Bitcoin Poised for Strongest Weekly Gain Since Trump Win as ETFs Gobble $2.7B Inflows

Analysis

Price Impact

HighStrongest weekly gain since trump win, fueled by $2.7b etf inflows. bitcoin's decoupling from traditional macro assets and increased corporate treasury adoption signal a maturing store-of-value asset.

Trustworthiness

HighData from coindesk, citing sosovalue data on etf inflows and expert analysis from coinbase institutional's global head of research and the cio of ledn.

Price Direction

BullishAnticipation of reaching $130,000 by late 2025, early 2026, driven by elliott wave analysis and strong etf inflows.

Time Effect

LongAnalysis points to a multi-month rally extending into late 2025/early 2026.

Original Article:

Article Content:

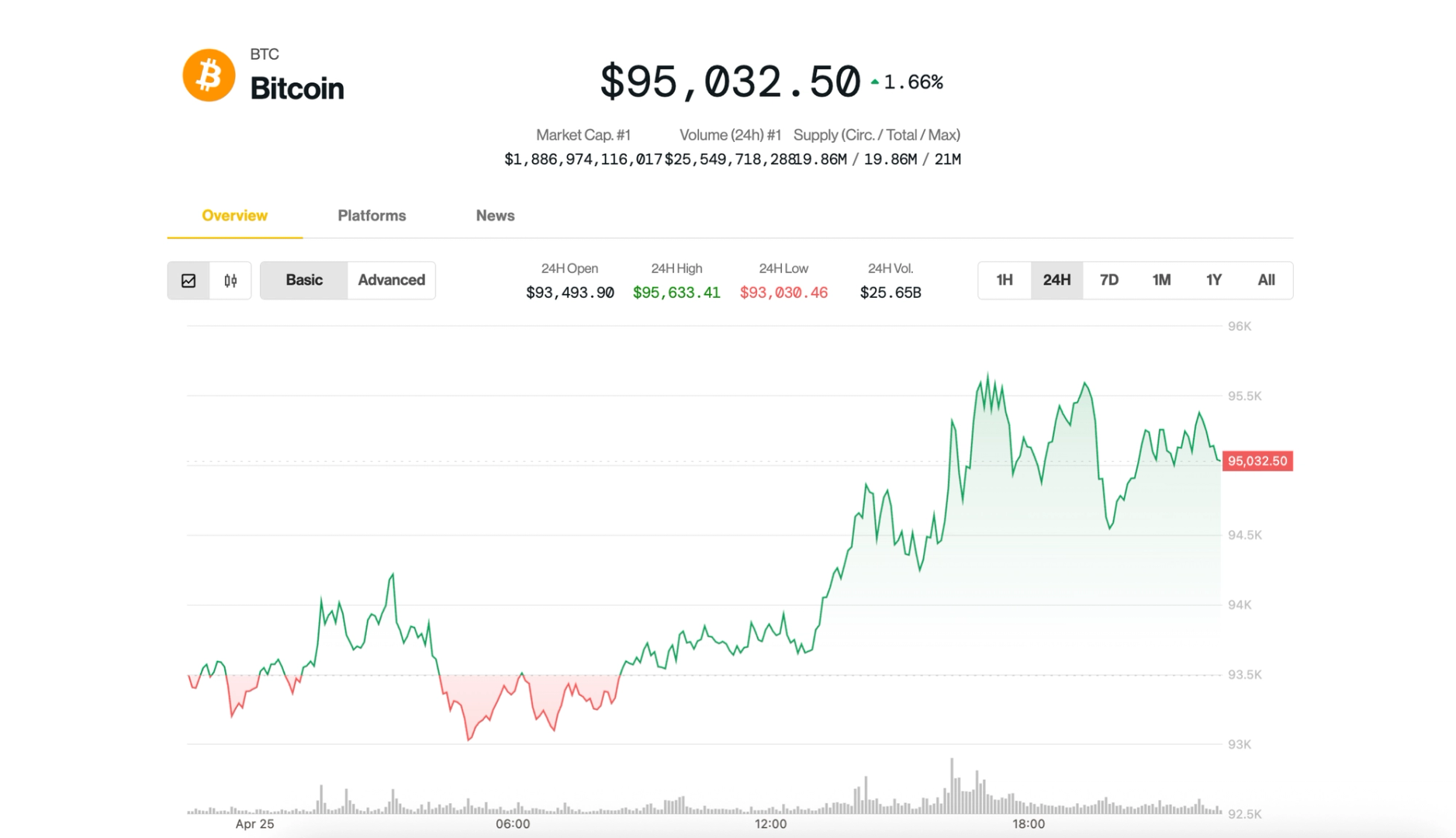

BTC $ 94,832.73 + 1.46 % ETH $ 1,792.97 + 1.90 % USDT $ 1.0008 + 0.04 % XRP $ 2.1884 - 0.28 % BNB $ 600.05 - 0.02 % SOL $ 150.82 - 0.10 % USDC $ 0.9999 + 0.00 % DOGE $ 0.1817 + 1.10 % ADA $ 0.7104 - 0.62 % TRX $ 0.2412 - 1.86 % SUI $ 3.5079 + 6.13 % LINK $ 14.99 + 0.37 % AVAX $ 22.26 + 0.20 % XLM $ 0.2835 + 1.64 % SHIB $ 0.0₄1400 + 3.25 % LEO $ 8.8976 - 3.77 % HBAR $ 0.1937 + 3.43 % TON $ 3.1985 + 0.77 % BCH $ 376.97 + 7.24 % LTC $ 86.85 + 3.49 % News Back to menu News Markets Finance Tech Policy Focus Prices Back to menu Prices Data Back to menu Data Trade Data Derivatives Order Book Data On-Chain Data API Research & Insights Data Catalogue AI & Machine Learning Indices Back to menu Indices Multi-Asset Indices Reference Rates Strategies and Services API Insights & Announcements Documentation & Governance Research Back to menu Research Consensus Back to menu Consensus Consensus 2025 Consensus 2025 Coverage Sponsored Back to menu Sponsored Thought Leadership Press Releases CoinW MEXC Phemex Advertise Videos Back to menu Videos CoinDesk Daily Shorts Editor's Picks Podcasts Back to menu Podcasts CoinDesk Podcast Network Markets Daily Gen C Unchained with Laura Shin The Mining Pod Newsletters Back to menu Newsletters The Node Crypto Daybook Americas State of Crypto Crypto Long & Short Crypto for Advisors Webinars & Events Back to menu Webinars & Events Consensus 2025 Policy & Regulation Conference English Select Language English en Français fr Español es Filipino fil Italiano it Português pt-br Русский ru Українська uk News Prices Data Indices Research Consensus Sponsored Sign In Sign Up Markets Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email Bitcoin Poised for Strongest Weekly Gain Since Trump Win as ETFs Gobble $2.7B Inflows SUI, BCH and Hedera's HBAR led Friday gains in the CoinDesk 20 Index, with one analyst saying this week's crypto rally is likely the beginning of BTC's climb to fresh record prices. By Krisztian Sandor | Edited by Aoyon Ashraf Apr 25, 2025, 10:09 p.m. Bitcoin price on April 25 (CoinDesk) What to know : Bitcoin's 11% surge to $95,000 this week is on track to be the asset's strongest weekly performance since November 2024. U.S.-listed spot bitcoin ETFs saw $2.68 billion in net inflows this week until Thursday, the largest since December. Bitcoin could surpass $130,000 by late 2025, early 2026, the CIO of Ledn predicted. Bitcoin (BTC) continued its spring rally on Friday and is on track for its strongest weekly showing since Trump's election victory. The largest and oldest cryptocurrency held around $95,000 during U.S. afternoon hours, up 1.8% over the past 24 hours. Ethereum’s ether (ETH) followed closely, gaining 2% to hover just over $1,800. Sui’s native (SUI), Bitcoin Cash (BCH), and Hedera’s HBAR led gains in the broad-market crypto benchmark CoinDesk 20 Index. STORY CONTINUES BELOW Don't miss another story. Subscribe to the Crypto for Advisors Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy . Today's gains cap an exceptional momentum for crypto markets recovering from the early April lows amid tariff turmoil. BTC is up over 11% since Monday, putting it at its largest weekly gain since November 2024, when Donald Trump clinched the U.S. presidency, kickstarting a broad-market crypto rally. Read more: Bitcoin Traders Target $95K in Near Term; SUI Continues Multiday Rally Investor appetite from ETF investors also bounced back strongly: U.S.-listed spot bitcoin ETFs recorded $2.68 billion in net inflows this week so far, the largest since December, according to SoSoValue data . (Friday inflow data will be published later.) BTC decoupling Bitcoin's recent strength relative to U.S. stocks and gold underscores BTC's decoupling from traditional macro assets, said David Duong, Coinbase Institutional's global head of research. "It’s rare to witness market inflection points in real time, as we only tend to recognize major regime shifts with the benefit of time and reflection," Duong said in a Friday report . "This week’s decoupling of bitcoin’s performance from that of traditional macro assets may be as close as we come to such a moment." "In our view, this divergence highlights bitcoin’s maturing role as a store-of-value asset—one that is increasingly being viewed by institutional and retail investors alike as resilient against the macroeconomic forces affecting risk assets more broadly," he wrote. Doung noted that the thesis is gaining traction with more companies adopting BTC corporate treasuries. Following the success of Michael Saylor's Strategy, Twenty One Capital , a new firm backed by Tether, Bitfinex, SoftBank, and a Cantor Fitzgerald affiliate, also plans to hold 42,000 BTC at launch. Due in part to recent accumulation, liquidity in the spot BTC market has been "significantly drained," Dr. Kirill Kretov, lead strategist at trading automation platform CoinPanel, said in a Telegram note. According to the firm's proprietary blockchain analysis, a large portion of bitcoin liquidity has been withdrawn from actively transacting addresses, including exchanges, since November 2024, exposing markets to volatile price swings. “The market is thin, vulnerable, and easily moved by large players," Kretov said. "Sharp swings of 10% up or down are likely to remain the norm for now." Bitcoin's route to fresh records While the route could be choppy, this week’s rally is likely the early innings of bitcoin's next leg higher to new records, said John Glover, chief investment officer of crypto lender Ledn. Based on his technical analysis using Elliott Waves, he said BTC began the fifth and final wave of its multi-year bull market. BTC price prediction by Lend CIO John Glover (Ledn/TradingView) Elliott Wave theory suggests asset prices move in predictable patterns called waves, driven by collective investor psychology. These patterns typically unfold in five-wave trends, in which the first, third, and fifth waves are impulsive rallies, while the second and fourth waves are corrective phases. While retesting this month's low at $75,000 cannot be ruled out, Glover sees BTC climbing to a cycle top around late 2025, early 2026. "My expectations continue to be for a rally to $133-$136k into the end of this year, beginning of next,” he said. Read more: Bitcoin Whales Return in Force, Buy the BTC Price Rally, On-Chain Data Show Market Wrap Bitcoin David duong Ledn Krisztian Sandor Krisztian Sandor is a U.S. markets reporter focusing on stablecoins, tokenization, real-world assets. He graduated from New York University's business and economic reporting program before joining CoinDesk. He holds BTC, SOL and ETH. X icon About About Us Masthead Careers CoinDesk News Crypto API Documentation Contact Contact Us Accessibility Advertise Sitemap System Status DISCLOSURE & POLICES CoinDesk is an award-winning media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of editorial policies . CoinDesk has adopted a set of principles aimed at ensuring the integrity, editorial independence and freedom from bias of its publications. CoinDesk is part of the Bullish group, which owns and invests in digital asset businesses and digital assets. CoinDesk employees, including journalists, may receive Bullish group equity-based compensation. Bullish was incubated by technology investor Block.one. Ethics Privacy Terms of Use Cookie Settings Do Not Sell My Info © 2025 CoinDesk, Inc. X icon