Traders Load Up on Nine-Figure Bullish Bitcoin Bets, Raising Liquidation Risks

Analysis

Price Impact

HighLarge leveraged positions can cause significant price swings due to liquidations.

Trustworthiness

HighNews from coindesk is generally reliable.

Price Direction

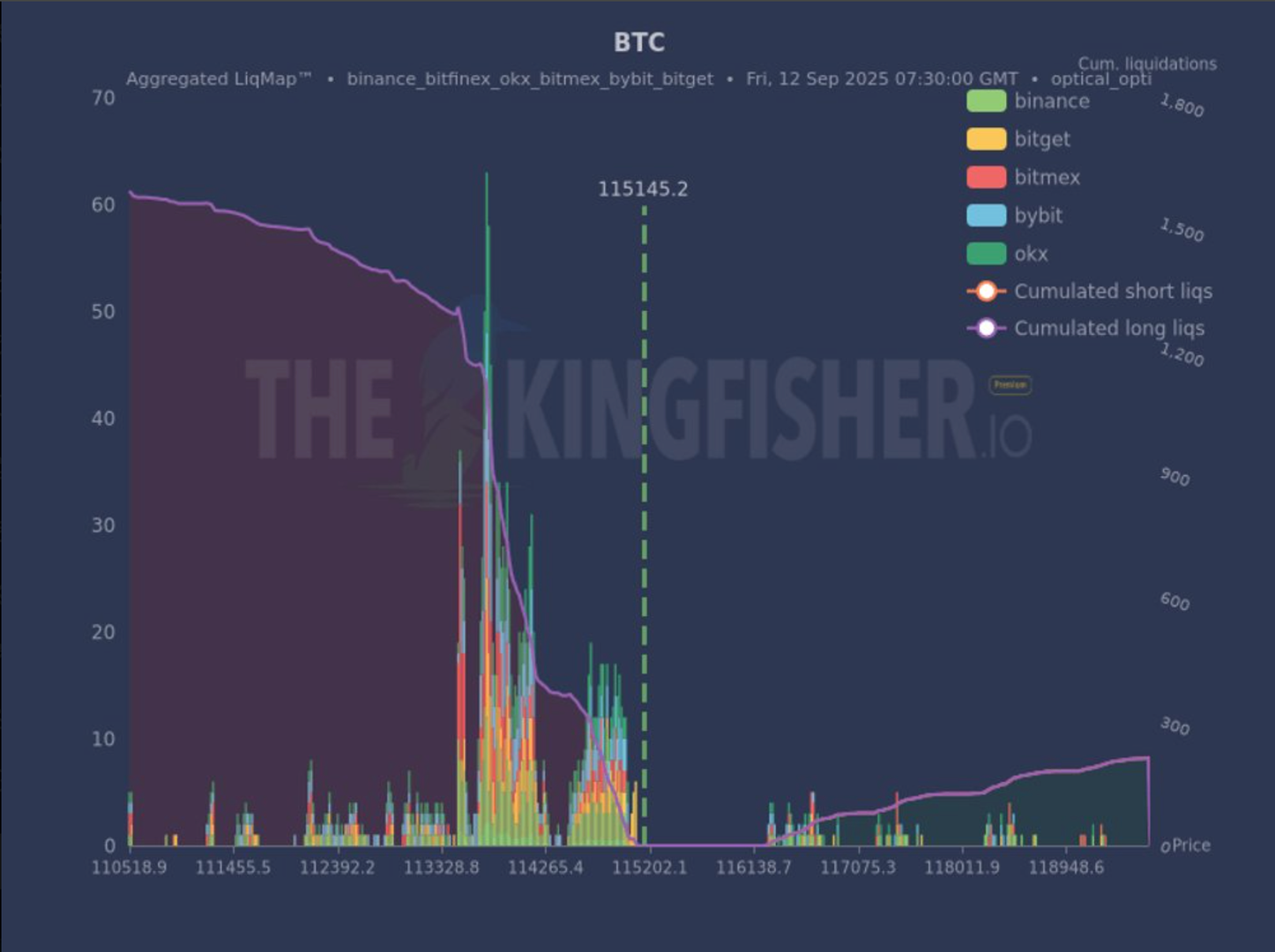

BearishThe concentration of liquidation levels below the current price suggests potential for a downside cascade if those levels are triggered.

Time Effect

ShortLiquidations typically cause immediate price reactions.

Original Article:

Article Content:

News Back to menu News Markets Finance Tech Policy Focus Prices Back to menu Prices Data Back to menu Data Trade Data Derivatives Order Book Data On-Chain Data API Research & Insights Data Catalogue AI & Machine Learning Indices Back to menu Indices Multi-Asset Indices Reference Rates Strategies and Services API Insights & Announcements Documentation & Governance Research Back to menu Research Events Back to menu Events CoinDesk: Policy & Regulation Consensus Hong Kong Consensus Miami Sponsored Back to menu Sponsored Thought Leadership Press Releases CoinW MEXC Phemex Advertise Stellar Videos Back to menu Videos CoinDesk Daily Shorts Editor's Picks Podcasts Back to menu Podcasts CoinDesk Podcast Network Markets Daily Gen C Unchained with Laura Shin The Mining Pod Newsletters Back to menu Newsletters CoinDesk Headlines Crypto Daybook Americas State of Crypto Crypto Long & Short Crypto for Advisors Webinars Back to menu Webinars English Select Language English en Français fr Italiano it Nederlands nl Українська uk Português pt-br Español es 中文 zh Русский ru 한국어 ko Filipino fil Deutsch de Search / News Prices Data Indices Research Events Sponsored Search / Sign In Sign Up BTC $ 115,181.14 0.30 % ETH $ 4,537.54 1.81 % XRP $ 3.0439 0.83 % USDT $ 1.0001 0.01 % SOL $ 239.23 4.53 % BNB $ 909.23 0.79 % USDC $ 0.9996 0.00 % DOGE $ 0.2626 4.33 % TRX $ 0.3479 0.56 % ADA $ 0.8882 0.31 % LINK $ 24.41 2.15 % HYPE $ 56.43 1.90 % USDE $ 1.0010 0.02 % SUI $ 3.6278 0.37 % XLM $ 0.3929 0.74 % AVAX $ 28.49 2.06 % BCH $ 590.39 1.02 % HBAR $ 0.2399 1.24 % WBT $ 43.51 0.41 % LEO $ 9.5679 0.25 % BTC $ 115,181.14 0.30 % ETH $ 4,537.54 1.81 % XRP $ 3.0439 0.83 % USDT $ 1.0001 0.01 % SOL $ 239.23 4.53 % BNB $ 909.23 0.79 % USDC $ 0.9996 0.00 % DOGE $ 0.2626 4.33 % TRX $ 0.3479 0.56 % ADA $ 0.8882 0.31 % LINK $ 24.41 2.15 % HYPE $ 56.43 1.90 % USDE $ 1.0010 0.02 % SUI $ 3.6278 0.37 % XLM $ 0.3929 0.74 % AVAX $ 28.49 2.06 % BCH $ 590.39 1.02 % HBAR $ 0.2399 1.24 % WBT $ 43.51 0.41 % LEO $ 9.5679 0.25 % Ad Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email Traders Load Up on Nine-Figure Bullish Bitcoin Bets, Raising Liquidation Risks Heavy leverage in bitcoin derivatives has set up the market for potential downside cascades, with pockets of vulnerability looming if prices break lower. By Oliver Knight | Edited by Stephen Alpher Sep 12, 2025, 1:45 p.m. Bitcoin liquidation chart (thekingisher.io) What to know : Traders are taking on nine-figure leveraged bullish bitcoin positions, exposing the market to sharp downside risks if prices reverse. Data from The Kingfisher shows a cluster of liquidation levels between $113,300 and $114,500 that could spark a cascade back to $110,000 support. Traders are using leverage in an attempt to lift bitcoin BTC $ 114,979.25 back to record highs, creating a high-risk environment that could result in a derivatives unwind to the downside if price begins to shift the other way. Market analyst Skew warned one trader intent on opening a nine-figure long position to "maybe wait for spot to carry the buying so it doesn't create toxic flows." STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy . $BTC To the random 9 figure whale apeing into longs maybe wait for spot to carry the buying so it doesn't create toxic flows pic.twitter.com/GOi1GZazl0 — Skew Δ (@52kskew) September 12, 2025 Bears are also adding leverage, with a separate trader currently dealing with a $7.5 million unrealized loss after shorting BTC to the tune of $234 million with an entry at $111,386. That trader added $10 million worth of stablecoins to maintain their position, with the liquidation currently standing at $121,510. But the major liquidation risk is present to the downside, with data from The Kingfisher showing a large pocket of derivatives will be liquidated between $113,300 and $114,500, which could potentially prompt a liquidation cascade back to the $110,000 level of support. "This chart shows where traders are over-leveraged," wrote The Kingfisher . "It's a pain map. Price tends to get sucked into those zones to clear out positions. Use this data so you don't end up on the wrong side of a big move." Bitcoin is currently trading quietly around $115,000 having entered a period of low volatility, failing to break out of its current range for more than two months. Bitcoin Derivatives Cryptocurrency Derivatives market analysis More For You Solana Surges as Galaxy Scoops Up Over $700M Tokens From Exchanges By Krisztian Sandor | Edited by Stephen Alpher 33 minutes ago The maneuver could be linked to digital asset treasury firm Forward Industries, which raised $1.65 billion to accumulate SOL with Galaxy's backing. What to know : Solana's price surged to its highest since January, with a 5% increase over the past 24 hours and a 17% gain for the week. Galaxy Digital withdrew $724 million worth of SOL tokens from exchanges, possibly linked to Forward Industries' $1.65 billion treasury strategy. Anticipated demand from treasury companies and potential SOL ETFs could further boost Solana's market performance, Bitwise's CIO said. Read full story Latest Crypto News Solana Surges as Galaxy Scoops Up Over $700M Tokens From Exchanges 33 minutes ago CoinDesk 20 Performance Update: Solana (SOL) Jumps 5.5% as Index Moves Higher 38 minutes ago CleanCore Solutions' DOGE Holdings Top 500M; Shares Rise 13% 43 minutes ago In the AI Economy, Universal Basic Income Can’t Wait 56 minutes ago Crypto Markets Today: Bitcoin Pulls Back, PENGU Open Interest Surges 1 hour ago Winklevoss-Backed Gemini Prices IPO at $28/Share, Values Crypto Exchange at More Than $3B 1 hour ago Top Stories Solana Surges as Galaxy Scoops Up Over $700M Tokens From Exchanges 33 minutes ago CleanCore Solutions' DOGE Holdings Top 500M; Shares Rise 13% 43 minutes ago Get Ready for Alt Season as Traders Eye Fed Cuts: Crypto Daybook Americas 2 hours ago Crypto Pundits Retain Bullish Bitcoin Outlook as Fed Rate Cut Hopes Clash With Stagflation Fears 9 hours ago Winklevoss-Backed Gemini Prices IPO at $28/Share, Values Crypto Exchange at More Than $3B 1 hour ago Here Are the 3 Things That Could Spoil Bitcoin's Rally Towards $120K 5 hours ago In this article BTC BTC $ 114,979.25 ◢ 0.30 % About About Us Masthead Careers CoinDesk News Crypto API Documentation Blog Contact Contact Us Accessibility Advertise Sitemap System Status Disclosure & Polices CoinDesk is an award-winning media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of editorial policies . CoinDesk has adopted a set of principles aimed at ensuring the integrity, editorial independence and freedom from bias of its publications. CoinDesk is part of Bullish (NYSE:BLSH), an institutionally focused global digital asset platform that provides market infrastructure and information services. Bullish owns and invests in digital asset businesses and digital assets and CoinDesk employees, including journalists, may receive Bullish equity-based compensation. Ethics Privacy Terms of Use Cookie Settings Do Not Sell My Info © 2025 CoinDesk, Inc. X icon