Institutional Bets Drive HBAR Higher Amid ETF Hopes

Analysis

Price Impact

MedNews of potential hbar etf filings and grayscale considering an hbar trust is driving institutional interest and trading volume.

Trustworthiness

MedThe news comes from coindesk. while the etf filings are real, sec approval is not guaranteed, and dtcc listings are preliminary.

Price Direction

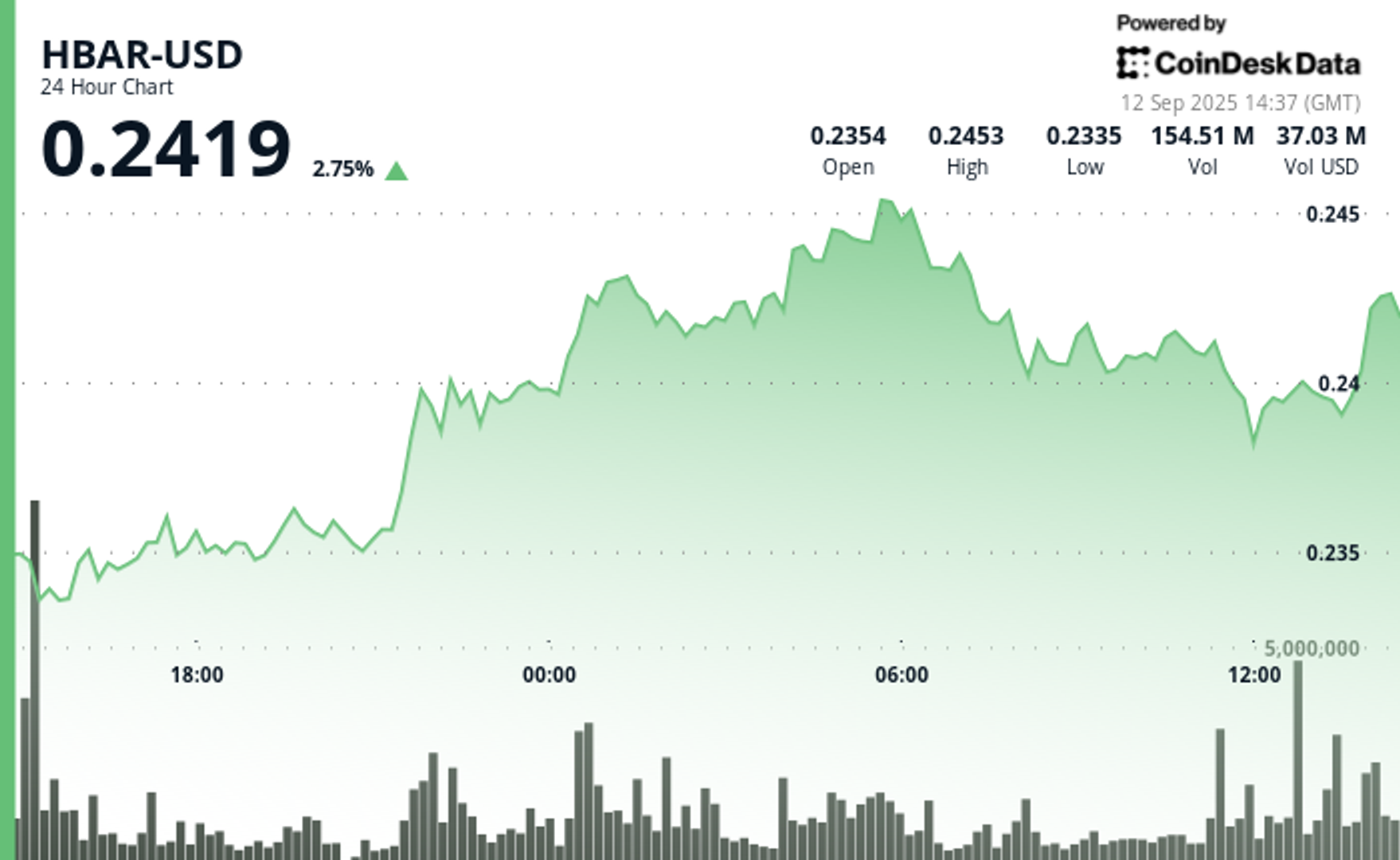

BullishThe increase in trading volume and institutional interest is pushing the price higher, although resistance remains at $0.245.

Time Effect

ShortThe price is reacting to immediate etf speculation. the long-term effect depends on regulatory approval.

Original Article:

Article Content:

News Back to menu News Markets Finance Tech Policy Focus Prices Back to menu Prices Data Back to menu Data Trade Data Derivatives Order Book Data On-Chain Data API Research & Insights Data Catalogue AI & Machine Learning Indices Back to menu Indices Multi-Asset Indices Reference Rates Strategies and Services API Insights & Announcements Documentation & Governance Research Back to menu Research Events Back to menu Events CoinDesk: Policy & Regulation Consensus Hong Kong Consensus Miami Sponsored Back to menu Sponsored Thought Leadership Press Releases CoinW MEXC Phemex Advertise Stellar Videos Back to menu Videos CoinDesk Daily Shorts Editor's Picks Podcasts Back to menu Podcasts CoinDesk Podcast Network Markets Daily Gen C Unchained with Laura Shin The Mining Pod Newsletters Back to menu Newsletters CoinDesk Headlines Crypto Daybook Americas State of Crypto Crypto Long & Short Crypto for Advisors Webinars Back to menu Webinars English Select Language English en Español es Filipino fil Français fr Italiano it Português pt-br Русский ru Українська uk Deutsch de Nederlands nl 한국어 ko 中文 zh Search / News Prices Data Indices Research Events Sponsored Search / Sign In Sign Up BTC $ 115,070.43 0.75 % ETH $ 4,535.50 2.73 % XRP $ 3.0222 0.90 % USDT $ 1.0001 0.00 % SOL $ 239.04 5.34 % BNB $ 907.05 1.53 % USDC $ 0.9996 0.01 % DOGE $ 0.2638 6.81 % TRX $ 0.3483 0.95 % ADA $ 0.8887 1.35 % HYPE $ 55.61 1.61 % LINK $ 24.41 3.77 % USDE $ 1.0009 0.00 % SUI $ 3.6233 0.93 % XLM $ 0.3916 1.40 % AVAX $ 28.57 1.28 % BCH $ 588.74 0.09 % HBAR $ 0.2407 3.07 % WBT $ 43.48 0.83 % LTC $ 116.14 1.89 % BTC $ 115,070.43 0.75 % ETH $ 4,535.50 2.73 % XRP $ 3.0222 0.90 % USDT $ 1.0001 0.00 % SOL $ 239.04 5.34 % BNB $ 907.05 1.53 % USDC $ 0.9996 0.01 % DOGE $ 0.2638 6.81 % TRX $ 0.3483 0.95 % ADA $ 0.8887 1.35 % HYPE $ 55.61 1.61 % LINK $ 24.41 3.77 % USDE $ 1.0009 0.00 % SUI $ 3.6233 0.93 % XLM $ 0.3916 1.40 % AVAX $ 28.57 1.28 % BCH $ 588.74 0.09 % HBAR $ 0.2407 3.07 % WBT $ 43.48 0.83 % LTC $ 116.14 1.89 % Ad Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email Institutional Bets Drive HBAR Higher Amid ETF Hopes Hedera’s token sees heightened Wall Street activity as trust and ETF filings surface, though regulatory hurdles remain. By CD Analytics , Oliver Knight Sep 12, 2025, 2:44 p.m. "HBAR gains 4% amid ETF speculation and institutional trading, consolidating support at $0.24 despite profit-taking near $0.245 resistance." What to know : HBAR ETF buzz: Grayscale flagged plans for a Hedera trust while the DTCC listed a Canary HBAR ETF under ticker HBR. Institutional flows: Resistance at $0.245 capped gains, with $0.240 holding as a critical support amid heavy trading volumes. Regulatory roadblocks: Analysts warn DTCC listings are preliminary, with SEC approval still required before any ETF launch. Hedera’s native token HBAR posted modest gains during the September 11–12 trading window, climbing from $0.237 to as high as $0.245 before closing at $0.240. The move reflected a surge in institutional participation, with market activity closely tied to fresh developments around potential exchange-traded products. Corporate momentum built after Grayscale Investments revealed plans for a potential HBAR trust and the Depository Trust and Clearing Corporation (DTCC) added a Canary HBAR ETF filing to its regulatory database. The listing, under the proposed ticker HBR, accompanied similar submissions for Solana and XRP, underscoring growing Wall Street appetite for digital assets beyond Bitcoin. STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy . Traders reacted sharply to the news. Technical resistance at $0.245 triggered profit-taking, while $0.240 emerged as a key institutional support level, reinforced by late-session volume spikes that topped 17 million tokens. Analysts say the speculation could set up a test of the $0.25 psychological threshold if momentum continues. Still, industry observers caution that DTCC inclusions represent only preliminary steps, not SEC approval. Regulators remain focused on addressing market manipulation risks and investor protection standards for non-Bitcoin crypto assets, leaving the timeline for any HBAR-based ETF uncertain. For now, the filings have placed Hedera firmly on Wall Street’s radar, driving institutional attention even amid regulatory fog. HBAR/USD (TradingView) Market Data Reveals Institutional Trading Patterns Intraday trading established a $0.012 range representing 4.24% volatility between the session high of $0.2456 and low of $0.2335. Primary upward momentum occurred during the 21:00-05:00 trading window as HBAR advanced from $0.235 to peak levels near $0.245. Volume activity averaged 54.7 million during key breakout periods, exceeding the 24-hour average of 50.1 million and indicating institutional participation. The $0.240 price level demonstrated strong institutional support with high-volume defensive trading throughout the session. Selling pressure intensified near $0.245 on elevated volume, suggesting coordinated profit-taking by institutional holders. Late-session volume surge of 17.08 million at 11:32 triggered systematic selling and price consolidation around support levels. Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards . For more information, see CoinDesk's full AI Policy . AI Market Insights More For You XLM Holds Ground Amid Market Volatility as Payment-Sector Rivalry Heats Up By CD Analytics , Oliver Knight 51 minutes ago New challenger Remittix raises $25.2M with aggressive referral program while technical forecasts project XLM’s potential surge toward $1.96. What to know : Price action: XLM swung between $0.384 and $0.400 over 24 hours before closing at $0.393, with selling pressure emerging late in the session. Sector competition: Payments challenger Remittix raised $25.2M and launched a 15% USDT referral incentive, targeting XRP and XLM’s market dominance. Technical outlook: Elliott Wave analysis points to a possible 400% rally for XLM, while speculation grows over Ripple-Stellar collaboration on cryptographic infrastructure. Read full story Latest Crypto News XLM Holds Ground Amid Market Volatility as Payment-Sector Rivalry Heats Up 51 minutes ago Polymarket Connects to Chainlink to Cut Tampering Risks in Price Bets 1 hour ago Father of Crypto Bills, French Hill, Says Market Structure Effort Should Tweak GENIUS 1 hour ago Traders Load Up on Nine-Figure Bullish Bitcoin Bets, Raising Liquidation Risks 1 hour ago Solana Surges as Galaxy Scoops Up Over $700M Tokens From Exchanges 2 hours ago CoinDesk 20 Performance Update: Solana (SOL) Jumps 5.5% as Index Moves Higher 2 hours ago Top Stories Traders Load Up on Nine-Figure Bullish Bitcoin Bets, Raising Liquidation Risks 1 hour ago Father of Crypto Bills, French Hill, Says Market Structure Effort Should Tweak GENIUS 1 hour ago Solana Surges as Galaxy Scoops Up Over $700M Tokens From Exchanges 2 hours ago CleanCore Solutions' DOGE Holdings Top 500M; Shares Rise 13% 2 hours ago Get Ready for Alt Season as Traders Eye Fed Cuts: Crypto Daybook Americas 4 hours ago Winklevoss-Backed Gemini Prices IPO at $28/Share, Values Crypto Exchange at More Than $3B 3 hours ago About About Us Masthead Careers CoinDesk News Crypto API Documentation Blog Contact Contact Us Accessibility Advertise Sitemap System Status Disclosure & Polices CoinDesk is an award-winning media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of editorial policies . CoinDesk has adopted a set of principles aimed at ensuring the integrity, editorial independence and freedom from bias of its publications. CoinDesk is part of Bullish (NYSE:BLSH), an institutionally focused global digital asset platform that provides market infrastructure and information services. Bullish owns and invests in digital asset businesses and digital assets and CoinDesk employees, including journalists, may receive Bullish equity-based compensation. Ethics Privacy Terms of Use Cookie Settings Do Not Sell My Info © 2025 CoinDesk, Inc. X icon