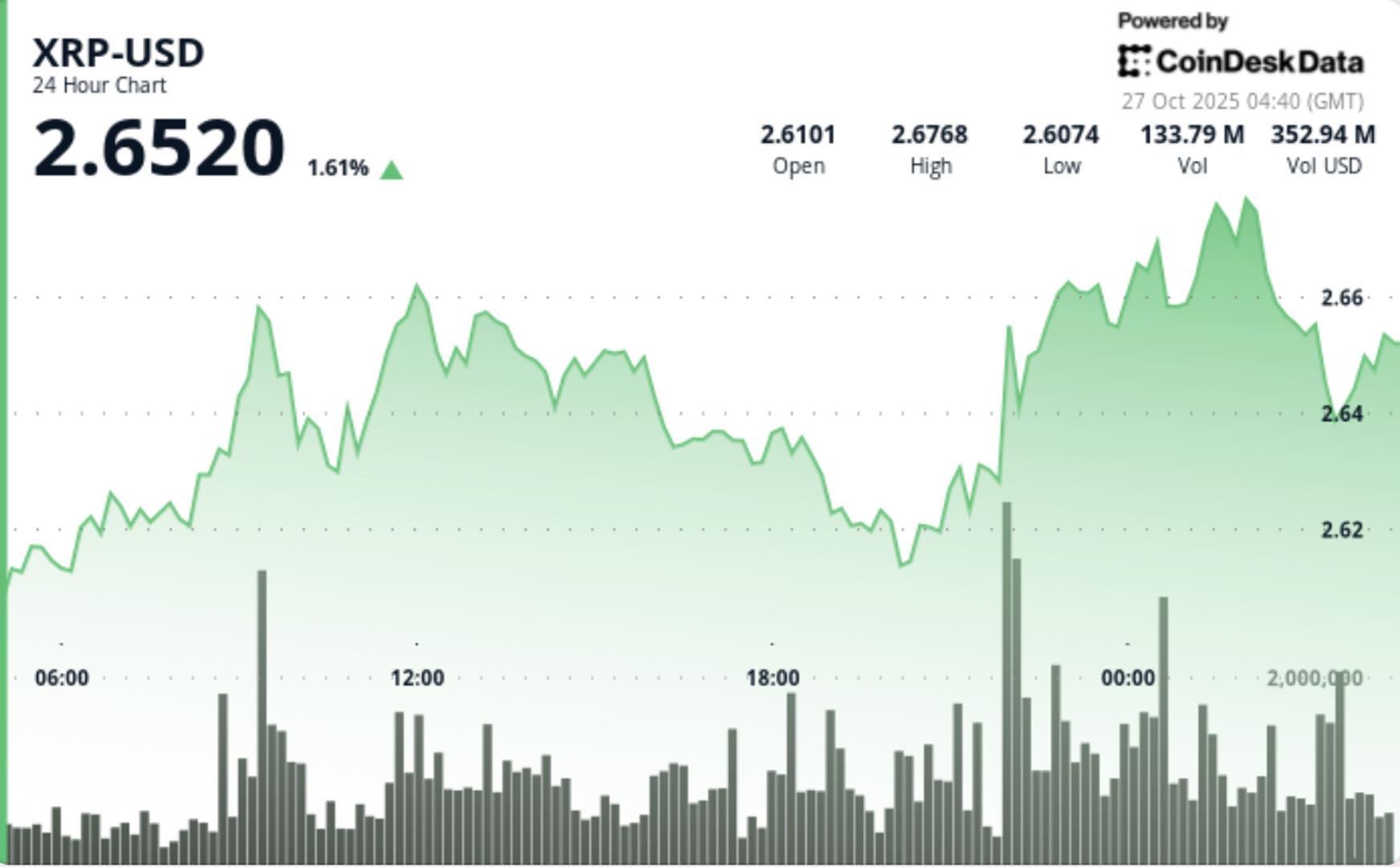

Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email XRP’s Clean Technical Break Repositions Bulls for $2.80 Push XRP surged 3% to $2.68 during Sunday’s session, breaking above the critical resistance level at $2.63 on a dramatic volume spike — one of the largest of the month. By Shaurya Malwa Updated Oct 27, 2025, 4:48 a.m. Published Oct 27, 2025, 4:48 a.m. (CoinDesk Data) What to know : XRP surged 3% to $2.68, breaking above the critical resistance level at $2.63 with significant trading volume. Institutional interest and upcoming regulatory developments are driving the current momentum in XRP. Traders are monitoring whether XRP can maintain its support at $2.63 and if volume remains high to support further gains. XRP climbed from $2.60 to $2.68, clearing the $2.63 barrier and establishing new support between $2.61-$2.63. News Background XRP surged 3% to $2.68 during Sunday’s session, breaking above the critical resistance level at $2.63 on a dramatic volume spike — one of the largest of the month. The breakout aligns with growing institutional interest, backed by recent commentary from fund managers noting “hundreds of millions” flowing into XRP-exposure vehicles. The move also comes ahead of expected regulatory and ETF developments, which many analysts believe could accelerate demand. Price Action Summary XRP climbed from $2.60 to $2.68, clearing the $2.63 barrier and establishing new support between $2.61-$2.63. Trading volume hit approximately 106.5 million units in a single breakout hour — a 147% increase above the prior 24-hour average. The token traded in a tight $0.08 range, illustrating disciplined accumulation rather than erratic speculation. Price action was characterized by higher lows that reinforced the breakout structure, and late-session consolidation near $2.67 suggested buyers were defending gains rather than exiting. Technical Analysis The structure now defines a breakout above a multi-session resistance zone with strong volume confirmation, a textbook signal of institutional accumulation. Support at $2.61-$2.63 is newly anchored, while immediate resistance lies in the $2.70-$2.75 area. Volume patterns confirm the move: large spike at breakout, followed by lower volatility during consolidation, pointing toward absorption. Key momentum indicators (RSI, MACD) remain constructive on daily charts, aligning with broader breakout psychology. What Traders Should Know Traders are now watching two critical behaviours: First, whether XRP can hold the $2.63 support base; a re-test and hold would validate the breakout. Second, if volume remains elevated or picks up again, the breakout has higher-probability extension toward the $2.70-$2.75 zone. On-chain flows and institutional product commentary (e.g., remarks from Teucrium Trading executives about large inflows) support the accumulation narrative. On the risk side, a sustained close below $2.61 would undermine the breakout and could trap price back in its prior consolidation range. Ripple More For You OwlTing: Stablecoin Infrastructure for the Future By CoinDesk Research Oct 16, 2025 Commissioned by OwlTing Stablecoin payment volumes have grown to $19.4B year-to-date in 2025. OwlTing aims to capture this market by developing payment infrastructure that processes transactions in seconds for fractions of a cent. View Full Report More For You Bitcoin Surpasses 50-Day Average, but CoinDesk BTC Trend Indicator Remains Bearish By Omkar Godbole 33 minutes ago BTC looks north as Fed rate cut looms. But one key resistance is yet to be cleared. What to know : BTC moves above key average hurdle as Fed rate cut looms. CoinDesk's BTI continues to signal downtrend. Prices are yet to top the Ichomoku cloud. Read full story Latest Crypto News Bitcoin Surpasses 50-Day Average, but CoinDesk BTC Trend Indicator Remains Bearish 33 minutes ago Bitcoin Set for Massive Surge as Bank Reserves Near 'Danger Zone,' Says Adam Livingston 1 hour ago Asia Morning Briefing: Bitcoin Holds Above $114K as Whales Absorb Supply and Shorts Rebalance 2 hours ago Bitcoin Rebounds as $319M in Shorts Are Liquidated While Traders Eye U.S.-China Talks 3 hours ago XRP Ledger Validator Sees NFT-to-NFT Trading Potential in Proposed 'Batch' Amendment 12 hours ago Bitcoin Bid, XRP Retakes 200-Day Average as Fed Rate Cut Looms; 'Mag 7' Earnings, Trump-Xi Summit Eyed 14 hours ago Top Stories Asia Morning Briefing: Bitcoin Holds Above $114K as Whales Absorb Supply and Shorts Rebalance 2 hours ago Bitcoin Bid, XRP Retakes 200-Day Average as Fed Rate Cut Looms; 'Mag 7' Earnings, Trump-Xi Summit Eyed 14 hours ago North Korea’s AI-Powered Hackers Are Redefining Crypto Crime Oct 25, 2025 Bitmine’s Tom Lee Sees Crypto Rally Into Year-End, Says S&P 500 Could Climb Another 10% Oct 25, 2025 Tether Eyes Fresh Investments to Push USAT Stablecoin to 100M Americans at December Launch Oct 24, 2025 Bitcoin Treasury Firms Now Valued at Less Than Their BTC Holdings Amid Crumbled Sentiment Oct 25, 2025