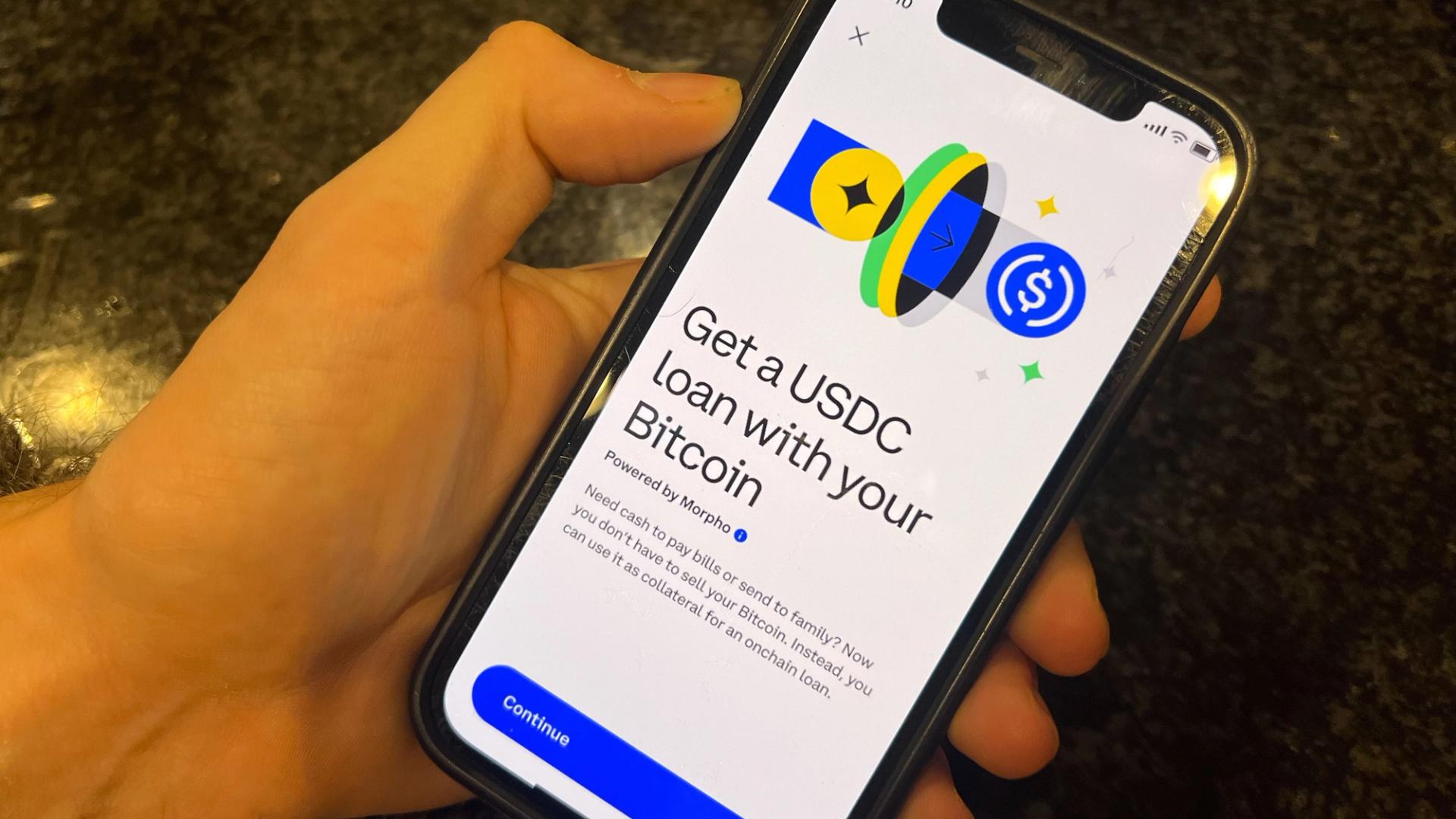

Coinbase Adds USDC Lending With Morpho and Steakhouse Financial

Analysis

Price Impact

MedCoinbase adding usdc lending increases its utility and demand, potentially leading to price appreciation. however, usdc's price is pegged to the us dollar, limiting significant fluctuations.

Trustworthiness

HighCoinbase is a reputable exchange, and morpho is a defi protocol. the move builds coinbase’s first full onchain lending and borrowing ecosystem.

Price Direction

NeutralUsdc is a stablecoin, and while increased utility could slightly increase demand, its price is designed to remain stable around $1.

Time Effect

ShortThe impact on usdc demand and lending rates will be immediate but likely stabilize quickly.

Original Article:

Article Content:

News Back to menu News Markets Finance Tech Policy Focus Prices Back to menu Prices Data Back to menu Data Trade Data Derivatives Order Book Data On-Chain Data API Research & Insights Data Catalogue AI & Machine Learning Indices Back to menu Indices Multi-Asset Indices Reference Rates Strategies and Services API Insights & Announcements Documentation & Governance Research Back to menu Research Events Back to menu Events CoinDesk: Policy & Regulation Consensus Hong Kong Consensus Miami Sponsored Back to menu Sponsored Thought Leadership Press Releases CoinW MEXC Phemex Advertise Stellar Videos Back to menu Videos CoinDesk Daily Shorts Editor's Picks Podcasts Back to menu Podcasts CoinDesk Podcast Network Markets Daily Gen C Unchained with Laura Shin The Mining Pod Newsletters Back to menu Newsletters CoinDesk Headlines Crypto Daybook Americas State of Crypto Crypto Long & Short Crypto for Advisors Webinars Back to menu Webinars English Select Language English en 中文 zh Italiano it Русский ru Filipino fil Nederlands nl Español es Português pt-br 한국어 ko Українська uk Deutsch de Français fr Search / News Prices Data Indices Research Events Sponsored Search / Sign In Sign Up BTC $ 117,811.33 2.23 % ETH $ 4,609.52 3.50 % XRP $ 3.1156 3.88 % USDT $ 1.0003 0.00 % BNB $ 989.81 3.69 % SOL $ 250.39 7.27 % USDC $ 0.9997 0.01 % DOGE $ 0.2839 7.82 % ADA $ 0.9324 7.64 % TRX $ 0.3514 3.60 % HYPE $ 58.73 7.26 % LINK $ 24.52 6.86 % AVAX $ 34.56 15.89 % SUI $ 3.9576 10.75 % USDE $ 1.0011 0.02 % XLM $ 0.4034 5.37 % BCH $ 638.16 7.23 % HBAR $ 0.2479 6.21 % WBT $ 44.08 2.00 % LTC $ 118.32 4.09 % BTC $ 117,811.33 2.23 % ETH $ 4,609.52 3.50 % XRP $ 3.1156 3.88 % USDT $ 1.0003 0.00 % BNB $ 989.81 3.69 % SOL $ 250.39 7.27 % USDC $ 0.9997 0.01 % DOGE $ 0.2839 7.82 % ADA $ 0.9324 7.64 % TRX $ 0.3514 3.60 % HYPE $ 58.73 7.26 % LINK $ 24.52 6.86 % AVAX $ 34.56 15.89 % SUI $ 3.9576 10.75 % USDE $ 1.0011 0.02 % XLM $ 0.4034 5.37 % BCH $ 638.16 7.23 % HBAR $ 0.2479 6.21 % WBT $ 44.08 2.00 % LTC $ 118.32 4.09 % Ad Finance Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email Coinbase Adds USDC Lending With Morpho and Steakhouse Financial The feature lets Coinbase users earn yield on USDC deposits while powering the platform’s crypto-backed loan market. By Ian Allison , AI Boost | Edited by Nikhilesh De Sep 18, 2025, 5:49 p.m. Coinbase adds bitcoin-backed borrowing (Shutterstock) What to know : Coinbase launched USDC lending powered by DeFi protocol Morpho Users earn interest from borrowers, including Coinbase’s crypto-backed loan customers The move builds Coinbase’s first full onchain lending and borrowing ecosystem U.S.-listed cryptocurrency exchange Coinbase (COIN) has rolled out a USDC lending product that allows its customers to earn yield directly from the exchange’s app, deepening its integration with decentralized finance (DeFi) . The feature is powered by Morpho, a protocol that routes deposits through curated “vaults” managed by Steakhouse Financial, according to a blogpost on Thursday STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy . When users deposit USDC, their funds are lent out to borrowers — including those already tapping Coinbase’s crypto-backed loans secured by bitcoin. The interest borrowers pay generates returns for depositors, who can withdraw anytime without lockups. Coinbase said the setup creates a flywheel effect where its lending and borrowing products reinforce each other. The launch follows more than $900 million in loans originated through Coinbase’s crypto-backed loan service. Together, the two offerings form what the company calls its first complete onchain lending and borrowing ecosystem. By outsourcing the backend to Morpho’s smart contracts while keeping the Coinbase interface, the company is betting on what it calls the “DeFi mullet” approach: a familiar fintech user experience at the front, powered by open, decentralized infrastructure in the back. For users, the product offers an easier way into decentralized lending markets without leaving Coinbase’s platform. For Morpho, it underscores the argument that the future of finance will be built on open networks, but accessed through trusted gateways. AI Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards . For more information, see CoinDesk's full AI Policy . More For You Tristan Thompson Taps Somnia to Bring Basketball Fandom On-Chain By Oliver Knight | Edited by Nikhilesh De 1 hour ago The NBA champion is launching an on-chain experience this October that tokenizes player value in real time. What to know : The project will tokenize NBA players, letting fans speculate on rising talent and earn rewards tied to sentiment and performance. Built on Somnia, a new Layer 1 that launched September 2, the platform leans on speed, scalability and billions in early trading volume. Co-founder Hadi Teherany says the app avoids native token dependence, focusing instead on infrastructure, gamification and fan empowerment. Read full story Latest Crypto News Chainlink's LINK Surges 6% on Treasury Purchase, ETF Anticipation 6 minutes ago XLM Technicals Signal Bullish Strength Amid 4% Rally 1 hour ago Tristan Thompson Taps Somnia to Bring Basketball Fandom On-Chain 1 hour ago HBAR Climbs 7% as Strong Volumes Drive Breakout Toward Key Resistance 1 hour ago Crypto Exchange Gemini's Stock Trades Below IPO Price Despite Day’s Gains 1 hour ago RCMP Seizes $56M CAD in Crypto, Shuts Down TradeOgre in Canada’s Largest Digital Asset Bust 1 hour ago Top Stories Nvidia to Invest $5B in Intel and Develop Data Centers, PCs; AI Tokens Climb 4 hours ago Tristan Thompson Taps Somnia to Bring Basketball Fandom On-Chain 1 hour ago DeFi TVL Rebounds to $170B, Erasing Terra-Era Bear Market Losses 4 hours ago ETFs Offering Exposure to XRP, DOGE Debut in U.S. 2 hours ago Strategy Up 7%, Nears 200 Day Simple Moving Average as Bitcoin Rallies 3 hours ago Solmate Joins Solana Treasury Push With $300M Funding From UAE Investors, ARK Invest 3 hours ago About About Us Masthead Careers Blog Investor Relations Contact Contact Us Accessiblility Advertise Sitemap System status News Markets Finance Tech Policy Focus Videos CoinDesk Daily Editors Picks Shorts Spotlight Podcasts CoinDesk Podcast Network Markets Daily Gen C Unchained with Laura Shin The Mining Pod Cryptocurrencies Prices Bitcoin (BTC) Ethereum (ETH) XRP Solana (SOL) Data Trade Data Deriviatives OrderBook Data On-Chain Data API Data Catalogue AI & Machine Learning Indices Mult-Asset Indices Reference Rates Strategies & Services Insights & Announcements Documentation & Governance Events CoinDesk: Policy & Regulation Consensus Hong Kong Consensus Miami Webinars Sponsored Thought Leadership Press Release MEXC Phemex Stellar Research Research Reports Ethics Privacy Terms of Use Cookie Settings Do Not Sell My Info X icon © 2025 CoinDesk, Inc. Disclosure & Polices : CoinDesk is an award-winning media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of editorial policies . CoinDesk has adopted a set of principles aimed at ensuring the integrity, editorial independence and freedom from bias of its publications. CoinDesk is part of Bullish (NYSE:BLSH), an institutionally focused global digital asset platform that provides market infrastructure and information services. Bullish owns and invests in digital asset businesses and digital assets and CoinDesk employees, including journalists, may receive Bullish equity-based compensation.