Bitcoin's Price Surge to $104K Liquidates Nearly $400M in Bearish BTC Bets, Opening Doors to Further Gains

Analysis

Price Impact

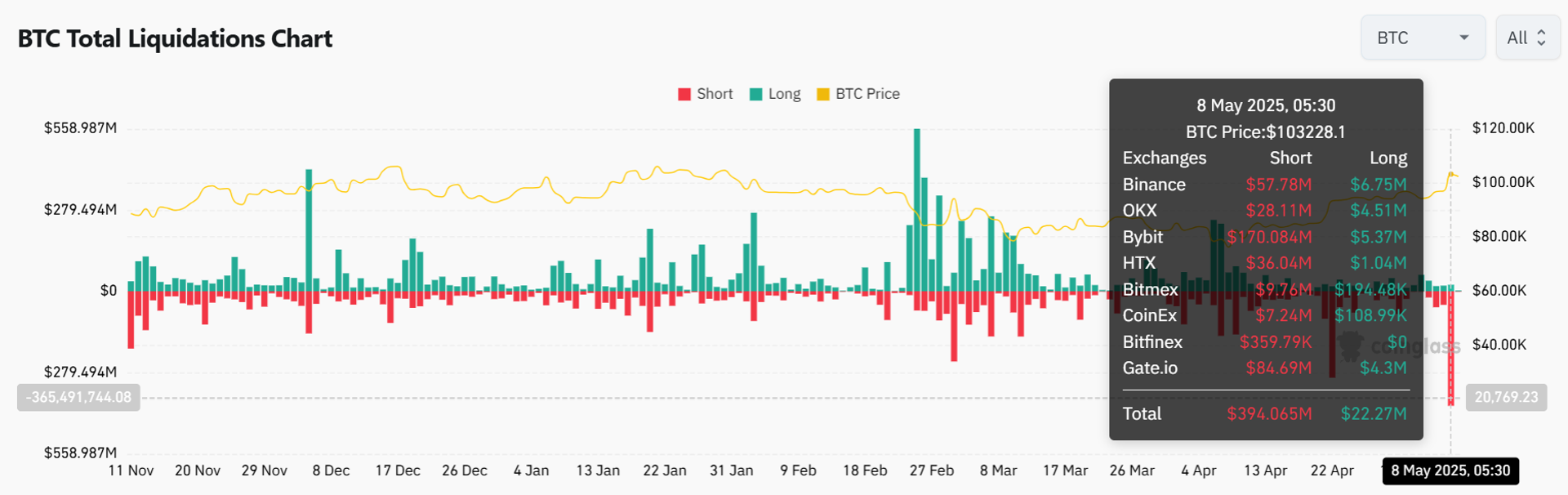

HighA surge to $104k led to nearly $400m in liquidations of bearish btc bets, signaling strong upward momentum.

Trustworthiness

HighThe information is based on a coindesk article citing specific data on liquidations and market movements.

Price Direction

BullishThe liquidation of short positions suggests that the market was heavily tilted bearishly, and the clearing of these positions could lead to further gains.

Time Effect

ShortThe immediate impact is the liquidation of shorts, but the long-term effect depends on sustained etf inflows and market sentiment.

Original Article:

Article Content:

BTC $ 102,614.85 + 3.68 % ETH $ 2,218.17 + 17.10 % USDT $ 0.9998 - 0.03 % XRP $ 2.3093 + 5.60 % BNB $ 625.69 + 2.72 % SOL $ 161.54 + 7.04 % USDC $ 1.0000 - 0.01 % DOGE $ 0.1944 + 8.04 % ADA $ 0.7588 + 8.26 % TRX $ 0.2547 + 1.79 % SUI $ 3.8657 + 7.43 % LINK $ 15.68 + 8.14 % AVAX $ 22.11 + 7.66 % XLM $ 0.2933 + 9.12 % SHIB $ 0.0₄1421 + 7.28 % BCH $ 417.14 + 0.59 % HBAR $ 0.1941 + 6.12 % LEO $ 8.8638 + 0.95 % HYPE $ 23.86 + 12.47 % TON $ 3.1982 + 3.07 % News Back to menu News Markets Finance Tech Policy Focus Prices Back to menu Prices Data Back to menu Data Trade Data Derivatives Order Book Data On-Chain Data API Research & Insights Data Catalogue AI & Machine Learning Indices Back to menu Indices Multi-Asset Indices Reference Rates Strategies and Services API Insights & Announcements Documentation & Governance Research Back to menu Research Consensus Back to menu Consensus Consensus 2025 Consensus 2025 Coverage Sponsored Back to menu Sponsored Thought Leadership Press Releases CoinW MEXC Phemex Advertise Videos Back to menu Videos CoinDesk Daily Shorts Editor's Picks Podcasts Back to menu Podcasts CoinDesk Podcast Network Markets Daily Gen C Unchained with Laura Shin The Mining Pod Newsletters Back to menu Newsletters The Node Crypto Daybook Americas State of Crypto Crypto Long & Short Crypto for Advisors Webinars & Events Back to menu Webinars & Events Consensus 2025 Policy & Regulation Conference English Select Language English en Español es Français fr Українська uk Filipino fil Italiano it Português pt-br Русский ru News Prices Data Indices Research Consensus Sponsored Sign In Sign Up Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email Bitcoin's Price Surge to $104K Liquidates Nearly $400M in Bearish BTC Bets, Opening Doors to Further Gains The rally followed a U.K. trade deal announcement and record ETF inflows exceeding $40 billion. By Omkar Godbole May 9, 2025, 4:03 a.m. BTC rally shakes out shorts. (Coinglass) What to know : Bitcoin's price surged over 3% to $102,500, triggering $400 million in short position liquidations. The rally followed a U.K. trade deal announcement and record ETF inflows exceeding $40 billion. Bitcoin's rapid price rally has caught traders off guard, triggering large liquidations of bearish short positions. The leading cryptocurrency by market value has risen over 3% to $102,500 in the past 24 hours, with prices topping $104,000 at one point, the highest since Jan. 31. The bullish move came as President Donald Trump announced a comprehensive trade deal with the U.K. and the cumulative inflows into the spot exchange-traded funds (ETFs) hit a record high above $40 billion. STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto Long & Short Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy . The broader market rallied as well, with the total market cap of all coins excluding BTC surging by 10% to $1.14 trillion, the highest since March 6, according to data source TradingView. That has led to substantial liquidations of bearish short positions, or leveraged plays aimed at profiting from price losses. A position is liquidated or forced closed when the trader's account balance falls below the required margin level, often due to adverse price movements. This leads the exchange to close the position to prevent further losses automatically. Nearly $400 million in BTC short positions were liquidated in the past 24 hours—marking the highest single-day total since at least November, according to Coinglass. Meanwhile, $22 million in long positions were also wiped out. This significant imbalance indicates that leverage was heavily tilted towards the bearish side, and the rapid liquidation of shorts suggests there could be more upside potential for the market ahead. Bitcoin Markets Macro Liquidations Omkar Godbole Omkar Godbole is a Co-Managing Editor on CoinDesk's Markets team based in Mumbai, holds a masters degree in Finance and a Chartered Market Technician (CMT) member. Omkar previously worked at FXStreet, writing research on currency markets and as fundamental analyst at currency and commodities desk at Mumbai-based brokerage houses. Omkar holds small amounts of bitcoin, ether, BitTorrent, tron and dot. X icon About About Us Masthead Careers CoinDesk News Crypto API Documentation Contact Contact Us Accessibility Advertise Sitemap System Status DISCLOSURE & POLICES CoinDesk is an award-winning media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of editorial policies . CoinDesk has adopted a set of principles aimed at ensuring the integrity, editorial independence and freedom from bias of its publications. CoinDesk is part of the Bullish group, which owns and invests in digital asset businesses and digital assets. CoinDesk employees, including journalists, may receive Bullish group equity-based compensation. Bullish was incubated by technology investor Block.one. Ethics Privacy Terms of Use Cookie Settings Do Not Sell My Info © 2025 CoinDesk, Inc. X icon