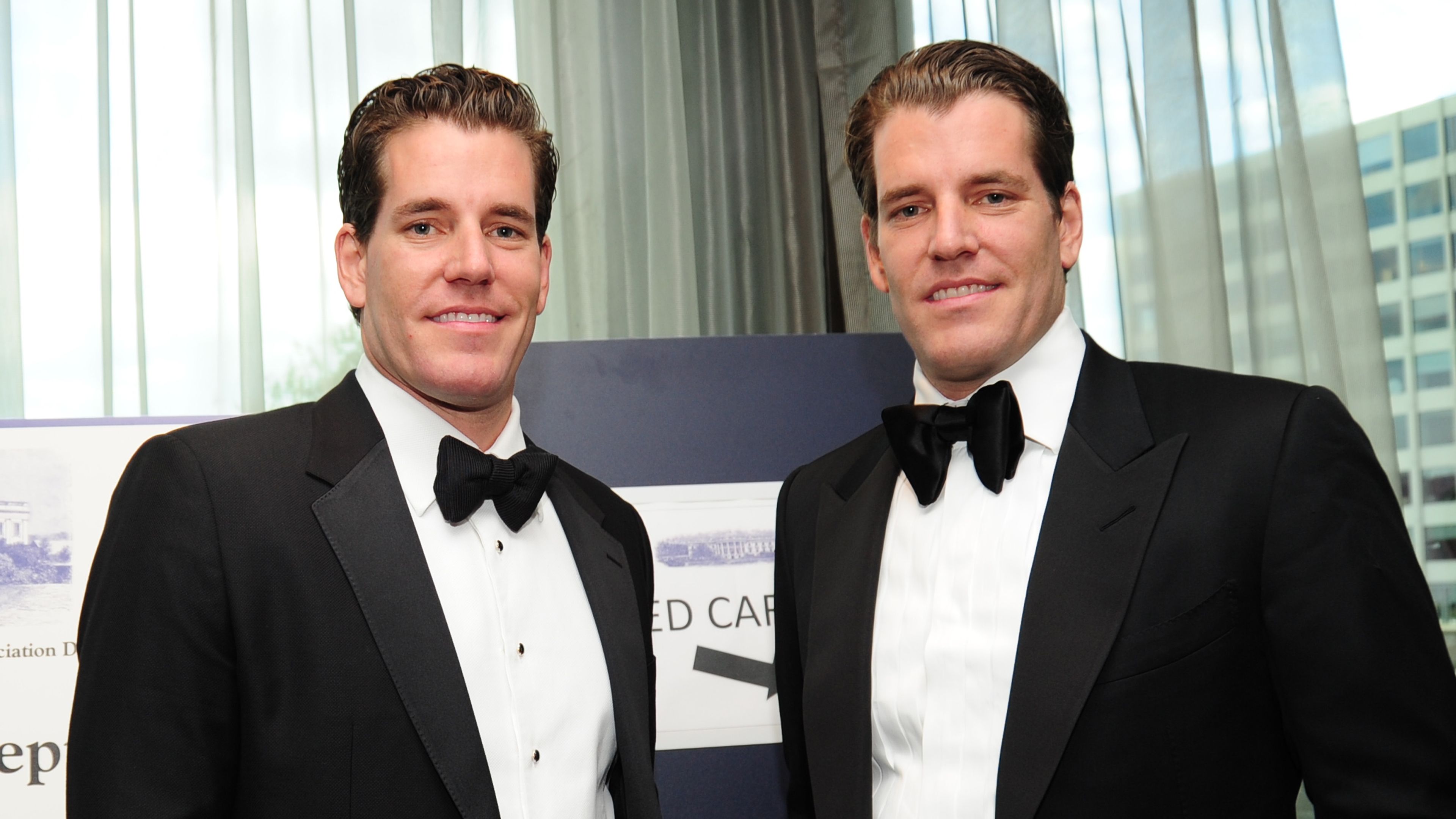

Billionaire Winklevoss Twins-Backed Gemini Confidentially Filed for a U.S IPO: Bloomberg

Analysis

Price Impact

MedGemini's potential ipo, backed by the winklevoss twins, signals growing institutional acceptance of crypto exchanges, potentially increasing market confidence and investment. the sec ending its investigation into gemini without action and the settlement of a cftc lawsuit could be seen as positive developments.

Trustworthiness

HighThe information is sourced from bloomberg and coindesk, reputable news outlets, citing people familiar with the matter and official reports. the details about the sec investigation and cftc settlement are verifiable.

Price Direction

BullishAn ipo from a major exchange like gemini can lead to increased market liquidity and validation of the crypto industry's maturation, potentially driving positive price movement in the medium term.

Time Effect

LongIpos take time to materialize and their effects unfold over months, reflecting long-term institutional commitment and integration into traditional financial markets.

Original Article:

Article Content:

BTC $ 86,589.96 - 3.76 % ETH $ 2,135.66 - 3.07 % USDT $ 0.9998 - 0.04 % XRP $ 2.3817 - 8.70 % BNB $ 592.26 - 0.66 % SOL $ 138.63 - 3.33 % USDC $ 1.0001 + 0.00 % ADA $ 0.8164 - 10.12 % DOGE $ 0.1977 - 2.09 % TRX $ 0.2437 + 1.43 % WBTC $ 86,456.94 - 3.72 % LINK $ 15.91 - 6.89 % HBAR $ 0.2340 - 1.77 % LEO $ 9.9253 + 0.01 % XLM $ 0.2835 - 4.58 % AVAX $ 20.06 - 4.54 % SUI $ 2.5878 - 5.63 % LTC $ 103.14 - 0.28 % BCH $ 390.77 - 1.26 % SHIB $ 0.0₄1312 - 2.45 % Ad Sign Up News Back to menu News Prices Back to menu Prices Data Back to menu Data Trade Data Derivatives Order Book Data On-Chain Data API Research & Insights Data Catalogue AI & Machine Learning Indices Back to menu Indices Multi-Asset Indices Reference Rates Strategies and Services API Insights & Announcements Documentation & Governance Consensus Back to menu Consensus Sponsored Back to menu Sponsored Videos Back to menu Videos CoinDesk Daily Shorts Editor's Picks Podcasts Back to menu Podcasts CoinDesk Podcast Network Markets Daily Gen C Unchained with Laura Shin The Mining Pod Newsletters Back to menu Newsletters The Node Crypto Daybook Americas State of Crypto Crypto Long & Short Crypto for Advisors Research Back to menu Research Webinars & Events Back to menu Webinars & Events Consensus 2025 Policy & Regulation Conference Sponsored Back to menu Sponsored Thought Leadership Press Releases CoinW MEXC Phemex Advertise News Sections Back to menu News Sections Markets Finance Tech Policy Focus English Select Language English en Español es Filipino fil Français fr Italiano it Português pt-br Русский ru Українська uk News Prices Data Indices Consensus Sponsored Sign In Sign Up Finance Share Share this article Copy link X icon X (Twitter) LinkedIn Facebook Email Billionaire Winklevoss Twins-Backed Gemini Confidentially Filed for a U.S IPO: Bloomberg Gemini has hired Goldman Sachs and Citigroup for the potential IPO, the report said. By Aoyon Ashraf Updated Mar 7, 2025, 11:32 p.m. UTC Published Mar 7, 2025, 11:29 p.m. UTC Gemini's Cameron and Tyler Winklevoss (Image Catcher News Service/Getty Images) What to know : Crypto exchange Gemini, founded by the Winklevoss twins, has confidentially filed for an IPO, with Goldman Sachs and Citigroup involved in the process. The potential IPO follows the SEC's decision to end its investigation into Gemini without taking action, and a $5 million settlement of a separate lawsuit by the Commodity Futures Trading Commission. Gemini joins several other crypto firms, including Kraken, Circle, Bullish, and Blockchain.com, that are considering U.S. public listings amid a retreat from full-scale litigation by the SEC. Crypto exchange and custodian Gemini has confidentially filed for an initial public offering (IPO), Bloomberg reported , citing people familiar with the matter. The firm, founded by billionaire Cameron and Tyler Winklevoss, is working with Goldman Sachs and Citigroup, the report said, noting that no final decision has been made on the listing. Story continues Don't miss another story. Subscribe to the Crypto Long & Short Newsletter today . See all newsletters Sign me up By signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy . The potential IPO comes after the U.S. Securities and Exchange Commission (SEC) ended its investigation into Gemini without taking action, according to a February post by Cameron Winklevoss. The company also settled a separate Commodity Futures Trading Commission lawsuit in January for $5 million. Gemini is among several crypto firms lining up to list their companies in the U.S. public market after the SEC has been in a full-scale litigation retreat in the first months of the Trump administration. Just today, Bloomberg reported that Crypto exchange Kraken is considering an IPO by the first quarter of 2026, adding to the reports that firms such as Circle, Bullish (parent company of CoinDesk) and Blockchain.com are also queueing up for a U.S. listing. IPO Gemini Aoyon Ashraf Aoyon Ashraf is CoinDesk's managing editor for Breaking News. He spent almost a decade at Bloomberg covering equities, commodities and tech. Prior to that, he spent several years on the sellside, financing small-cap companies. Aoyon graduated from University of Toronto with a degree in mining engineering. He holds ETH and BTC, as well as ALGO, ADA, SOL, OP and some other altcoins which are below CoinDesk's disclosure threshold of $1,000. X icon About About Us Masthead Careers CoinDesk News Crypto API Documentation Contact Contact Us Accessibility Advertise Sitemap System Status DISCLOSURE & POLICES CoinDesk is an award-winning media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of editorial policies . CoinDesk has adopted a set of principles aimed at ensuring the integrity, editorial independence and freedom from bias of its publications. CoinDesk is part of the Bullish group, which owns and invests in digital asset businesses and digital assets. CoinDesk employees, including journalists, may receive Bullish group equity-based compensation. Bullish was incubated by technology investor Block.one. Ethics Privacy Terms of Use Cookie Consent Do Not Sell My Info © 2025 CoinDesk, Inc. X icon