U.S. Posts $345B August Deficit, Net Interest at 3rd Largest Outlay, Gold and BTC Rise

Analysis

Price Impact

HighUs deficit news and rising interest rates often drive investors to seek alternative assets like bitcoin, increasing demand.

Trustworthiness

HighCoindesk is a reputable news source in the crypto space, and the article cites specific data points from the u.s. treasury.

Price Direction

BullishThe article explicitly states that bitcoin is gaining traction and climbing above $115,000 amidst concerns about debt sustainability.

Time Effect

ShortInitial market reaction will be bullish, but long-term depends on how the fed handles inflation and interest rates.

Original Article:

Article Content:

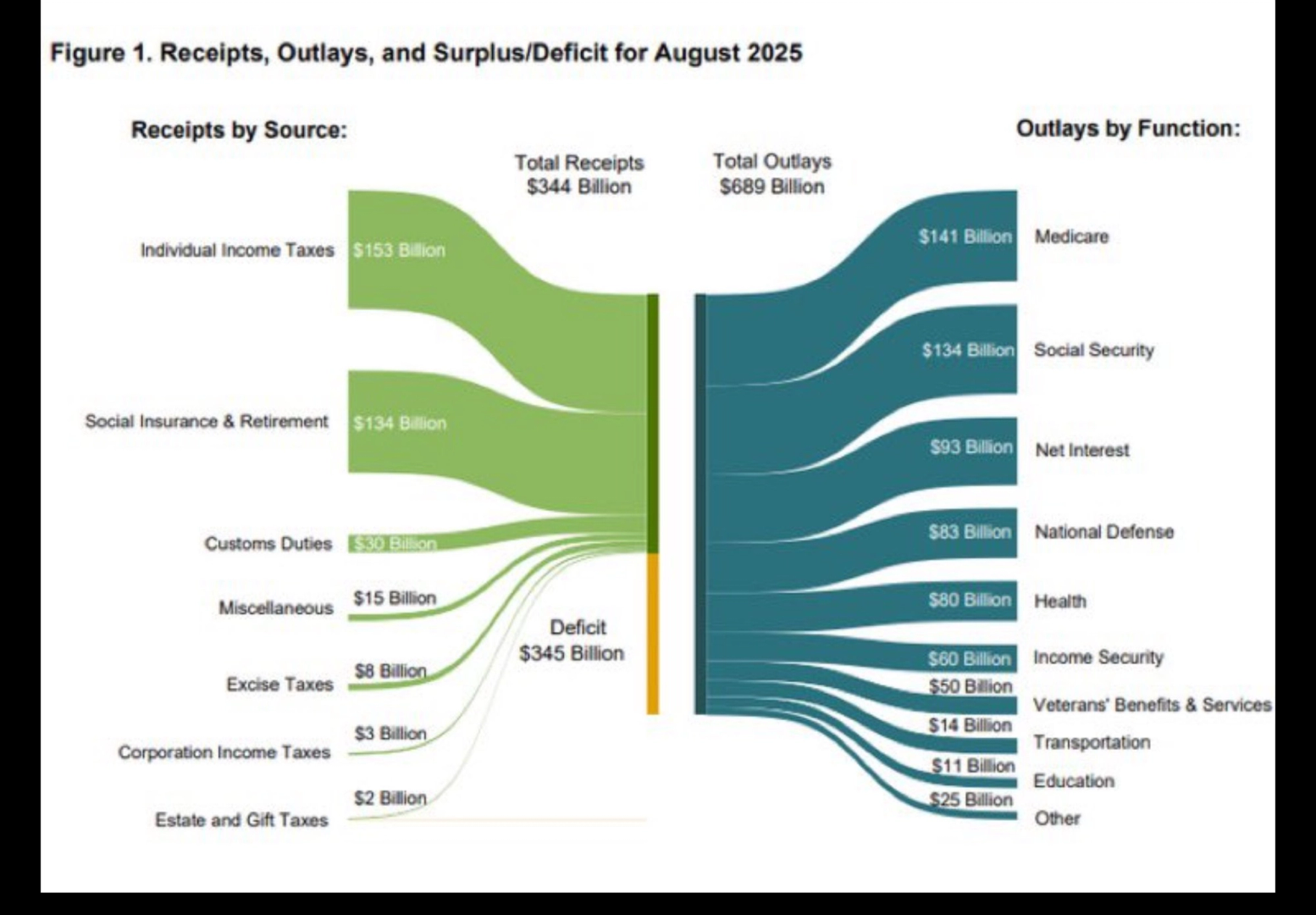

News Back to menu News Markets Finance Tech Policy Focus Prices Back to menu Prices Data Back to menu Data Trade Data Derivatives Order Book Data On-Chain Data API Research & Insights Data Catalogue AI & Machine Learning Indices Back to menu Indices Multi-Asset Indices Reference Rates Strategies and Services API Insights & Announcements Documentation & Governance Research Back to menu Research Events Back to menu Events CoinDesk: Policy & Regulation Consensus Hong Kong Consensus Miami Sponsored Back to menu Sponsored Thought Leadership Press Releases CoinW MEXC Phemex Advertise Stellar Videos Back to menu Videos CoinDesk Daily Shorts Editor's Picks Podcasts Back to menu Podcasts CoinDesk Podcast Network Markets Daily Gen C Unchained with Laura Shin The Mining Pod Newsletters Back to menu Newsletters CoinDesk Headlines Crypto Daybook Americas State of Crypto Crypto Long & Short Crypto for Advisors Webinars Back to menu Webinars English Select Language English en Italiano it Русский ru Español es Français fr Українська uk Deutsch de Nederlands nl 한국어 ko Filipino fil Português pt-br 中文 zh Search / News Prices Data Indices Research Events Sponsored Search / Sign In Sign Up BTC $ 114,988.05 0.92 % ETH $ 4,518.45 2.28 % XRP $ 3.0506 0.84 % USDT $ 1.0002 0.00 % SOL $ 237.88 6.00 % BNB $ 907.14 0.93 % USDC $ 0.9997 0.01 % DOGE $ 0.2600 4.19 % TRX $ 0.3484 1.00 % ADA $ 0.8942 1.16 % HYPE $ 56.10 2.73 % LINK $ 24.45 2.95 % USDE $ 1.0009 0.01 % SUI $ 3.6785 1.81 % XLM $ 0.3938 0.43 % AVAX $ 28.54 1.77 % BCH $ 591.12 0.59 % HBAR $ 0.2415 1.49 % WBT $ 43.44 0.87 % LTC $ 115.73 0.86 % BTC $ 114,988.05 0.92 % ETH $ 4,518.45 2.28 % XRP $ 3.0506 0.84 % USDT $ 1.0002 0.00 % SOL $ 237.88 6.00 % BNB $ 907.14 0.93 % USDC $ 0.9997 0.01 % DOGE $ 0.2600 4.19 % TRX $ 0.3484 1.00 % ADA $ 0.8942 1.16 % HYPE $ 56.10 2.73 % LINK $ 24.45 2.95 % USDE $ 1.0009 0.01 % SUI $ 3.6785 1.81 % XLM $ 0.3938 0.43 % AVAX $ 28.54 1.77 % BCH $ 591.12 0.59 % HBAR $ 0.2415 1.49 % WBT $ 43.44 0.87 % LTC $ 115.73 0.86 % Ad Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email U.S. Posts $345B August Deficit, Net Interest at 3rd Largest Outlay, Gold and BTC Rise US spending surged to $689B in August as gold hit fresh highs near $3,670 and bitcoin crossed $115K. By James Van Straten , AI Boost | Edited by Oliver Knight Updated Sep 12, 2025, 9:16 a.m. Published Sep 12, 2025, 9:13 a.m. U.S. Department of the Treasury's Monthly Treasury Statement for August 2025 (U.S. Treasury) What to know : US collected $344B in revenue against $689B in outlays, leaving a $345B monthly deficit. Net interest payments reached $93B, ranking behind only Medicare and Social Security. Federal Reserve expected to cut rates in September by 25bps, but rising inflation risks could push yields higher. The US government posted a $345 billion deficit in August, with receipts of $344 billion overshadowed by $689 billion in spending. The largest outlays were Medicare at $141 billion and Social Security at $134 billion, but what stands out is net interest at $93 billion, now the third-largest expense. This highlights the growing pressure that rising borrowing costs are placing on federal finances. The Federal Reserve is expected to cut rates by 25 basis points in September, but history suggests it wont be that straight forward. In September 2024, the Fed eased policy by 100bps only to see yields on the long end move sharply higher. The 30 year Treasury jumped from 3.9% to 5%, and today sits at 4.7%. With recent data pointing to an acceleration in inflation , the risk is that cutting rates could fuel further price pressures. That would force yields higher , increase debt servicing costs and potentially deepen the fiscal hole, creating a challenging backdrop for policymakers and markets alike. STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Daybook Americas Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy . Markets are responding decisively. Gold has surged to new record highs, just below $3,670 per ounce, marking a year-to-date gain of almost 40%. Bitcoin is also gaining traction, climbing above $115,000 as investors search for alternatives in an environment where debt sustainability is becoming a bigger concern. Bitcoin Federal Reserve Gold AI Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards . For more information, see CoinDesk's full AI Policy . More For You Here are the 3 Things That Could Spoil Bitcoin's Rally toward $120K By Omkar Godbole , AI Boost | Edited by Parikshit Mishra 1 hour ago BTC's case for a rally to $120K strengthens with prices topping the 50-day SMA. But, at least three factors can play spoilsport. What to know : BTC's case for a rally to $120K strengthens with prices topping the 50-day SMA. BTC, however, is trading close to a "bull fatigue zone." The dollar index may have priced in Fed rate cuts. The downside in the 10-year Treasury yield could be limited. Read full story Latest Crypto News Here are the 3 Things That Could Spoil Bitcoin's Rally toward $120K 1 hour ago World Liberty Financial Token Holds Steady as Community Backs Buyback-and-Burn Plan 2 hours ago This Invisible 'ModStealer' Is Targeting Your Browser-Based Crypto Wallets 2 hours ago Crypto Pundits Retain Bullish Bitcoin Outlook as Fed Rate Cut Hopes Clash With Stagflation Fears 4 hours ago DOGE Rallies 6% Ahead of Anticipated ETF Launch 4 hours ago Christie’s Closes Digital Art Department as NFT Market Stays Frozen 4 hours ago Top Stories Crypto Pundits Retain Bullish Bitcoin Outlook as Fed Rate Cut Hopes Clash With Stagflation Fears 4 hours ago Here are the 3 Things That Could Spoil Bitcoin's Rally toward $120K 1 hour ago Christie’s Closes Digital Art Department as NFT Market Stays Frozen 4 hours ago This Invisible 'ModStealer' Is Targeting Your Browser-Based Crypto Wallets 2 hours ago World Liberty Financial Token Holds Steady as Community Backs Buyback-and-Burn Plan 2 hours ago Galaxy, Circle, Bitfarms Lead Crypto Stock Gains as Bitcoin Vehicles Metaplanet, Nakamoto Plunge 17 hours ago About About Us Masthead Careers CoinDesk News Crypto API Documentation Blog Contact Contact Us Accessibility Advertise Sitemap System Status Disclosure & Polices CoinDesk is an award-winning media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of editorial policies . CoinDesk has adopted a set of principles aimed at ensuring the integrity, editorial independence and freedom from bias of its publications. CoinDesk is part of Bullish (NYSE:BLSH), an institutionally focused global digital asset platform that provides market infrastructure and information services. Bullish owns and invests in digital asset businesses and digital assets and CoinDesk employees, including journalists, may receive Bullish equity-based compensation. Ethics Privacy Terms of Use Cookie Settings Do Not Sell My Info © 2025 CoinDesk, Inc. X icon