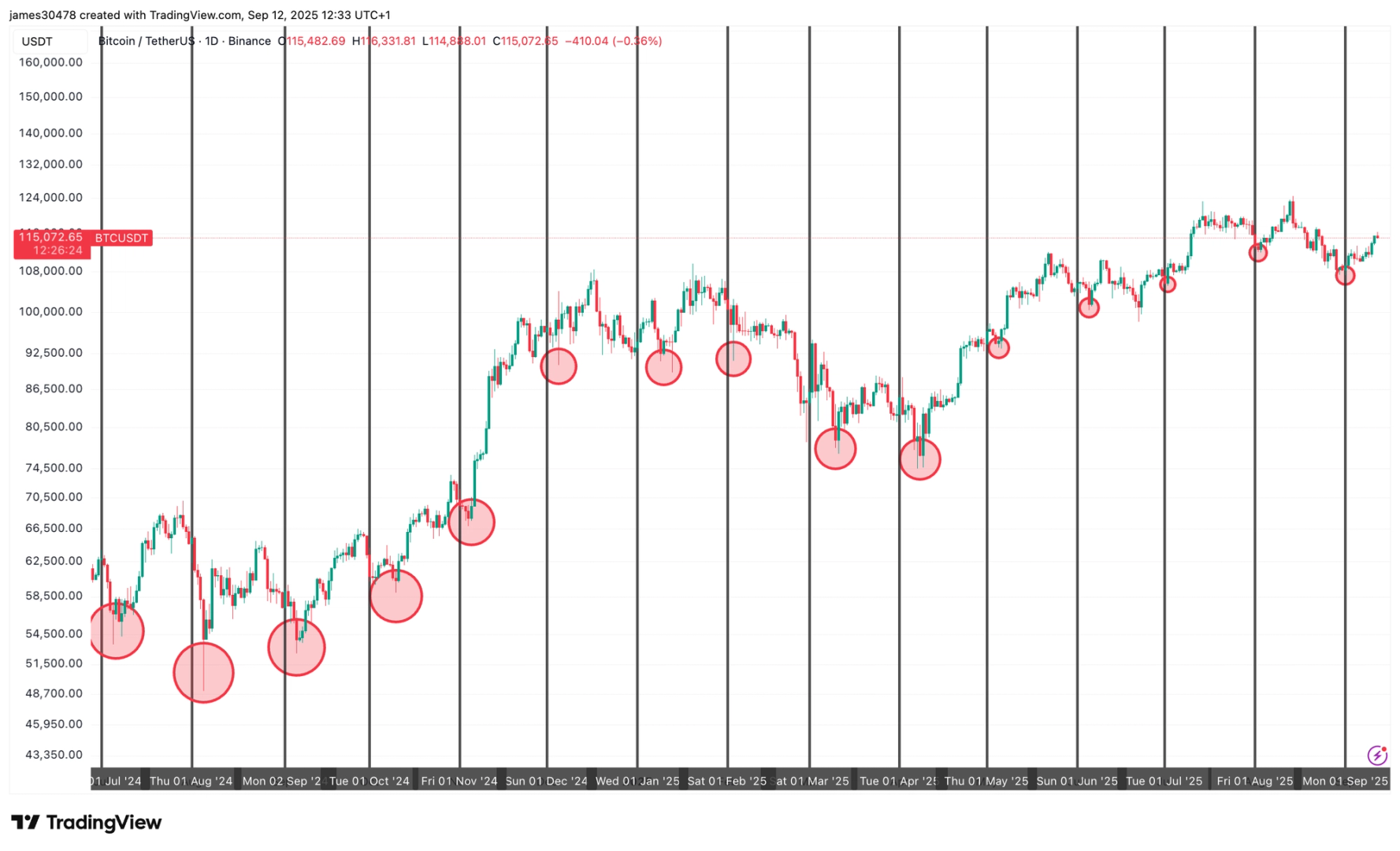

Bitcoin's Historical September Low May Already Be Priced In

Analysis

Price Impact

MedHistorical patterns suggest september lows may be priced in, with potential q4 gains.

Trustworthiness

HighCoindesk is a reputable news source, and the analysis is based on historical data and expert opinions.

Price Direction

BullishQ4 is historically bitcoin's strongest quarter, with potential for new lifetime highs.

Time Effect

ShortPotential lull in trading activity as traders either rollover trades or reposition entirely.

Original Article:

Article Content:

News Back to menu News Markets Finance Tech Policy Focus Prices Back to menu Prices Data Back to menu Data Trade Data Derivatives Order Book Data On-Chain Data API Research & Insights Data Catalogue AI & Machine Learning Indices Back to menu Indices Multi-Asset Indices Reference Rates Strategies and Services API Insights & Announcements Documentation & Governance Research Back to menu Research Events Back to menu Events CoinDesk: Policy & Regulation Consensus Hong Kong Consensus Miami Sponsored Back to menu Sponsored Thought Leadership Press Releases CoinW MEXC Phemex Advertise Stellar Videos Back to menu Videos CoinDesk Daily Shorts Editor's Picks Podcasts Back to menu Podcasts CoinDesk Podcast Network Markets Daily Gen C Unchained with Laura Shin The Mining Pod Newsletters Back to menu Newsletters CoinDesk Headlines Crypto Daybook Americas State of Crypto Crypto Long & Short Crypto for Advisors Webinars Back to menu Webinars English Select Language English en Українська uk Deutsch de Español es 中文 zh Русский ru Nederlands nl Português pt-br Français fr Italiano it Filipino fil 한국어 ko Search / News Prices Data Indices Research Events Sponsored Search / Sign In Sign Up BTC $ 114,892.82 0.79 % ETH $ 4,512.28 1.97 % XRP $ 3.0351 1.25 % USDT $ 1.0000 0.01 % SOL $ 237.99 4.99 % BNB $ 906.61 0.62 % USDC $ 0.9997 0.01 % DOGE $ 0.2596 4.71 % TRX $ 0.3484 0.71 % ADA $ 0.8852 0.45 % HYPE $ 55.81 3.03 % LINK $ 24.26 2.11 % USDE $ 1.0008 0.01 % SUI $ 3.6013 0.10 % XLM $ 0.3927 0.91 % AVAX $ 28.36 1.91 % BCH $ 592.33 1.07 % HBAR $ 0.2391 0.88 % WBT $ 43.41 0.56 % LTC $ 115.20 1.04 % BTC $ 114,892.82 0.79 % ETH $ 4,512.28 1.97 % XRP $ 3.0351 1.25 % USDT $ 1.0000 0.01 % SOL $ 237.99 4.99 % BNB $ 906.61 0.62 % USDC $ 0.9997 0.01 % DOGE $ 0.2596 4.71 % TRX $ 0.3484 0.71 % ADA $ 0.8852 0.45 % HYPE $ 55.81 3.03 % LINK $ 24.26 2.11 % USDE $ 1.0008 0.01 % SUI $ 3.6013 0.10 % XLM $ 0.3927 0.91 % AVAX $ 28.36 1.91 % BCH $ 592.33 1.07 % HBAR $ 0.2391 0.88 % WBT $ 43.41 0.56 % LTC $ 115.20 1.04 % Ad Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email Bitcoin's Historical September Low May Already Be Priced In Historical monthly patterns suggest early September could mark the bottom before Q4 momentum builds. By James Van Straten | Edited by Parikshit Mishra Sep 12, 2025, 11:37 a.m. BTCUSDT (TradingView) What to know : Since July 2024, bitcoin has typically formed monthly lows within the first 10 days, with only a few brief deviations. Q4 has historically been Bitcoin’s strongest quarter, averaging around 85% gains. Historical data suggests that bitcoin BTC $ 114,927.23 has likely put in its September 2025 low, around $107,000 on the first of the month. Looking back to July 2024, a consistent pattern emerges where bitcoin tends to form a bottom for the month within the first 10 days of each month. STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy . The notable exceptions were February, June and August 2025, when the lows came later in the month, but even then, the market experienced a correction within those first 10 days before resuming its broader trend. Speculatively, the reason bitcoin often puts in its low within the first 10 days of the month could be tied to institutional portfolio rebalancing or the timing of key macroeconomic events that tend to cluster early in the month. "It’s worth noting that several futures and options markets expire on the final day of the month or the first day of the next, this can lead to short term volatility and a subsequent lull in trading activity as traders either rollover trades or reposition entirely,” said Oliver Knight, deputy managing editor, data and tokens, at CoinDesk. Of course, past performance is not a guarantee of future results, but as Q4 approaches it is worth noting that this quarter has historically been bitcoin’s strongest, delivering an average return of 85%. October in particular has been especially favorable, with only two losing months since 2013. Bitcoin More For You Crypto Markets Today: Bitcoin Pulls Back, PENGU Open Interest Surges By Omkar Godbole , Oliver Knight | Edited by Sheldon Reback 23 minutes ago Analysts remained optimistic saying they expect new lifetime highs in BTC and outsized gains in select few tokens, such as HYPE, SOL and ENA. What to know : Bitcoin has dropped from overnight highs above $116,000 to under $115,000 as the Dollar Index remains steady. Analysts are optimistic about bitcoin reaching new lifetime highs and expect significant gains in tokens like HYPE, SOL and ENA. Smaller tokens such as MYX, HASH, PENGU, PUMP, and MNT have achieved double-digit price gains this week. Read full story Latest Crypto News Crypto Markets Today: Bitcoin Pulls Back, PENGU Open Interest Surges 23 minutes ago Winklevoss-Backed Gemini Prices IPO at $28/Share, Values Crypto Exchange at More Than $3B 24 minutes ago Get Ready for Alt Season as Traders Eye Fed Cuts: Crypto Daybook Americas 1 hour ago Bitcoin ETFs Record Fourth Consecutive Day of Inflows, Adding $550M 2 hours ago U.S. Posts $345B August Deficit, Net Interest at 3rd Largest Outlay, Gold and BTC Rise 3 hours ago Here Are the 3 Things That Could Spoil Bitcoin's Rally Towards $120K 4 hours ago Top Stories Get Ready for Alt Season as Traders Eye Fed Cuts: Crypto Daybook Americas 1 hour ago Crypto Pundits Retain Bullish Bitcoin Outlook as Fed Rate Cut Hopes Clash With Stagflation Fears 7 hours ago Winklevoss-Backed Gemini Prices IPO at $28/Share, Values Crypto Exchange at More Than $3B 24 minutes ago Here Are the 3 Things That Could Spoil Bitcoin's Rally Towards $120K 4 hours ago Christie’s Closes Digital Art Department as NFT Market Stays Frozen 8 hours ago Bitcoin ETFs Record Fourth Consecutive Day of Inflows, Adding $550M 2 hours ago In this article BTC BTC $ 114,895.64 ◢ 0.79 % About About Us Masthead Careers CoinDesk News Crypto API Documentation Blog Contact Contact Us Accessibility Advertise Sitemap System Status Disclosure & Polices CoinDesk is an award-winning media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of editorial policies . CoinDesk has adopted a set of principles aimed at ensuring the integrity, editorial independence and freedom from bias of its publications. CoinDesk is part of Bullish (NYSE:BLSH), an institutionally focused global digital asset platform that provides market infrastructure and information services. Bullish owns and invests in digital asset businesses and digital assets and CoinDesk employees, including journalists, may receive Bullish equity-based compensation. Ethics Privacy Terms of Use Cookie Settings Do Not Sell My Info © 2025 CoinDesk, Inc. X icon