Med

Santiment's analysis suggests that current 365-day bitcoin buyer returns are mirroring levels seen in late 2022 before a significant rally. this historical parallel indicates potential for a future price increase, though the exact timing and magnitude are uncertain.

High

Bullish

The mvrv ratio for 365-day buyers is at -26.6%, similar to late 2022 levels that preceded a 67% rally. while not an exact match structurally, this historical precedent suggests a potential upward price movement.

#btc

#onchain

#santiment

High

The article highlights a historical pattern of bitcoin surging 54% on average following us midterm elections. this suggests a significant potential price movement based on past performance.

Med

Bullish

The historical data suggests a strong upward trend for bitcoin in the months following us midterm elections, with an average increase of 54%. this pattern indicates a potential bullish outlook.

#btc

#midtermelections

#cryptoanalysis

High

Bitcoin's price action, particularly its early crash, is being presented as a leading indicator for traditional stock markets, suggesting a broader market downturn influenced by macroeconomic factors and geopolitical events.

High

Bearish

The article suggests that bitcoin's prior sharp decline, which preceded a stock market swoon, acts as a warning. while bitcoin has stabilized, the implication is that the broader market, having followed bitcoin's lead, is likely to experience further weakness or at least a period of caution.

#BTC

#StockMarket

#Crypto

High

Ethereum is experiencing a significant rally driven by substantial etf inflows, outperforming other major cryptocurrencies like xrp and even bitcoin in terms of daily institutional investment. this indicates strong demand from traditional finance.

High

Bullish

Positive net inflows into ethereum etfs for three consecutive days, coupled with a significant price surge, indicate strong buying pressure and positive market sentiment towards eth.

#eth

#ethereum

#etf

High

The article highlights a significant increase in binance's futures-to-spot ratio, suggesting increased leveraged trading and speculation. this indicates that price movements are likely to be more volatile and sensitive to liquidations and news events, especially in the short term.

High

Bearish

The high futures-to-spot ratio, coupled with geopolitical risks and uncertain macro conditions (inflation, fed policy), points to increased short-term speculation and hedging rather than long-term accumulation. historically, such spikes have coincided with increased volatility and potential for sharp corrections or squeezes, suggesting a current bearish leaning with high potential for sharp moves.

#btc

#binance

#cryptotrading

High

Blackrock's entry into staked ether etfs with significant first-day trading volume suggests growing institutional interest in yield-generating crypto products. this could lead to increased demand for eth as more capital flows into such instruments, potentially driving up its price.

High

Bullish

The positive reception and high trading volume for the ethb etf, which offers staking rewards, suggests an increased demand for eth and yield-generating crypto products. this could translate into upward price pressure for eth.

#eth

#etf

#blackrock

Med

The cftc's move to regulate prediction markets, including those linked to sports outcomes, could indirectly impact cryptocurrencies that have similar characteristics or are used on such platforms. while not directly targeting crypto, increased regulatory scrutiny in financial derivatives and event contracts could spill over or create a cautious environment for crypto assets perceived as similar.

High

Neutral

The cftc's action is focused on prediction markets and event contracts, not directly on cryptocurrencies like bitcoin or ethereum. while there could be indirect impacts due to regulatory overlap or market sentiment, there's no immediate or clear indication of a direct bullish or bearish effect on major cryptocurrencies. the market's reaction will depend on how these regulations are interpreted and applied, and if they influence the broader crypto regulatory landscape.

#cftc

#regulation

#predictionmarkets

Med

Stanley druckenmiller's speculation about crypto potentially becoming a reserve currency, even with his expressed 'hate' for it, is a significant endorsement. his past purchase of btc as a hedge against fiat debasement adds weight to this. however, his recent divestment and concerns about risk-on assets during tightening cycles temper the immediate bullishness.

High

Bullish

The narrative of crypto as a potential reserve currency and a hedge against fiat debasement, coming from a figure like druckenmiller, is fundamentally bullish for bitcoin and the broader crypto market in the long term. it could attract further institutional interest and adoption.

#btc

#reservecurrency

#druckenmiller

Low

While ghana's crypto sandbox is a positive development for regulatory clarity in the region, it is unlikely to have a significant immediate impact on the global price of bitcoin. the sandbox focuses on a specific market and a limited number of companies, and the scale of adoption within ghana is still developing. broader adoption and regulatory frameworks in larger economies would be more likely to influence bitcoin's price.

High

Neutral

The news indicates increased regulatory clarity and potential for crypto adoption within ghana. this is a positive step for the crypto ecosystem, but it is a localized development. without a broader trend or a significant increase in demand directly attributable to this sandbox, it is unlikely to cause a major price shift for bitcoin in the short to medium term.

#ghana

#cryptoregulation

#btc

Med

The article suggests a potential breakout for solana towards $100, supported by recent upward momentum and breaking key resistance levels. however, it also highlights potential downside corrections if immediate resistance is not overcome.

High

Bullish

The article explicitly states that solana has started a 'fresh increase' and is trading in a 'short-term positive zone', with potential to 'extend gains' if key resistance at $92 and then $95 is cleared, aiming for $100.

#sol

#solana

#crypto

Med

The report highlights both bullish tokenomics (fee-driven buybacks) and bearish risks (token unlocks, competition, regulation), creating a nuanced view rather than a definitive price catalyst.

High

Neutral

The analysis presents a balanced view, acknowledging strong tokenomic design but also significant risks, leading to an uncertain short-term price direction. the mention of potential $150 by august 2026 from another analyst adds a longer-term bullish signal.

#hype

#crypto

#defi

High

Xrp has broken a significant downtrend and resistance level, indicating a strong shift in market sentiment. the surge in volume accompanying this breakout suggests conviction from traders, potentially leading to further upward movement.

High

Bullish

The breakout above a long-term downtrend and resistance zone, coupled with increased trading volume and the potential to establish new support levels, points to a bullish short-to-medium term outlook for xrp.

#xrp

#crypto

#bullish

Low

The news focuses on leadership changes and ai integration within adobe and other tech companies, with no direct impact on cryptocurrency markets. while ai is a general trend, this specific news doesn't directly correlate with any cryptocurrency price movement.

High

Neutral

There is no direct link or catalyst mentioned in this news that would cause a significant price movement for any specific cryptocurrency.

AI

Tech

Layoffs

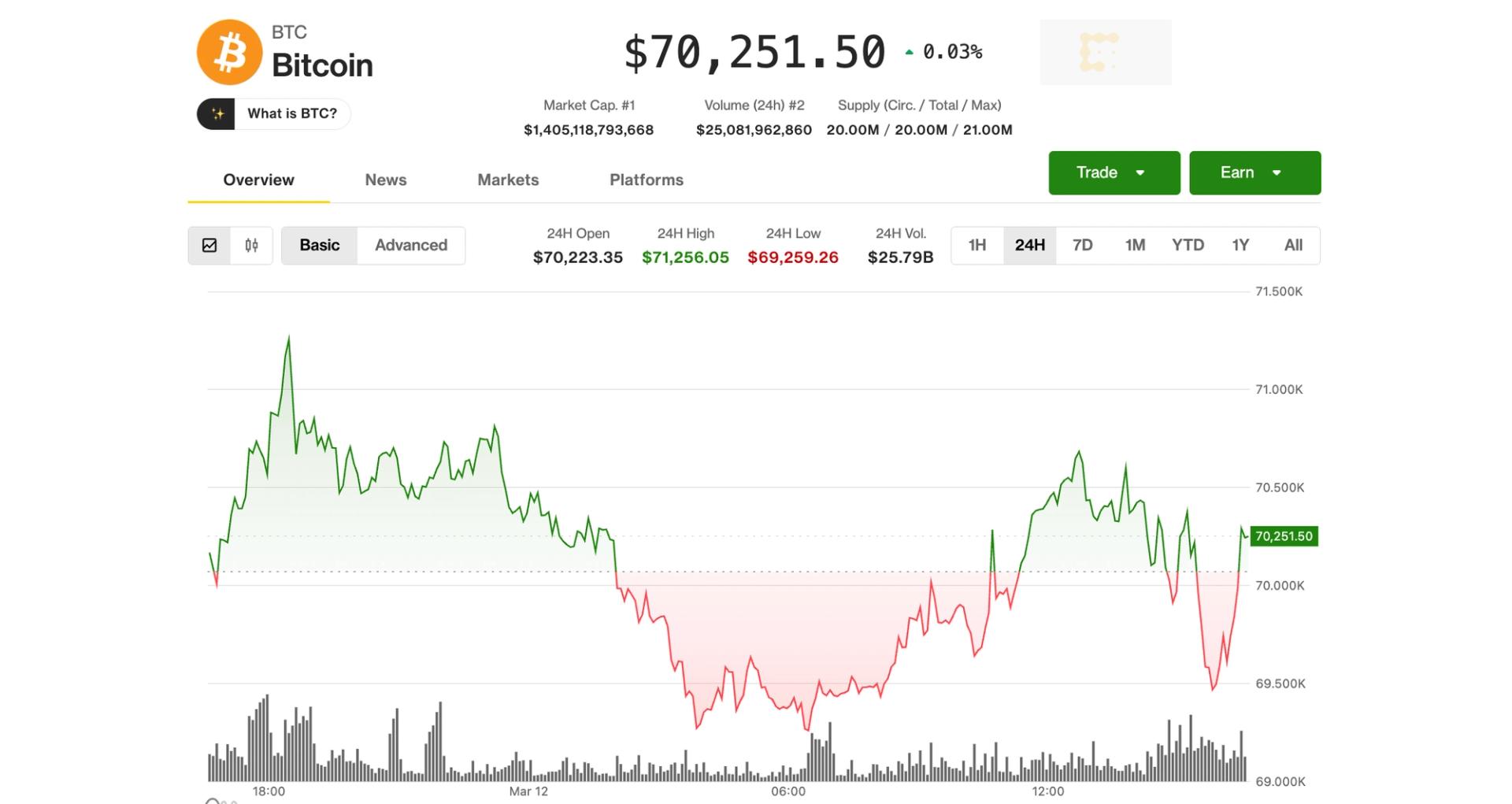

Med

The article indicates bitcoin is holding strong near $71,000 and other major altcoins like eth, sol, and xrp are also showing modest gains, suggesting a general positive sentiment in the crypto market. however, the market is described as being in a 'stabilization phase' and requires new capital for a sustained rally, indicating that immediate significant upside might be limited.

High

Bullish

Bitcoin is trading at the upper end of its consolidation range and showing resilience against traditional market weakness. eth, sol, and xrp are also experiencing gains, indicating a bullish short-term trend. the ongoing institutional interest in bitcoin defi could further fuel upward momentum.

#btc

#crypto

#eth

Med

The article suggests a potential breakout for xrp, with specific price targets if resistance levels are breached. while positive, it doesn't indicate a massive, immediate surge.

Med

Bullish

The analysis highlights a recovery wave above key support levels and a break above a bearish trend line, with potential for further upside if resistance at $1.420 is overcome.

#xrp

#crypto

#trading

High

A significant decrease in exchange reserves indicates lower availability of bitcoin for immediate sale. this scarcity, coupled with consistent demand from etfs and corporate buyers, can amplify price movements with even moderate buying pressure, potentially leading to substantial price increases.

High

Bullish

The combination of record-low exchange stockpiles, steady inflows from spot etfs, and significant accumulation by corporate entities points to a supply squeeze. this reduced supply, if met with sustained or increasing demand, is a strong bullish indicator for bitcoin's price.

#btc

#supplysqueeze

#hodl

Med

Bitcoin is seeing a short-term boost due to specific crypto market demand and inflows into yield products, but broader geopolitical tensions and potential global liquidity tightening pose a risk to sustained gains.

Med

Bullish

Bitcoin is currently trading at a weekly high, showing resilience against traditional markets affected by middle east tensions. this is supported by strong demand within the crypto market, particularly from yield-generating products.

#BTC

#Crypto

#Geopolitics

Med

The article indicates a positive price movement for ethereum, suggesting a potential for further gains, but also outlines key resistance levels that could halt the upward trend.

High

Bullish

The price has recovered above key levels ($2,050, 100-hourly sma) and broken a declining channel, with technical indicators (macd, rsi) showing bullish momentum. however, significant resistance lies ahead.

#ETH

#Ethereum

#Crypto

Med

The article suggests a bullish setup for bitcoin with potential gains towards $72,000 and beyond, but also outlines downside risks if key support levels are broken. this indicates a moderate impact as the direction is not yet confirmed.

High

Bullish

The article highlights a 'bullish flag' pattern breakout and mentions bitcoin trading above key moving averages and resistance levels, with potential to test higher targets if $72,000 is breached.

#BTC

#Crypto

#Bitcoin

Low

The bitcoin bull score index has risen to 30, indicating a slight improvement from extreme bearish conditions. however, it remains in the bearish zone, and the analyst suggests it's a relief rally within a bear market, limiting significant positive price impact.

High

Neutral

While the bull score index shows improvement, it's still in bearish territory. the analyst explicitly states 'we are still in a bear market, but in a relief rally.' this suggests a temporary upward movement rather than a sustained bullish trend.

#BTC

#CryptoQuant

#MarketAnalysis

Med

Solana is showing early signs of stabilization around the $85 support level, with bulls attempting to build a recovery base. however, the broader trend remains bearish, and a significant bullish shift requires breaking the $100 trendline.

High

Neutral

While there are signs of a short-term recovery attempt and stabilization above $85, the overall trend is still bearish. a decisive bullish move depends on breaking the $100 resistance, making the current direction neutral.

#sol

#solana

#crypto

Med

The article discusses a potential long-term convergence between swift's messaging system (iso 20022) and blockchain settlement layers like the xrp ledger. while not an immediate catalyst, it suggests a future where xrp could play a role in settlement, which could positively impact its price if adopted.

Med

Bullish

The potential for xrp ledger to be utilized as a settlement layer alongside swift's messaging system, especially with the adoption of iso 20022 and tokenization, presents a bullish outlook. this scenario could significantly increase demand and utility for xrp.

#xrp

#swift

#crypto

Med

The news about us treasury secretary bessent calming oil fears and allowing the sale of russian oil has led to a bitcoin price jump. while the immediate effect is positive, the long-term impact depends on the actual stabilization of oil prices and broader economic reactions.

Med

Bullish

Bitcoin has shown an immediate upward reaction, climbing near $72,000 following the announcement. this suggests that reduced fears of economic instability due to oil prices can lead to increased investor confidence in riskier assets like bitcoin.

#btc

#oil

#crypto

Med

Shiba inu experienced a surprising breakout from a short-term consolidation pattern, but remains below key moving averages and faces resistance. the overall market structure is still bearish, suggesting this might be a temporary relief rally.

Med

Neutral

While there was a recent upward movement, the prevailing technical indicators and the overall bearish structure suggest a neutral short-term outlook. a break above the 26-day ema is needed for a bullish shift.

#shib

#crypto

#breakout

High

Mastercard exploring ripple's technology and potential integration into its vast global payment network could significantly boost xrp's utility and adoption, leading to substantial price appreciation.

Med

Bullish

The potential for mainstream adoption by a financial giant like mastercard, coupled with ripple's existing efforts in cross-border payments and stablecoins, creates a strong bullish sentiment for xrp.

#xrp

#ripple

#mastercard

Med

A significant loss for one trader, but unlikely to directly impact aave or usdt market prices in the short term due to the isolated nature of the incident and the refund offer. however, it highlights risks in defi trading.

High

Neutral

While the trader suffered a massive loss, the protocol is offering a refund of fees. this specific event is unlikely to cause a sustained price movement for aave or usdt. the underlying market conditions for these assets will be the primary drivers.

#defi

#aave

#usdt

Med

Stricter mica rules in the eu are likely to lead to a consolidation within the crypto industry, potentially favoring more compliant and established platforms. this could indirectly impact major cryptocurrencies like btc and eth by increasing regulatory certainty and potentially attracting more institutional capital in the long run, but short-term uncertainty or reduced liquidity from smaller players could cause volatility. solana (sol) could be indirectly affected by the exploit mentioned, though the news emphasizes it was an external wallet, which might have minimal direct impact on the sol token itself if the platform recovers and maintains trust.

Med

Neutral

The news suggests a potential shakeout of less compliant crypto platforms in the eu, which could lead to a more stable and regulated environment in the long term. however, the immediate impact on major cryptocurrencies is uncertain, as it depends on how quickly and effectively these new rules are implemented and how market participants adapt. there's no direct news about a fundamental change in the underlying technology or demand for btc, eth, or sol that would warrant a clear bullish or bearish prediction based solely on this article.

#mica

#eucrypto

#regulation

High

A single transaction resulted in a loss of approximately $50 million due to extreme slippage. this highlights the risks of large trades in low-liquidity pools within defi.

High

Neutral

While this specific event was a massive loss for one individual, it doesn't directly impact the price of usdt itself in the broader market. it's an isolated incident related to a specific trading strategy and execution.

#USDT

#DeFi

#Slippage

Low

This news relates to ai advancements in flood prediction and data analysis. while it showcases technological progress, it has no direct or immediate impact on cryptocurrency markets. there is no mention of cryptocurrency or blockchain technology in the article.

High

Neutral

There is no correlation between advancements in ai for flood prediction and the price movements of cryptocurrencies. the news does not mention any crypto assets, exchanges, or regulatory changes that would influence the market.

#AI

#Tech

#Google

Med

The sec's advisory group backing tokenized securities could lead to increased adoption and integration of blockchain technology within traditional finance. this may positively impact cryptocurrencies that act as settlement layers or stablecoins used in such tokenized ecosystems, like btc, eth, usdt, and usdc. however, the direct impact on individual altcoins is less clear until specific use cases and regulations are fully defined.

High

Bullish

The positive recommendation and stated intention to develop a regulatory framework for tokenized securities suggests a move towards greater clarity and legitimacy for blockchain-based financial instruments. this could encourage institutional adoption and investment in related crypto assets.

#TokenizedSecurities

#SEC

#Blockchain

Med

The partnership with mastercard is significant for xrp's adoption in cbdc initiatives, potentially increasing its utility and demand. however, the immediate price impact is tempered by the technical bollinger bands squeeze, which indicates potential volatility but not a guaranteed upward movement.

Med

Bullish

The partnership with mastercard for cbdc integration provides a fundamental bullish case for xrp. the bollinger bands squeeze on xrp's chart suggests that a significant price move is imminent, and given the positive partnership news, the direction is likely to be upwards, aiming to retest previous highs.

#XRP

#Ripple

#CBDC

High

A single user's catastrophic mistake of losing $50 million due to a fat-finger trade on aave, despite warnings, highlights a significant risk in defi. while the direct loss is on an individual, it draws attention to the security and user-friendliness of defi interfaces, potentially impacting investor confidence in aave and similar platforms.

High

Neutral

While the news highlights a significant loss for an individual trader, it does not directly indicate a systemic issue with aave's underlying value or technology that would cause a price drop. the price impact is more on user experience and platform safeguards rather than the asset's fundamental worth in the short term. the ceo's statement aims to reassure users.

#aave

#defi

#crypto

Med

A significant drop in xrp reserves on binance could indicate investors are moving xrp off the exchange for long-term holding or other purposes, potentially reducing available supply for immediate selling. this could lead to price appreciation if demand remains constant or increases, but the current consolidation suggests the market is digesting this information.

High

Neutral

While a decrease in exchange reserves is often seen as bullish due to reduced selling pressure, xrp is currently in a consolidation phase below $1.50. the broader market sentiment is described as uncertain, and technical indicators still show a bearish trend, suggesting that the reserve drop alone may not be enough to trigger a strong upward movement immediately.

#xrp

#cryptoquant

#binance

Med

The event announcement caused a short-term 10% price jump, indicating some speculative interest from holders and potential buyers attracted by the exclusivity and association with a prominent political figure. however, the price quickly retraced, suggesting that the long-term impact may be limited unless further positive developments or sustained interest emerge.

Low

Neutral

While there was a brief spike, the retracement suggests a lack of sustained buying pressure. the coin's price is highly dependent on news and hype rather than intrinsic value, making its direction difficult to predict and likely to remain volatile and largely neutral between these sporadic events.

#trump

#memecoin

#solana

Med

The news of another mar-a-lago lunch for $trump token holders could lead to a short-term price increase due to increased attention and potential demand from holders wanting to attend. however, the token's price has historically been volatile and significantly down from its all-time high, suggesting that sustained gains may be limited.

Low

Neutral

The price direction is neutral as the short-term excitement from the event announcement might be offset by the historical price underperformance and the ongoing political scrutiny. while there might be a brief bump, the long-term trend is uncertain.

#TRUMP

#Crypto

#DonaldTrump

Low

The report states that the quantum threat to bitcoin is real but not imminent, likely years or decades away. this long-term perspective means it's unlikely to cause significant short-term price volatility.

High

Neutral

The report addresses a long-term technical risk but concludes it's not an immediate threat. the market is likely to remain neutral as the current focus is on other market drivers and the potential upgrade timeline is extended.

#btc

#quantumcomputing

#crypto

High

A specific analyst projection of a significant price increase to $21.5 is a strong indicator of potential high price movement if the prediction gains traction. the bullish wick on the weekly chart adds to this potential.

Med

Bullish

The article explicitly states that a bullish candlestick formation on the weekly chart signals the potential opening of a full-scale uptrend, with an analyst projecting a significant price rise.

#xrp

#crypto

#trading

Med

The news discusses potential tax exemptions for bitcoin transactions, which could significantly lower the barrier to entry for everyday use. if enacted, this would make bitcoin more attractive for payments, potentially increasing demand and adoption.

High

Bullish

A de minimis tax exemption would reduce the friction for using bitcoin for everyday purchases, as it would eliminate the need for capital gains calculations on small transactions. this could lead to increased adoption and, consequently, a positive impact on bitcoin's price.

#BTC

#TaxExemption

#Adoption

High

Nvidia's significant investment in open-source ai and the launch of nemotron 3 super could lead to increased demand for their hardware (gpus) if developers adopt this new model widely, especially given its performance claims and lower cost for autonomous agents. this could boost nvidia's stock price.

High

Bullish

The news indicates a strong strategic push by nvidia to dominate the open-source ai landscape, a move designed to secure its hardware dominance and counter competition. successful adoption of nemotron 3 super by developers and enterprises would directly translate to higher demand for nvidia's ai chips, driving the stock price up.

#nvidia

#ai

#opensourceai

Med

The news of layoffs and the potential shift in ethereum's l2 strategy could create uncertainty for op, impacting its value. however, the core technology is still widely used, and the layoffs are stated to be for focus rather than financial distress.

High

Bearish

Layoffs and a potential shift away from its core technology by a major partner (base) are negative signals. while not a complete collapse, it suggests short-term headwinds and potential investor concern.

#optimism

#op

#eth

Low

While $3.5 million in crypto was frozen, this amount is relatively small compared to the total market capitalization of major cryptocurrencies. the disruption of a proxy network primarily impacts illicit activities rather than direct market trading.

High

Neutral

This news is related to law enforcement actions against cybercrime and does not directly affect the fundamental supply or demand of major cryptocurrencies for legitimate users. it may indirectly deter some illicit use of crypto, but the market impact is likely negligible.

#Crypto

#Cybersecurity

#LawEnforcement

High

The article highlights a significant contraction in the memecoin sector, with market cap falling from $150b to $31b. this indicates a major shift in investor sentiment and risk appetite away from these speculative assets, impacting all memecoins.

High

Bearish

The article details a sharp decline in the total market capitalization of memecoins and describes the technical structure as 'weak' with moving averages sloping downward. this suggests a bearish trend for the memecoin sector.

#memecoin

#crypto

#doge

High

Bitcoin's recent ~6% gain during a period of geopolitical tension, outperforming traditional safe-haven assets like gold and equities, indicates a significant shift in investor perception and asset allocation strategies.

High

Bullish

Bitcoin's resilience and gains during geopolitical turmoil, combined with consistent institutional inflows into digital asset products, suggest a growing preference for bitcoin as a hedge against instability, indicating a bullish trend.

#btc

#geopolitics

#digitalassets

High

The article criticizes the current state of crypto, highlighting its lack of everyday utility, poor user experience, and speculative nature. this fundamental critique suggests a prolonged period of stagnation or decline in adoption and potentially prices if significant improvements aren't made.

Med

Bearish

The core argument is that crypto has failed to solve everyday problems and is primarily used for speculation. this lack of tangible utility, coupled with a poor user experience and the proliferation of complex financial instruments, is presented as a major barrier to mass adoption and sustainable price growth.

#crypto

#utility

#adoption

Med

Alkimi's adfi platform built on sui aims to revolutionize online advertising by reducing fraud and intermediary fees. while promising, widespread adoption and revenue generation for sui are not yet guaranteed. the success of alkimi's platform directly influences demand for sui's network.

Med

Bullish

Increased adoption and success of alkimi's adfi platform on sui could lead to greater demand for sui tokens to facilitate transactions and utilize the network. the potential for disruption in the large online advertising market provides a significant growth opportunity.

#SUI

#AdFi

#Blockchain

Low

The ban on a potential us cbdc until 2031 does not directly impact existing stablecoins like usdt or usdc, as they are privately issued. however, it might indirectly reduce the urgency for private stablecoin innovation in the us for a period, as regulatory uncertainty around a government-backed digital dollar is lessened.

High

Neutral

The ban is on a *potential* us cbdc, not on existing stablecoins. while it removes a potential future competitor, it doesn't directly affect the current utility or demand for stablecoins. the focus is on government-issued digital currency, not private ones.

#cbdc

#usdt

#usdc

Med

The news highlights eightco's investments in ai and blockchain, specifically mentioning ethereum and worldcoin. the significant fundraise and board additions from bitmine and ark invest suggest increased institutional interest and validation for companies operating in the blockchain and ai space, which could indirectly benefit ethereum as a foundational technology. however, the direct impact on eth price is not immediate and depends on eightco's future developments.

High

The information comes from reputable financial news sources and includes direct quotes from key figures like tom lee (bitmine) and cathie wood (ark invest), adding significant credibility to the report.

Bullish

The substantial fundraise of $125 million, coupled with strategic investments in ai and blockchain projects, and the addition of influential figures to the board, indicates positive future prospects for eightco. this positive sentiment and increased investment in the sector, including ethereum, can lead to a bullish outlook.

#ETH

#AI

#Blockchain

High

The article proposes a scenario where xrp's price could reach $3,700 if a significant portion of the global financial settlement volume, currently processed by entities like dtcc, were to flow through xrp as a liquidity bridge. this represents a massive potential demand increase.

Medium

The article cites a crypto analyst ('x finance bull') and points to the involvement of former dtcc and us treasury officials in ripple as reasons to believe in its potential. while these are positive signals, the price targets are highly speculative and depend on many unproven assumptions about xrp's adoption and future market structure.

Bullish

The analysis presented in the article is inherently bullish, outlining a path to extremely high xrp prices based on capturing a fraction of the global financial settlement market. the involvement of high-profile individuals and the perceived limitations of existing financial infrastructure support this optimistic outlook.

#xrp

#ripple

#crypto

Med

The news highlights a significant miscalculation by the gemini exchange bosses, the winklevoss twins, leading to substantial financial losses for their company. this reflects poorly on the broader crypto market sentiment and management, potentially influencing investor confidence.

High

The report is attributed to the information, a reputable publication known for its in-depth business reporting. the details provided are specific and align with general market trends observed.

Bearish

Gemini's ipo timing coincided with a severe bear market, leading to plummeting trading volumes and revenue. the company's valuation has dropped significantly, indicating a negative impact on the market perception of crypto-related businesses, which could indirectly affect bitcoin's price.

#BTC

#Gemini

#Crypto

Low

The senate's vote to ban cbdcs until 2030 is a policy development that could be perceived as positive for stablecoins like usdt and usdc, as it removes a potential competitor. however, the bill faces uncertainty in the house and president trump's stance adds further doubt, limiting immediate price impact.

Med

The news is from a reputable financial news outlet (coindesk) and details a concrete legislative action (senate vote). however, the outcome is uncertain due to potential hurdles in the house and the president's position, which lowers the overall trustworthiness of a definitive price impact.

Neutral

While a ban on cbdcs could indirectly benefit stablecoins by reducing competition, the overall legislative uncertainty, potential political roadblocks, and the fact that stablecoins are already established and widely used means there is no clear immediate bullish or bearish pressure on their prices. the market may wait for more clarity.

#cbdc

#stablecoin

#regulation

Med

While the layoffs are framed as a strategic refocus rather than financial distress, any news of restructuring within a core development team of a prominent layer-2 solution can create short-term uncertainty and affect investor sentiment.

High

The information comes directly from the ceo of op labs and is corroborated by the reporting from coindesk, a reputable crypto news outlet. the ceo's statement about financial runway and narrowing focus appears transparent.

Bearish

Layoffs, even when explained as strategic, often lead to a temporary dip in token price due to market perception of instability or reduced development velocity. the article also notes the op token is already down 3%.

#op

#optimism

#ethereum

Med

Vitalik buterin's vision shift for ethereum from pure speculation to a foundational technology stack could attract new use cases and developers, positively impacting eth's long-term value. however, the impact might be gradual as the ecosystem adapts.

High

Vitalik buterin is a co-founder of ethereum and a leading figure in the crypto space. his pronouncements on the future direction of the network carry significant weight and are generally considered highly reliable.

Bullish

The redefinition of ethereum's core values towards utility as a global bulletin board, spam prevention mechanism, and a convenient smart contract platform, backed by upgrades like peerdas, suggests increased demand for eth for these functionalities. this could lead to a bullish price movement.

#eth

#vitalikbuterin

#ethereum

Med

While binance is delisting 21 altcoins, these tokens were on binance alpha, which is an experimental platform. this suggests they were not widely traded or fully launched on the main binance platform, limiting the direct impact on major cryptocurrencies. however, it indicates binance's commitment to quality control, which can be a positive signal for the broader market.

High

Binance is the world's largest exchange and regularly reviews its listings to maintain standards. delisting underperforming or high-risk assets is a common practice for exchanges. the announcement details specific tokens and the rationale (not meeting listing standards), lending credibility to the news.

Neutral

The delisted coins themselves will likely see a significant price drop or become illiquid on binance. however, for major coins like btc, eth, or bnb, the impact is expected to be neutral. the news might even be perceived as slightly bullish for binance's reputation as a quality-controlled exchange, but it doesn't directly trigger buying pressure for other listed assets.

#Binance

#Crypto

#Altcoins

Low

The burning of rlusd tokens, while a regular occurrence for stablecoins to manage supply, does not directly impact the price of other cryptocurrencies like xrp or eth. it primarily affects the rlusd supply itself, aiming to maintain its peg. the news is more operational than market-moving for other assets.

High

The information comes from a stablecoin tracker and is linked to a specific transaction hash on the ethereum blockchain, making it verifiable. ripple's involvement is direct, and the reporting seems factual.

Neutral

Token burns are a standard mechanism for stablecoins to manage their circulating supply and maintain their peg to the underlying asset (in this case, usd). this specific event doesn't signal a fundamental change in rlusd's value proposition or any significant shift in market sentiment that would directly cause a price movement in other cryptocurrencies.

#rlusd

#ripple

#stablecoin

Med

While only 8-10% of bitcoin's hashrate is directly tied to oil-sensitive power markets, broader macroeconomic impacts from geopolitical shocks can lead to risk-off sentiment affecting btc prices more significantly than mining costs.

High

The analysis is based on research from luxor's hashrate index, a reputable source for bitcoin mining data. the reasoning is logical, distinguishing between direct operational costs and indirect market sentiment effects.

Neutral

The immediate impact on mining costs is limited, but the potential for broader market downturns due to geopolitical instability introduces bearish pressure. however, bitcoin has shown resilience around the $70,000 level, suggesting a neutral short-term outlook pending further developments.

#btc

#oil

#mining

Med

Shiba inu has seen a 4.2% rally, overtaking zcash in market cap ranking. while this shows positive short-term momentum for shib, the overall market is described as being in an accumulation phase, suggesting this might be a localized surge rather than a broad market trend.

Med

The article notes that the drivers behind the surge are unclear and that trading volume is declining, despite a majority of top traders on binance being long on shib. this suggests a potential lack of strong fundamental backing for the rally.

Bullish

The direct price action shows a 4.2% gain and a move up in market cap ranking, indicating a bullish sentiment for shib in the short term.

#shib

#shibainu

#crypto

Low

The update on shibarium block syncing (41% indexed) is a technical progress report. while positive for the network's functionality and addressing past display issues, it doesn't immediately translate to significant price changes. the market is likely to view this as ongoing development rather than a catalyst for a major price movement.

Med

The information is derived from a shibariumscan explorer notice and tweets from a shiba inu team member (lucie). this provides a reasonable level of confidence, but 'med' is chosen because explorer indexing is a technical process that can be subject to interpretation and doesn't represent direct market sentiment or a major fundamental shift.

Neutral

The news indicates ongoing development and recovery for shibarium, which is a positive sign for the ecosystem's long-term health. however, the current price action (up 1.61%) is modest and reflects gradual adoption and recovery rather than a strong bullish or bearish trend driven by this specific update. the market is likely waiting for more substantial developments or a broader crypto market upturn.

#SHIB

#Shibarium

#Crypto

Low

The lawsuit targets jpmorgan for its alleged role in a ponzi scheme, not directly impacting bitcoin's fundamental value. while it highlights risks in the crypto space, it's unlikely to cause a significant short-term price movement for btc itself.

Med

The lawsuit is based on allegations and legal proceedings are ongoing. the claims are serious, but without a verdict or further evidence, the trustworthiness of the accusations against jpmorgan is medium.

Neutral

This news is about a specific alleged ponzi scheme and the banking infrastructure used, not a broad market trend or technological advancement affecting bitcoin's price. the market is more likely to remain focused on macroeconomic factors and broader crypto adoption trends.

#btc

#crypto

#regulation

Med

Bitcoin is holding strong above $70,000 despite a broad market sell-off driven by surging oil prices and credit issues. while this resilience is positive, the broader market sentiment is bearish, which could eventually drag bitcoin down if the geopolitical and financial instability intensifies.

High

The information is derived from multiple reputable sources like coindesk, and quotes from industry experts and financial news outlets, providing a balanced view of the market dynamics.

Neutral

Bitcoin is currently showing resilience by holding the $70,000 level, which is a bullish sign. however, the broader market is experiencing a sell-off due to geopolitical tensions and credit worries, which introduces bearish pressure. the neutral stance reflects the current equilibrium between these opposing forces.

#BTC

#CryptoMarket

#Geopolitics

Low

While quantum computing poses a long-term theoretical risk to bitcoin's cryptography, ark invest's analysis indicates that current technology is not a threat and any future risk would likely be gradual, allowing for network upgrades. this mitigates immediate price impact.

High

Ark invest, led by cathie wood, is a reputable investment management firm with significant research capabilities in emerging technologies. their analysis, co-authored with unchained, provides a detailed and reasoned perspective on a complex technical issue.

Neutral

The report concludes that quantum computing is a long-term risk and not an imminent threat. this suggests that the news itself is unlikely to cause significant short-term price fluctuations in either direction, maintaining a neutral outlook for immediate price action.

#btc

#quantumcomputing

#arkinvest

Low

This news pertains to prediction markets and regulatory guidance, not directly to specific cryptocurrencies like bitcoin or ethereum. while the crypto industry benefits from regulatory clarity, this specific development has a limited direct impact on coin prices.

High

The information comes from a reputable financial news source (coindesk) and details official actions by a u.s. regulatory body (cftc), making it highly reliable.

Neutral

The guidance aims to provide clarity and structure to prediction markets, which could foster growth in regulated platforms. however, it doesn't directly signal a price movement for major cryptocurrencies. it's more about the framework for financial products.

#regulation

#cftc

#predictionmarkets

Low

Vitalik's comments suggest a shift in perspective for ethereum's utility, focusing on its role as a data storage layer rather than just a platform for complex smart contracts. while this is a fundamental re-evaluation, the immediate price impact is likely to be low as it doesn't introduce new revenue streams or fundamentally alter the current demand drivers for eth in the short term. it's more of a long-term philosophical guidance.

High

Vitalik buterin is the co-founder of ethereum and a leading visionary in the crypto space. his opinions carry significant weight and are often influential in shaping development and community sentiment.

Neutral

The statement emphasizes ethereum's utility as a 'bulletin board' or 'global shared memory.' this perspective doesn't directly translate to immediate increased demand for eth for transaction fees or staking, which are primary price drivers. while it reinforces the value proposition of the network, it's a nuanced point that may not immediately excite speculative traders looking for rapid price appreciation.

#eth

#vitalikbuterin

#blockchain

High

Blackrock launching a staked ethereum etf (ethb) with a significant fee cut (0.12% for the first year/ $2.5b) and offering staking rewards directly to investors is a major development. this could attract substantial capital from existing ethereum etfs and new investors seeking yield, increasing demand for eth.

High

Blackrock is a massive financial institution with a proven track record in managing vast assets. the details of the etf's structure, including fee cuts and staking reward distribution, are clearly outlined, making the information reliable.

Bullish

The introduction of a yield-generating etf by a major player like blackrock is expected to drive demand for eth. investors might rotate from non-staked etfs to ethb, and the fee cut makes it more attractive, potentially leading to price appreciation.

#eth

#blackrock

#cryptoetf

Med

Burning a significant amount of stablecoins like rlusd can reduce the circulating supply. this can potentially lead to increased scarcity and demand, which might support the price of rlusd, especially if its peg to a fiat currency is strong. however, the direct price impact on rlusd itself is generally limited as stablecoins aim to maintain a fixed value. the impact is more on the ecosystem's liquidity and potential for wider adoption.

High

The information is directly from ripple's actions and publicly available blockchain data (burn transactions). the article cites specific transaction details and mentions a partnership with mastercard, adding credibility.

Neutral

As rlusd is a stablecoin, its price is designed to remain pegged to a specific asset, typically usd. while burns affect supply, they are intended to maintain stability and manage liquidity rather than cause significant price appreciation or depreciation away from its peg. the focus is on adoption and utility, not price speculation.

#rlusd

#ripple

#stablecoin

Med

The article discusses dogecoin's significant drop from its ath and analyzes historical patterns suggesting potential for a rally when altseason mentions decrease. however, it also highlights that altcoin recovery is contingent on bitcoin's stability and faces short-term resistance levels.

Med

The information is based on data from coingecko and santiment, which are reputable crypto data providers. however, the analysis relies on historical patterns and speculation regarding x's payment feature, introducing some uncertainty.

Bullish

The article suggests a potential for a doge rally based on historical correlations between declining altseason chatter and price recoveries. while short-term resistance exists, the overall sentiment, coupled with potential positive developments like x's payment feature, leans towards a bullish outlook.

#doge

#altcoins

#crypto

Med

Binance joining mastercard's crypto partner program, alongside other industry leaders like ripple and paypal, aims to integrate crypto into everyday commerce. this could boost adoption for major cryptocurrencies used in transactions, potentially increasing their utility and demand.

High

The announcement comes directly from binance and mastercard, major players in the crypto and traditional finance space, making the information highly credible.

Bullish

The partnership is designed to increase the ease of spending cryptocurrencies for everyday purchases, which should lead to increased demand and potentially higher prices for major cryptocurrencies like btc, eth, and bnb that are likely to be supported.

#binance

#mastercard

#cryptoadoption

Med

The article highlights a bullish outlook on circle and its stablecoin usdc, driven by an analyst's report. while this suggests positive sentiment for usdc, its price is inherently stable. the impact is on the perceived value and adoption potential rather than direct price volatility.

Med

The analysis is based on a wall street analyst's report from william blair, which adds credibility. however, analyst ratings can be subjective and may not always reflect actual market performance.

Neutral

Usdc is a stablecoin designed to maintain a peg to the us dollar, so its price is expected to remain stable around $1. the bullish sentiment focuses on its market position and future utility, not its price fluctuations.

#USDC

#Stablecoin

#Crypto

High

Multiple analysts suggest bitcoin has not reached its bottom and predict further significant price drops. historical data on drawdowns is used to support this thesis, indicating potential for a substantial decline.

Med

The article cites multiple crypto analysts (leshka, doctor profit, julio moreno, benjamin cowen) and their recent analyses. however, price predictions in crypto are inherently speculative, and even expert opinions can be wrong. the editorial policy mentioned adds some credibility, but the core of the analysis relies on analyst forecasts.

Bearish

Analysts believe that based on historical drawdown percentages and current resistance levels not being overcome, bitcoin is likely to experience another significant drop, potentially to the $40,000-$50,000 range, despite current attempts at recovery.

#btc

#bearmarket

#crypto

Med

Lido is a major player in the defi space, and launching a new stablecoin yield product could attract significant capital. however, the stablecoin market is already competitive, and the impact might be diluted by existing offerings.

High

Lido is a well-established and reputable liquid staking protocol on ethereum, known for its security and reliability. the launch of a new product from such a prominent entity generally carries a high degree of trust.

Bullish

This product directly targets stablecoin holders by offering a simplified way to earn yield. increased demand for these stablecoins within lido's ecosystem could lead to a slight increase in their market value or at least stabilize their price against other assets.

#usdc

#usdt

#defi

Low

This article discusses accounting and auditing challenges for crypto assets in the us and eu. it does not directly mention any specific cryptocurrency or provide price predictions. the focus is on regulatory and accounting frameworks, which may indirectly influence the broader market over time but do not have an immediate price impact on specific coins.

High

The article is from coindesk, a reputable source for cryptocurrency news and analysis. it features contributions from ganna vitko, president of the toronto chapter of women in crypto, and aaron brogan of brogan law, lending credibility to the information presented.

Neutral

The article does not offer any price predictions or analyze the current market trends of any specific cryptocurrency. it focuses on the complexities of accounting and auditing for digital assets and the differing regulatory approaches between the us and eu.

#CryptoAccounting

#Regulation

#CryptoAdvisors

Med

The statement from avalanche's business chief suggests a strategic shift towards enterprise solutions and real-world problem-solving rather than pure speculation. this could attract more institutional adoption and diverse use cases, potentially boosting avax's long-term value. however, the immediate market reaction may be muted as the focus is on future utility rather than short-term price action.

High

The source is coindesk, a reputable crypto news outlet. the information is directly from avalanche's business chief, john nahas, making it a primary source for the company's strategy. the arguments presented are logical and align with broader industry trends towards enterprise blockchain solutions.

Bullish

The emphasis on building a robust business infrastructure, attracting enterprise clients, and solving real-world problems with tailored blockchain solutions positions avalanche for sustainable growth. this shift away from speculative hype towards tangible utility is a positive signal for long-term price appreciation.

#AVAX

#EnterpriseBlockchain

#RealWorldAssets

High

A 75% drop in development activity suggests a significant slowdown in innovation, bug fixes, and new feature rollouts across the entire crypto ecosystem, potentially leading to stagnation and reduced investor confidence.

Medium

The data is sourced from 'solid intel' and supported by charts showing a decline in commits and active developers. while the source is not universally recognized as a top-tier analytics firm, the reported figures and trends are plausible given the current hype around ai.

Bearish

Reduced development activity implies less innovation and slower adoption. if developers are flocking to ai, it suggests that the perceived future growth and opportunities are stronger in ai, which could divert capital and talent away from crypto, negatively impacting prices.

#cryptodev

#ai

#blockchain