HBAR Climbs 7% as Strong Volumes Drive Breakout Toward Key Resistance

Analysis

Price Impact

MedThe news reports a 7% price increase in hbar with strong trading volumes, indicating a notable impact.

Trustworthiness

HighCoindesk is a reputable source for crypto news and market analysis.

Price Direction

BullishHbar has shown strong gains, breaking through resistance levels with high trading volumes, suggesting continued upward momentum.

Time Effect

ShortThe breakout occurred recently, and the current analysis focuses on immediate price action. the effect might extend if institutional buying continues.

Original Article:

Article Content:

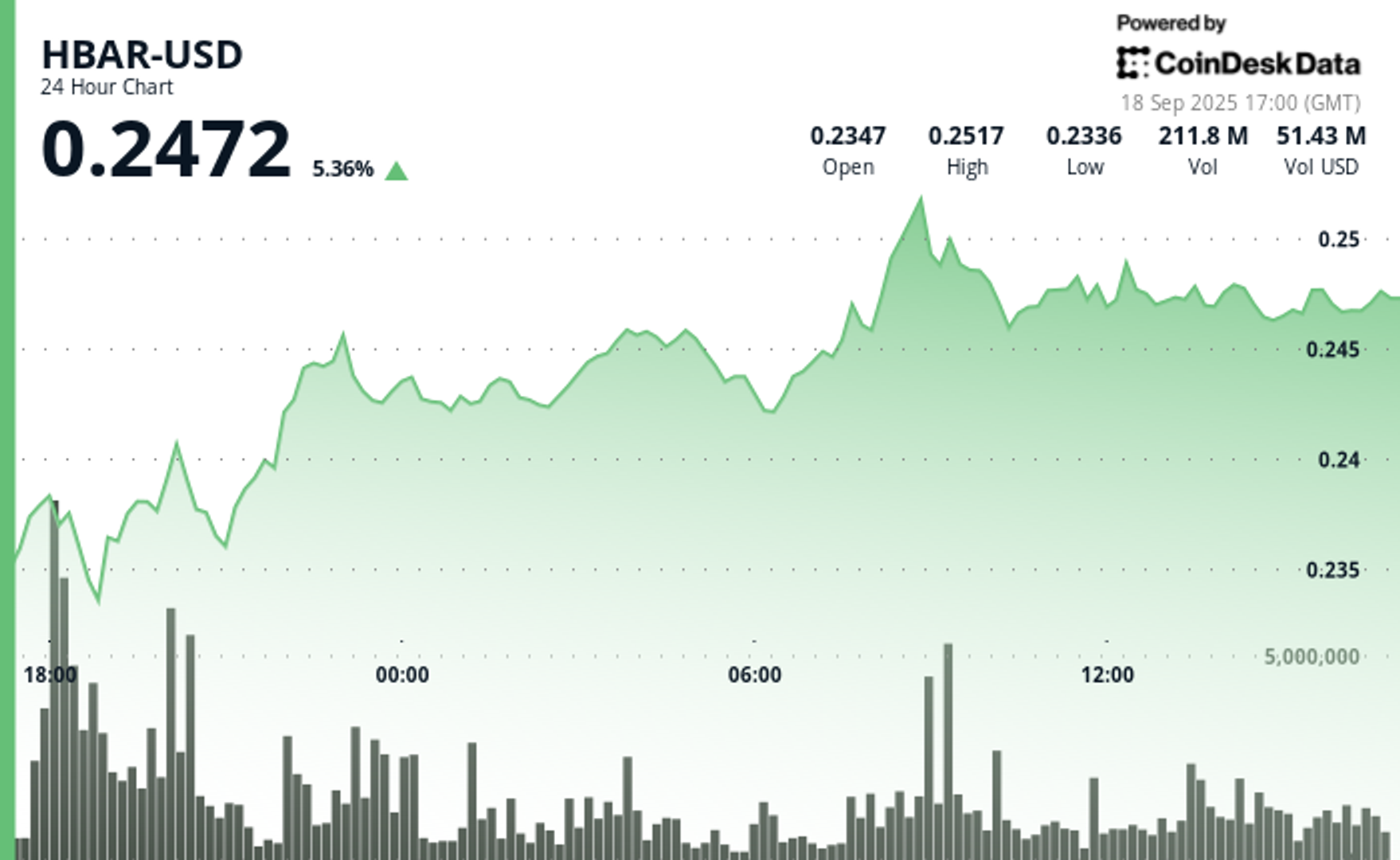

News Back to menu News Markets Finance Tech Policy Focus Prices Back to menu Prices Data Back to menu Data Trade Data Derivatives Order Book Data On-Chain Data API Research & Insights Data Catalogue AI & Machine Learning Indices Back to menu Indices Multi-Asset Indices Reference Rates Strategies and Services API Insights & Announcements Documentation & Governance Research Back to menu Research Events Back to menu Events CoinDesk: Policy & Regulation Consensus Hong Kong Consensus Miami Sponsored Back to menu Sponsored Thought Leadership Press Releases CoinW MEXC Phemex Advertise Stellar Videos Back to menu Videos CoinDesk Daily Shorts Editor's Picks Podcasts Back to menu Podcasts CoinDesk Podcast Network Markets Daily Gen C Unchained with Laura Shin The Mining Pod Newsletters Back to menu Newsletters CoinDesk Headlines Crypto Daybook Americas State of Crypto Crypto Long & Short Crypto for Advisors Webinars Back to menu Webinars English Select Language English en Français fr Español es Русский ru Português pt-br Italiano it 中文 zh Nederlands nl Filipino fil Українська uk Deutsch de 한국어 ko Search / News Prices Data Indices Research Events Sponsored Search / Sign In Sign Up BTC $ 117,680.60 1.55 % ETH $ 4,606.37 2.65 % XRP $ 3.1101 1.76 % USDT $ 1.0004 0.01 % BNB $ 992.56 3.94 % SOL $ 251.82 6.45 % USDC $ 0.9997 0.01 % DOGE $ 0.2843 5.93 % ADA $ 0.9284 5.42 % TRX $ 0.3504 2.59 % HYPE $ 58.16 5.12 % LINK $ 24.45 5.17 % AVAX $ 33.73 12.13 % SUI $ 3.9491 9.48 % USDE $ 1.0013 0.02 % BCH $ 639.10 7.10 % XLM $ 0.4011 3.25 % HBAR $ 0.2476 4.05 % WBT $ 44.05 1.30 % LTC $ 117.88 2.43 % BTC $ 117,680.60 1.55 % ETH $ 4,606.37 2.65 % XRP $ 3.1101 1.76 % USDT $ 1.0004 0.01 % BNB $ 992.56 3.94 % SOL $ 251.82 6.45 % USDC $ 0.9997 0.01 % DOGE $ 0.2843 5.93 % ADA $ 0.9284 5.42 % TRX $ 0.3504 2.59 % HYPE $ 58.16 5.12 % LINK $ 24.45 5.17 % AVAX $ 33.73 12.13 % SUI $ 3.9491 9.48 % USDE $ 1.0013 0.02 % BCH $ 639.10 7.10 % XLM $ 0.4011 3.25 % HBAR $ 0.2476 4.05 % WBT $ 44.05 1.30 % LTC $ 117.88 2.43 % Ad Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email HBAR Climbs 7% as Strong Volumes Drive Breakout Toward Key Resistance Hedera’s native token surged on high trading activity, breaking through multiple resistance levels and holding gains near $0.25. By CD Analytics , Oliver Knight Updated Sep 18, 2025, 5:09 p.m. Published Sep 18, 2025, 5:09 p.m. "HBAR surges 7% driven by institutional buying amid escalating geopolitical tensions and bullish market momentum." What to know : HBAR gained 7% over 24 hours, rising from $0.24 to $0.25 on volumes nearly double the daily average. The token saw a breakout during the 07:00–09:00 trading window, with institutional buying fueling momentum. HBAR held support at $0.25 into the session close, maintaining higher lows and positioning for continued gains. HBAR posted a strong 7% gain over the past 24 hours, climbing from $0.24 to $0.25 as trading volumes surged well above the daily average. The move was supported by heavy accumulation early in the session, where HBAR established a firm base around $0.23 before steadily advancing toward key resistance levels. Momentum accelerated during the morning window between 07:00 and 09:00, with volumes peaking at 119 million tokens traded — nearly double the 24-hour average of 67.5 million. This breakout through multiple resistance zones suggested heightened institutional activity and reinforced the bullish case for further price discovery. STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy . HBAR ultimately tested resistance near $0.25 in late trading, where selling pressure began to weigh. Despite this, the token maintained support at the same level during the final hour of the session, signaling resilience and sustained investor interest. With elevated volumes and consistent buy-side pressure, HBAR appears positioned for continued upside. HBAR/USD (TradingView) Technical Indicators Signal Sustained Strength HBAR exhibited robust bullish momentum throughout the 23-hour period from 17 September 17:00 to 18 September 16:00, advancing from $0.24 to $0.25 with an overall range of $0.02 representing 7% volatility. The cryptocurrency featured a notable surge at 08:00 achieving a $0.25 peak before consolidating around the $0.25 resistance threshold. HBAR maintained its robust bullish momentum during the final 60 minutes from 18 September 15:05 to 16:04, establishing a defined ascending channel between $0.25 support and $0.25 resistance with multiple successful breakout attempts. The cryptocurrency demonstrated pronounced institutional buying interest with significant volume spikes exceeding 2.50 million during critical resistance breaches at 15:33 and 15:54. HBAR preserved consistent higher lows throughout the session, confirming the continuation of the established uptrend and positioning HBAR favourably for further gains beyond the $0.25 resistance level. Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards . For more information, see CoinDesk's full AI Policy . AI Market Insights More For You XLM Technicals Signal Bullish Strength Amid 4% Rally By CD Analytics , Oliver Knight 7 minutes ago Stellar’s XLM climbed nearly 4% in the past 24 hours, with surging volumes and repeated resistance tests at $0.40 pointing to strong institutional buying momentum. What to know : XLM traded between $0.38 and $0.40, with volumes at key price levels outpacing the 24-hour average. A late-session breakout saw volume spike to 7.5 million, nearly 24 times the typical hourly benchmark. Consistent support at $0.40 suggests accumulation by larger players and potential for continued upside. Read full story Latest Crypto News XLM Technicals Signal Bullish Strength Amid 4% Rally 7 minutes ago Tristan Thompson Taps Somnia to Bring Basketball Fandom On-Chain 22 minutes ago Crypto Exchange Gemini's Stock Trades Below IPO Price Despite Day’s Gains 35 minutes ago RCMP Seizes $56M CAD in Crypto, Shuts Down TradeOgre in Canada’s Largest Digital Asset Bust 49 minutes ago ETFs Offering Exposure to XRP, DOGE Debut in U.S. 1 hour ago Plasma to Launch Mainnet Beta Blockchain for Stablecoins Next Week 1 hour ago Top Stories Nvidia to Invest $5B in Intel and Develop Data Centers, PCs; AI Tokens Climb 3 hours ago DeFi TVL Rebounds to $170B, Erasing Terra-Era Bear Market Losses 3 hours ago ETFs Offering Exposure to XRP, DOGE Debut in U.S. 1 hour ago Solmate Joins Solana Treasury Push With $300M Funding From UAE Investors, ARK Invest 2 hours ago Bullish Shares Jump as Citi, Canaccord Praise IPO Debut and BitLicense Win 3 hours ago Tether, Tokenization Pioneers Unveil Startup Focused on GENIUS-Aligned Digital Dollars 7 hours ago About About Us Masthead Careers Blog Investor Relations Contact Contact Us Accessiblility Advertise Sitemap System status News Markets Finance Tech Policy Focus Videos CoinDesk Daily Editors Picks Shorts Spotlight Podcasts CoinDesk Podcast Network Markets Daily Gen C Unchained with Laura Shin The Mining Pod Cryptocurrencies Prices Bitcoin (BTC) Ethereum (ETH) XRP Solana (SOL) Data Trade Data Deriviatives OrderBook Data On-Chain Data API Data Catalogue AI & Machine Learning Indices Mult-Asset Indices Reference Rates Strategies & Services Insights & Announcements Documentation & Governance Events CoinDesk: Policy & Regulation Consensus Hong Kong Consensus Miami Webinars Sponsored Thought Leadership Press Release MEXC Phemex Stellar Research Research Reports Ethics Privacy Terms of Use Cookie Settings Do Not Sell My Info X icon © 2025 CoinDesk, Inc. Disclosure & Polices : CoinDesk is an award-winning media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of editorial policies . CoinDesk has adopted a set of principles aimed at ensuring the integrity, editorial independence and freedom from bias of its publications. CoinDesk is part of Bullish (NYSE:BLSH), an institutionally focused global digital asset platform that provides market infrastructure and information services. Bullish owns and invests in digital asset businesses and digital assets and CoinDesk employees, including journalists, may receive Bullish equity-based compensation.